Lifetime Mortgage Early Repayment Charges – Hidden Costs Revealed

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Are you asking yourself, ‘Can you pay off a lifetime mortgage early?’ This is a common question. In fact, every month, more than 7,000 people like you visit our website seeking advice on equity release options, including lifetime mortgages.

In this article, we’ll delve into:

- The hidden costs of lifetime mortgages

- How to sidestep the pitfalls of a lifetime mortgage

- Getting a realistic quote for a lifetime mortgage

- The amount to pay back on a lifetime mortgage

- The process and implications of repaying a lifetime mortgage early

It’s normal to feel a bit lost when it comes to making big financial decisions. But don’t worry; we’re here to provide clear, straightforward advice to help you navigate this journey.

Let’s unravel the mysteries of lifetime mortgages together, starting with the hidden costs and how to avoid them.

Quick Summary

Lifetime mortgages are the most common method of equity release, which is a borrowing method exclusive to senior homeowners.

People aged 55 and over can access some of the equity in their residential property, providing they own the property outright with no outstanding debts secured against it.

The lifetime mortgage loan is charged with compounding interest, typically a fixed rate. But neither the principal loan amount of the interest has to be repaid each month. The debt simply gets bigger and bigger over time, until it’s eventually repaid by selling the property and using some or all of the sale proceeds to clear the debt.

The homeowners still own their home and it doesn’t have to be sold until the last surviving homeowner named on the lifetime mortgage either:

- Passes away

- Moves into long-term residential care (e.g an aged care facility)

Can I repay early?

Even though lifetime mortgages are expected to last for the remainder of your lifetime – as their name suggests – you can pay off a lifetime mortgage early.

There might be a financial penalty for paying off the equity release plan early. More on this shortly.

» TAKE ACTION NOW: Find out how much equity you could release

Why would you want to pay it off?

You may decide to pay off all or some of your lifetime mortgage early.

For example, you might win a lot of money or inherit a significant amount and use this to clear the lifetime mortgage debt, which would then allow you to pass on the property to loved ones.

Alternatively, you may decide to downsize to a lesser valuable property in the future. As part of the downsizing process, you could be allowed to take your lifetime mortgage with you and have it added to the new property.

But if there is a shortfall in value between your old and new property, you would be required to pay off some of the loan to port the lifetime mortgage to the new property.

How much do you pay back?

The amount you repay on a lifetime mortgage will depend on:

- Your loan amount

- The interest rate applied

- The length of time you have the lifetime mortgage

Thus, it’s impossible to state exactly how much you will repay from your property sale proceeds eventually. These loans are known as expensive, but if you only repay after death, they’re expensive for estate beneficiaries rather than yourself.

Another way to understand how much you would repay is with an example…

If you took out a lifetime mortgage for £65,000 at a fixed compounding interest rate of 6.4%, after 12 years of having the loan, the debt will have grown to almost £137,000!

How equity release could help

More than 2 million people have used Age Partnership to release equity since 2004.

How your money is up to you, but here’s what their customers do…

Find out how much equity you could release by clicking the button below.

In partnership with Age Partnership.

Will I incur additional costs?

Yes, early repayment charges are usually added to lifetime mortgage agreements. These fees are in place to compensate the lender if you decide to pay the debt off early.

However, there are some times when the lifetime mortgage early repayment charges are £0 or are no longer applied.

We’ll return to discuss how to avoid early repayment fees in specific situations.

What is a typical charge?

Equity release early repayment charges aren’t as standardised as early repayment fees applied to other loan agreements, which are usually between 1% and 5% of the outstanding loan amount.

Although some lifetime mortgage products will have a fixed early repayment cost structure, other agreements include a variable rate structure.

Equity release with variable structure

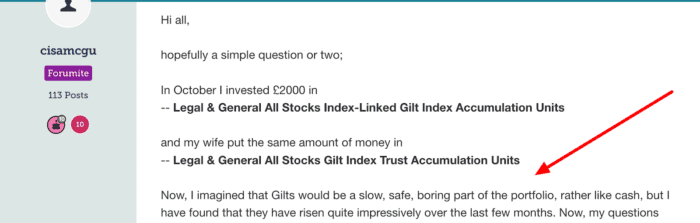

Lifetime mortgages with a variable early repayment charge structure use Gilt yields to determine the rate of early repayment cost. A Gilt is a type of bond from the British Government, which can increase or decrease in value.

If the current yield is at 0% then there won’t be any repayment charge. However, the yield could be much higher, costing you a significant amount to get out of the lifetime mortgage early.

Don’t assume Gilt yields will be low, as this lucky investor thought may be the case:

With this structure, the early repayment costs could exceed 15% at certain times. These sorts of scenarios contribute to equity release horror stories.

Fixed charges

Other lifetime mortgage agreements use fixed early repayment charges, so you’ll know exactly what rate you will need to pay on the outstanding debt to pay off the loan.

It’s common for lenders to use a decremental structure. For example, you might have to pay 8% within the first five years, followed by 3% in the next five years, and then the early repayment charge may drop to 0%.

How to avoid it

There are three ways to avoid having to pay an early repayment cost, which has been fully explained below:

#1: Pay it off at the right time

If your early repayment charge is based on Gilt yields, you might be able to pay no early repayment cost if you can time it right. However, this can be difficult.

#2: Pay at the end of the period

If your early repayment charge is fixed and depends on how long you have held the loan, you might be able to access a 0% charge if so many years have already passed. This is quite common but it means the debt will have already grown significantly.

#3: Use a downsizing clause when moving to a less valuable home

If you need to pay some of the loan off as part of downsizing to a lesser valuable property (but taking the lifetime mortgage with you), then you could avoid an early repayment charge with a downsizing clause.

A downsizing clause is agreed upon from the outset. It enables the homeowner to downsize by paying off some of their loan and not be subject to any early repayment charges. It may only come into effect after holding the lifetime mortgage for so many years.

Join thousands of others who release equity

Age Partnership have helped over 2 million people release equity from their home.

Mrs Wareham

“I am more than pleased to have taken out Equity Release with Age Partnership.”

Reviews shown are for Age Partnership. Search powered by Age Partnership.

How do you do it?

To repay your lifetime mortgage early, you will need to contact your lifetime mortgage provider and let them know you want to clear the debt.

If your plan includes a variable early repayment structure, you can ask the provider for a quote on the early repayment charge, which will only be valid for so many days before it expires.

You’ll need this quote to fully understand the costs of repaying a lifetime mortgage on a variable early repayment structure.

Things to consider

Equity release will involve a home reversion or a lifetime mortgage, which is secured against your property and will reduce the value of your estate and impact funding long-term care. Our equity release partner, Age Partnership provides a personalised illustration to explain the full details. The money you release, plus the accrued interest is then repaid when you die or move into long-term care. Advice is required before proceeding with equity release and any existing mortgage must be repaid. Age Partnership provide initial advice for free and without obligation. Only if your case completes would Age Partnership’s advice fee of £1,895 be payable. Other lender and solicitor fees may apply.