Not Told Insurance About Points? Here’s What May Happen

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you searching for affordable car insurance, but have points on your driving licence? It’s a common concern. We know this because over 9,300 people like you visit our website each month for guidance.

Let’s help you understand your situation better. Here’s what you’ll learn from this guide:

- Understanding penalty points and their workings.

- How penalty points can change your car insurance cost.

- If you should tell your insurer about your penalty points.

- How to get car insurance with points on your licence.

- Ways to bring down your car insurance cost even with points.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

I know this can be concerning, but don’t worry! We’re here to help you understand your options.

Let’s get started.

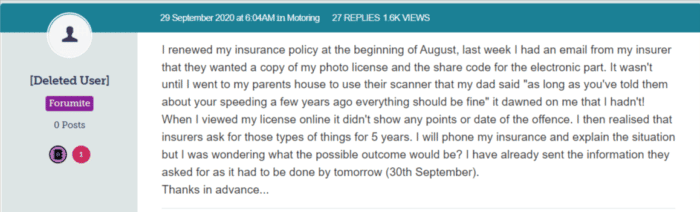

What happens if I don’t tell them?

If you don’t tell them it is likely that they will find out. This could make your insurance policy invalid.

Driving an uninsured vehicle is an offence and could result in prosecution and an additional 6 to 8 points on your licence.

Also if you are involved in an accident then your insurer will probably not pay out.

According to research done by the RAC, a 5th of drivers did not inform their insurers that they had points on their licence.

While declaring the points that you have on your licence your premiums will increase, it is less costly than the possible consequences of not declaring it.

Convicted Driver Insurance Increase

I’ve put together this table to help you better understand the impact points on your licence can have on your insurance costs.

| Points on License | Estimated Average Rate Increase |

|---|---|

| 1 – 3 Points : This range usually covers minor offenses. Insurance rates may increase but not excessively. | 5% – 20% |

| 4 – 6 Points : This range might indicate repeat offenses or a more serious violation. Insurance premiums are likely to rise more significantly. | 20% – 40% |

| 7 – 9 Points : At this level, the driver is considered high-risk. This can lead to substantial rate increases. | 40% – 60% |

| 10 – 12 Points : Accumulating this many points might lead to a driving ban. If insurance is offered, it would likely be at a very high rate. | 60% – 100%+ |

How will the insurance company find out that I have points on my licence?

When you apply for car insurance the insurer can, with your permission, check with the DVLA who have up-to-date information about you, including any driving convictions.

What if I don’t give them permission to check?

You have every right not to give them permission to check but some insurers may decline your application if you don’t.

The way they would look at it is that if you had nothing to hide then why would you not give them permission to check?

» TAKE ACTION NOW: Find the best insurance for drivers with points

Can I pay to have the points removed?

No, there is no way that you can pay to have the points removed.

They will stay on your licence until the DVLA removes them at the appropriate time.

Is there any way to stop the points from going on my licence?

There are circumstances where you could legally avoid having points on your licence, for instance, if your points are due to speeding than you could be issued with a fixed penalty notice or be offered the option of taking a Speed Awareness Class.

This option will not be offered if you had a speeding violation in the last 3 years.

Once you have completed the class you will not have points on your licence or have to pay a fine. The class is only an option for those on the lower end of speeding offences.

How long does it take for points to show up on my licence?

The Department of Transport will issue a notification and the points will be on your licence 28 days after the notification was given.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How much will my insurance go up if I have points?

That depends on the number of points that you have, for example, if you have 6 points then you are likely to see an increase of at least £400 on your insurance.

The more points you have, the higher the premium.

Depending on the number of points that you have, you may have to find a specialist insurance company.

Is there any way that I can bring my insurance premium amount down?

There are things that you can do that will make a difference to the amount of insurance that you will pay.

- Get a black box system installed in your car.

- Look at getting a different car, the bigger the engine the more expensive the insurance. A car with a smaller engine will save you money.

- If you have a garage then putting your car in it overnight will make a small difference.

- Get an alarm or immobiliser fitted to your car.

How can I check the endorsements on my driving licence?

You can check the endorsements that you have on your licence online.

| Online | https://www.gov.uk/penalty-points-endorsements/how-to-check-your-endorsement-details |

| DVLA | https://www.gov.uk/contact-the-dvla/y/driver-licensing |

Can I appeal the points on my licence?

Under certain circumstances, you can appeal.

- You were not driving the car but you know who was.

- You were not driving but you don’t know who was.

- It was a mistaken car identity and you can prove this.

- If you dispute the camera equipment’s efficacy

If you want to appeal you will need to go through the courts, not the police. Be aware though that if your appeal is rejected you could get 3 points on your licence, a bigger fine and have to pay the court costs.

When it comes to insurance, honesty really is the best policy, so it is in your best interest to make your insurance company know, as soon as possible, about your points.

Your policy will increase the amount depending on how many points you received.

If you have a lot of points then you may need to find a specialist insurance company that will accept you, as they will have their own criteria.

They do exist but the premiums that you will pay will be a lot higher.

Remember that withholding information is an offence under the Road Traffic Act 1988, so the sooner you tell your insurance company about your penalty points the better.