Cheapest Learner Driver Insurance with Convictions?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Finding the right insurance after a driving conviction can be a tough task, especially for learner drivers. Each month, we guide over 9,300 people, just like you, through this tricky process. In this article, we aim to help you understand:

- The different types of driving convictions and how they can affect your car insurance.

- The ways to avoid paying too much for your car insurance.

- How long driving convictions last and the steps to get insurance with convictions.

- The cheapest cars to insure after a ban and what to do if you can’t get vehicle insurance.

- Where to find affordable convicted driver insurance and where to go for further advice.

We know how worrying it can be to think about affording car insurance after a conviction or even worse, not being able to get insurance at all. But rest assured that we’re here to help you find your way through. With our guidance, you’ll learn about the ins and outs of insurance for convicted drivers, helping you move towards becoming a legal driver.

Let’s dive in and discuss your options.

Should You Tell Your Insurer?

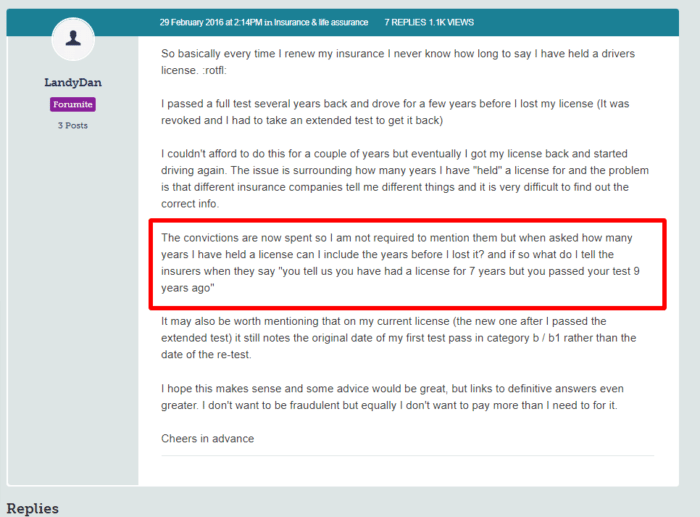

If you are a convicted or disqualified driver renewing insurance, or looking for a new policy, you are legally obliged to inform the insurance firm of any convictions or disqualifications. If you have lost your licence and got it back again, you can only count the years since your licence was reissued for insurance purposes.

However, you don’t have to tell your insurer about any convictions that are deemed spent. Even if the insurer asks you a direct question related to spent convictions. Later on in this post, we will look at how long driving convictions last.

Will Your Premium Go Up?

If you have been convicted of a driving offence, and the conviction is not yet spent, then you can expect your insurance premium to go up. For example, if you are a learner driver who has previously had a drink driving ban, your insurance premium is going to be far more costly than it would be otherwise.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How Can You Get It?

Learner drivers already have to pay more for their vehicle insurance, as they are seen as a high risk. Adding convictions or a driving ban to the mix will make it very difficult to find an insurer willing to take them on until the convictions are spent.

If you can find an insurance firm that will give you a quote as a learner driver with past driving convictions, you are very likely going to be shocked by how much the premium will cost. It won’t be cheap.

» TAKE ACTION NOW: Find the best insurance for drivers with points

What Is the Least Expensive Car To Insure After a Ban?

As we have already mentioned, just finding an insurer that is willing to take you on as a learner driver with driving convictions is going to be a challenge. It is highly likely that you will need to go to a specialist insurer for this.

And unfortunately, these specialist insurers have you over a barrel. You can’t go anywhere else to get vehicle cover, you have to use them. When writing this post, we did some research to try and find an insurance firm in the UK that will cover learners with convictions and we only found one that looks to be even halfway affordable.

Even so, premiums were roughly three times more expensive than a comparable policy for an experienced driver with no convictions. Put simply, there just isn’t any cheap car insurance for learner drivers with convictions, or following an unspent ban,

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How Long Does It Last?

It is the Rehabilitation of Offenders Act (ROA) that lays out the rules on how long convictions for driving offences last until spent. However, we can summarise things here for you, but recommend that you check the full contents of the ROA for specific information.

- If you were over the age of 18 when the conviction was issued, it will be deemed spent after five years.

- If you were under the age of 18 when the conviction was issued, it will be deemed spent after two and a half years.

After this time, you will not be legally obliged to tell your vehicle insurance firm about the convictions, they are now spent.

What if I Can’t Get One?

You might find it impossible to get insurance if you are a learner driver with unspent driving convictions, let alone affordable insurance. But there might be one further option.

You may be able to be added as a named driver on somebody else’s vehicle insurance. However, once again, your convictions will need to be disclosed. And this, in turn, will have a significant impact on the cost of the insurance.

But in cases where you simply can’t get vehicle insurance any other way, this is a final hail Mary option for you to try. Some more advice here, is to try and find a mature driver, with many years of no claims bonus accrued to add you to their policy. This will make sure that you have to pay the very lowest amount possible. But of course, finding such a person might be a problem. If you are a young driver, a parent or grandparent might be a good option here.