How does a Debt Management Plan Affect Your Mortgage?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about how a Debt Management Plan (DMP) might affect your mortgage? You’re not alone. Each month, over 170,000 people come to our site to get advice on debt solutions. This article will give you clear answers to your questions. We’ll cover these key points:

- What a DMP is and how it works.

- How a DMP might affect your mortgage.

- If it’s possible to remortgage or get a loan while on a DMP.

- Other options you might have.

- What happens to your mortgage after your DMP ends.

We know that debts and mortgages can be a big worry, as some of our team members have had their own experiences with DMPs. We understand how tough it can be. Let’s dive in and learn more about DMPs and mortgages.

What is the effect of a DMP?

A Debt Management Plan is only used to pay back non-priority debts, so a residential mortgage debt cannot be included in a DMP. In fact, your mortgage repayments are included as essential expenses when the DMP provider assesses your personal finances to negotiate with lenders what you can afford to repay.

The same applies to any rent payments you have to make. You must have the finances to keep paying your mortgage or rent as part of essential living.

Therefore, your mortgage repayments can affect how much you are asked to pay as part of a DMP with non-priority creditors. But a DMP does not affect an existing mortgage you will continue to repay.

There may be implications if you want to switch mortgages during a DMP. Read on for more information on this.

Can I remortgage?

It is possible to remortgage your current deal while on a DMP, even if you were not on a DMP when you originally took out the mortgage. However, as part of the mortgage application process, the lender will assess your finances and how much you are paying in the DMP.

The mortgage provider may decide to reject your application based on your debts, or they may offer a deal that is less appealing than their representative example. This is true whether you apply for a new deal with your current provider or a different provider. Affordability checks are a key part of the mortgage process.

» TAKE ACTION NOW: Fill out the short debt form

Can I get a mortgage during the plan?

It’s not impossible to get a mortgage while you are still on a Debt Management Plan. However, it is considerably harder because of your existing debts and the damage that a DMP can do to your credit file. If you are approved for a mortgage while on a DMP, you could be offered a less favourable interest rate.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I get one after it has finished?

You will find it easier to get a new mortgage after your DMP has finished and your debts have been repaid. You may want to wait and build up your credit score gradually in the period after finalising your DMP. This will help you get accepted and potentially get a better mortgage deal.

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

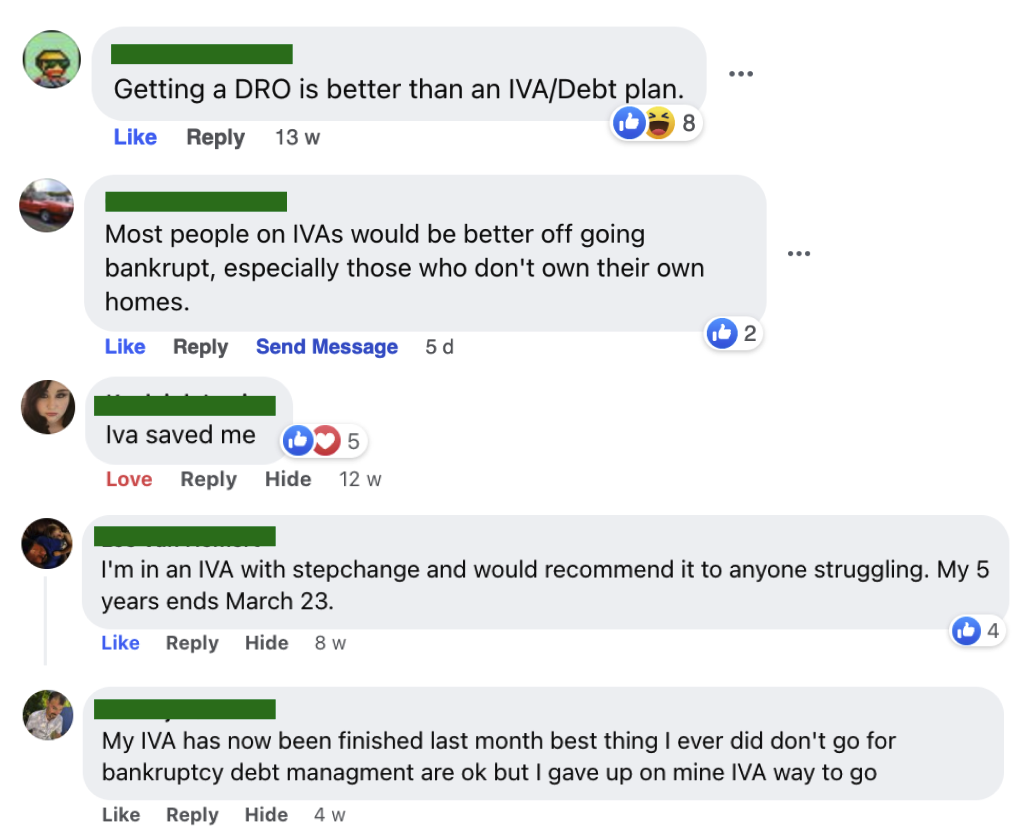

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Quick Summary

Existing mortgage repayments are taken into account as essential expenses when DMP providers negotiate your future repayments with creditors. But having a DMP can affect your ability to remortgage or take out a new mortgage, and even if you are approved, you might not get offered an appealing rate.

Thanks for reading this guide, and if you have more niche DMP queries, see if we have already answered them on our blog. MoneyNerd is covering all bases when it comes to DMPs and our content remains free!