What Are the Rights of a Second Charge Holder?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re dealing with loan debt, you may have heard of a term called ‘second charge holder’. This term may sound confusing but don’t worry. In this easy-to-understand guide, we’re going to explain it all. Every month, over 170,000 people come to our website for advice on how to handle their debts.

In this guide, we’ll explain:

- What a ‘second charge holder’ is and what rights they have.

- What a ‘first charge’ means in terms of loan debt.

- How a second charge might affect you if you can’t pay your loan.

- What to do if you’re finding it hard to pay off your debts.

- How a second charge might affect your credit rating.

We know that dealing with loan debt can be stressful. But remember, you’re not alone in this. We’re here to help you understand your situation and find the best way to manage it. We’ll explain everything in a simple, clear way, so you can make the right decisions about your debt.

Let’s get started.

What does it mean?

A second charge is a secured loan against a property with an outstanding loan already secured against it. The outstanding loan is usually a mortgage.

The second charge might be called a second charge mortgage. Some of the most common second charge loans are home equity loans, home equity lines of credit (HELOC), home improvement loans or homeowner loans. With the exception of a HELOC, most of these loans are similar but marketed differently.

For example, if you buy a property with an outstanding mortgage, the mortgage is the first charge loan. If you then borrow against some of the equity you build up in the property later by using a secured loan, this second loan will be the second charge on the property.

Advantages and disadvantages

There is a lot to consider when it comes to second charge loans. A few important factors include the potential benefits, risks, and cost comparison with unsecured lending. I’ve put together a complete analysis of the pros and cons of second charge loans to help you understand what second charges entail.

What is a holder?

The second charge holder is the provider of the second charge loan. This could be a bank, building society or another type of loan provider.

» TAKE ACTION NOW: Fill out the short debt form

When is permission needed?

The second charge loan provider might need permission from the first charge holder – usually the mortgage provider – to use the property as security in the loan agreement. This is known as second charge consent.

Can a holder force a sale?

Yes, if you don’t keep up with the repayments on the second charge loan, the second charge loan provider can force the sale of your property to recover the debt.

However, when the second charge loan provider forces the property sale, the money raised from the property sale is accessed by the first charge loan provider, usually the mortgage provider.

The first charge will get “first dibs” on the sale proceeds to clear the first charge debt, and only after the first charge debt has been cleared will the second charge provider be able to access the sales proceeds to clear the second charge debt.

There might be times when there won’t be enough sales proceeds to clear both debts, usually when the property has decreased in value.

For this reason, the second charge may choose not to force the property sale to recover the money and will look at other debt recovery options.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is its impact on credit rating?

In itself, a second charge loan shouldn’t hurt a person’s credit rating. If you regularly make payments, you can actually improve your score. However, you can expect your rating to dip if you default on your loan or make late payments.

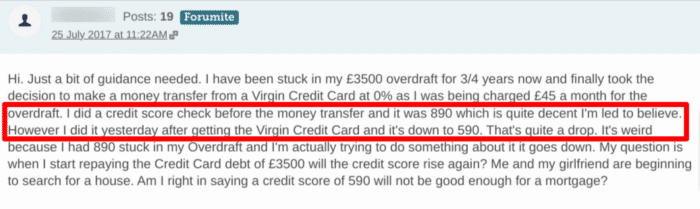

Taking out a new loan or another means of credit can also temporarily reduce your credit score, just like it did with this MoneySavingExpert forum user. The credit score is reduced because of the hard inquiry run on a credit file by the new lender.

Your score should improve if you continue to make regular repayments.

Are you dealing with loan debt?

If you’ve been asking about the rights of a second charge holder, there is a good chance you have loan arrears and are worried about defaulting on a second charge mortgage, such as a home equity loan or home improvement loan.

If you’re in this situation, it’s worth speaking to the second charge holder as soon as possible. The second charge provider is likely to renegotiate your payments to make them more affordable to you and prevent the need to force the sale of the home. You might even qualify for a brief payment holiday.