What are the HELOC Rates in the UK?

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Secured loans like a Home Equity Line of Credit (HELOC) can be a useful way to borrow money. But it can be a little hard to understand, especially when it comes to HELOC rates.

So, if you’re wondering about HELOC rates in the UK for 2023, you’re in the right place. Every month, over 6,900 people visit our website seeking advice on secured loans, just like you are doing now.

With this guide, we’ll help you understand:

- What a HELOC is and how it works.

- The costs of a bad HELOC deal.

- How HELOC compares to other types of credit.

- Alternatives to a HELOC.

- Where to get a free HELOC quote.

In the UK, early repayment fees for secured loans have more than doubled since the start of the decade, peaking in 2018.1

If you’re worried about your debts or are concerned about the risks of secured loans, you’re not alone. Many people share these worries. We’re here to offer clear, simple advice to help you make an informed decision.

So, let’s dive in and learn more about HELOC rates in the UK together.

Can I get a HELOC in the UK?

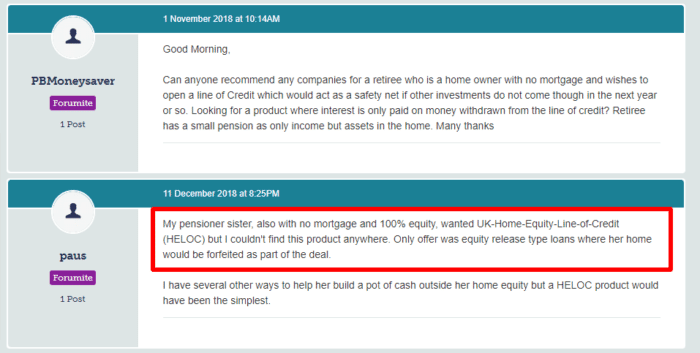

Initially, the idea of a HELOC came from the USA, where these are very popular financial products. Adopting the principles of a HELOC has been slower in the UK. However, a few independent lenders now provide nationwide HELOCs or other home equity release products.

UK HELOC lenders

If you are looking for a HELOC lender, you can try talking to your bank to determine if they offer this product. Some banks may be able to help you even though they don’t list HELOCs in their main product lineup.

What Are the Interest Rates Right Now?

When this post was written, HELOC interest rates in the UK were higher than equivalent financial products in the USA. However, there is a reason for this. HELOCs are pretty new to the UK and are only generally available from independent lenders. Some lenders might exploit the lack of HELOCS in the UK to force customers to pay higher interest rates.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.84% |

£218.47 |

£26,216.67 |

| Selina | 6.34% |

£219.34 |

£26,320.83 |

| Equifinance | 6.59% |

£219.77 |

£26,372.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.4% |

£221.18 |

£26,541.67 |

| Norton | 9.05% |

£224.05 |

£26,885.42 |

| Masthaven | 9.65% |

£225.09 |

£27,010.42 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Current HELOC interest rates UK 2024

As time passes and HELOC becomes more common in the UK, interest rates will likely drop. However, when this post was written, HELOC rates were around 2% to 10%. The interest rate offered is driven by the amount of equity in a property and the customer’s creditworthiness.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Do Home Equity Credits Have Higher Interest Rates?

The interest rate you are offered for a HELOC will depend entirely on your financial situation, how much equity you have in your home, and which lender is willing to accept you. Speak to different lenders to determine if you meet their HELOC eligibility criteria.

In general, a HELOC sits somewhere between a personal loan and a remortgage regarding the interest rate you will be offered. From my experience, a personal loan is the lending product with the worst rates, and a remortgage usually provides the best.

The difference can be considerable but don’t forget to factor in the fact that you only pay interest on the credit you have spent under a HELOC. If you don’t need a large lump sum and will instead use your credit over time, a HELOC can work out more financially attractive than a remortgage in the long term.