Does an IVA Affect Car Insurance?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re thinking about getting an Individual Voluntary Agreement (IVA) to handle your debt, you might also wonder, “Does an IVA affect car insurance?” This is a common concern, and we’re here to help you understand everything better.

Every month, over 170,000 people visit our website to learn more about debt solutions. We know that you may be feeling unsure about the IVA process and worried about how to handle your debt. We understand these concerns and aim to provide clear, helpful advice.

In this article, we’re going to explain:

- How an IVA impacts your ability to get car insurance.

- If it’s possible to get cheap car insurance with an IVA.

- How to reduce your insurance costs.

We’re a team of people who have dealt with debt problems too. We know it’s tough, but we’re here to help. We hope this article will make things a little clearer for you. Let’s get started.

Will It Impact Your Ability To Get Your Car Insured?

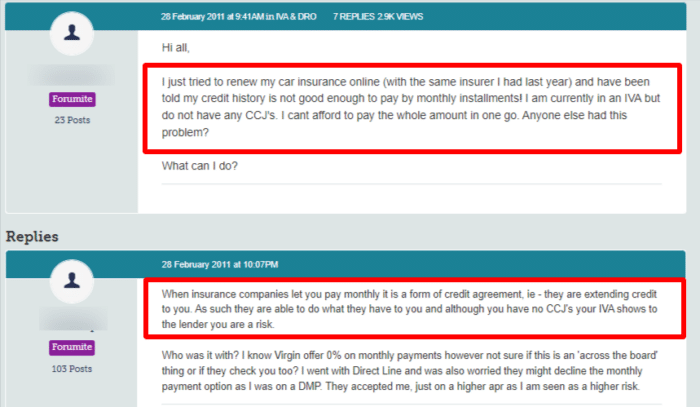

Remember item one in the list of restrictions placed on you when under an IVA? Namely, that you cannot apply for any credit? Well, if you are used to paying for your car insurance in monthly instalments, there is some bad news here. When an insurer allows you to pay in instalments, they are providing you with credit. Therefore, you cannot pay your car insurance monthly while under an IVA.

Additionally, some traditional insurers might see you as a high-risk driver due to you having poor creditworthiness. They may not wish to insure you at all. In this case, you would need to use a subprime insurer, that specialises in offering car insurance to people who are bankrupt or under an IVA.

Will You Be Able To Get It at A Cheap Rate?

As we have already mentioned, being under an IVA may cause insurance providers to see you as a higher risk. And in this case, you might find that the cost of your insurance coverage goes up. And in some cases, the cost from a traditional insurance firm might be too high. And in extreme cases, a traditional insurer may not be willing to quote you for car insurance at all.

You could be forced to deal with subprime insurers. These firms know that you have no other option, and the prices they charge reflect this. You really want to avoid having to go to a subprime insurer for your car insurance if you can avoid it.

Lowering the Cost

If you do find that the cost of your car insurance has gone up due to you being under an IVA, there are a few things you can try to get the cost down. We list some below.

- Switch to a car in a cheaper insurance bracket.

- Limit the number of miles you drive.

- Offer to pay more excess.

- Switch to a lower level of cover.

- Stop using your car for work.

- Offer to have a tracker installed.

- Stop parking your car on the road at night.

Shop Around for the Best Deals

All insurers are not equal, some calculate risk in different ways Therefore, it really can pay to shop around and get as many quotes as you can. You can also try using a comparison website, that will get you quotes from a whole range of car insurance firms so that you can choose the cheapest.