Scott Mears Debt – Should You Pay Them?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you have a debt letter from Scott Mears? You’re not alone. Every month, over 170,000 people visit our website for help with debt problems.

You’re probably wondering where this debt from Scott Mears came from, whether you should pay it, if Scott and Mears is a legitimate company, and what to do if you can’t afford to pay.

With Scott and Mears, you might not have to pay all the debt. But, it’s not good to ignore this.

In this article, we’ll tell you:

- How to check if the debt is yours.

- If you can ignore Scott and Mears.

- How to stop Scott and Mears from bothering you too much.

- Ways to set up payment plans.

- How to write off your debt if possible.

Our team knows what it’s like to get a debt letter. We can help because we understand.

Let’s get started!

Why Are They Contacting Me?

It is likely that one of your debts has been passed on to them for retrieval. It is their job to collect money owed on behalf of organisations for a fee.

If you are not sure who they are working with, they should explain everything to you when they make contact.

Also, you should understand your legal rights as a debtor. These include:

- Being treated fairly and with respect and not to be harassed or threatened

- You can request proof of the debt they claim you owe

- You can also request that Scott and Mears cease communication with you, except for certain essential notifications

- Ask them to provide clear and accurate information about the debt, including the amount owed, the original creditor, and repayment options

- Be ready to negotiate and agree upon an affordable repayment plan with them

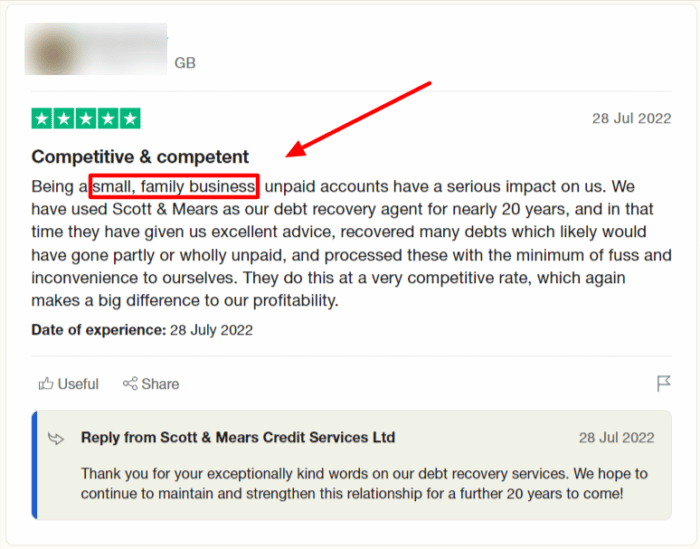

Reviews on Trustpilot suggest that they work with small businesses and property owners in the local area of the address;

Image courtesy of TrustPilot: https://uk.trustpilot.com/review/scottandmears.co.uk

Scott and Mears do say on their website that they work with small and larger organisations as well as companies looking to recover debt from abroad.

What to Do If The Collectors Contact You

You have a range of options available to help you prepare for when this happens.

Taking time to look at all your options, and then choosing to answer the phone will allow you to ask questions.

Then, after you know how much you owe them and what for, you can explore some options that can help you move towards a solution:

- Bankruptcy – This is an option many use to write their debts off. You can also learn what impact it might have on your wages.

- Debt Management Plan – This can be a good short-term option to help when you are between jobs – allowing you to pay smaller monthly payments while stopping them from adding interest.

- Write off – After six years, things change around how debtors can pursue you. This is another subject to consider in your decision.

- IVA – This can potentially help you write off up to 90%. You can also read up on the Individual Voluntary Arrangement and whether it applies to your circumstances.

- Debt Relief Order – if you don’t own your home, have a low income and earn less than £30,000, then this is another option to explore

It’s important not to ignore these phone calls, as they might go ahead to try and obtain the money through court.

Keeping open lines of communication and using our free sample letter templates is one way to be proactive in dealing with Scott and Mears Debt Collectors.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can They Take Me to Court?

Yes, they can and are more likely to take you to court if you ignore their calls and messages. This will largely depend on the amount you owe.

A parking fine is less likely to be worth the effort for them, although this is still something that could happen, and the likelihood increases with the total amount that you owe.

Can I Ignore Them?

Scott and Mears are legally obligated to allow you time to assess the situation, but ignoring them is not a course of action we would recommend.

This means that you don’t have to answer them straight away. You have time to read and research what your options are.

But they will not give you that space until you have told them that you are now getting your accounts into order.

Therefore, just letting them know this sooner rather than later is going to benefit you in the long run, and reduce the number of calls you get from them in the short term.

Their contact details are listed at the beginning of this article, and you can call them on 01702 466300 during office hours on weekdays.

How They Attempt to Recover Debt

On their services page, they say that the process they follow is:

- Account monitoring

- Assessment of means and pre-sue reports

- Process serving

Basically, they will communicate with you first to attempt to get information on the unpaid debt.

This includes how much money you have, how much you earn, and how much you can afford to pay. They will then use this information to get as much as possible for their clients, whom you are in debt with.

They won’t be able to start monitoring your account until the court grants access, but there are situations where debt collectors can see your bank account balance that you can learn more about.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I Stop the Letters?

Yes, you can stop Scott and Mears from sending you letters.

You have the right to be contacted in the way that you want and at the times that work best for you. Let them know this early on so that they know when you will answer.

They sometimes track their calls and messages to see when you are most likely to answer, so telling them the time that works for you will save them work, as well as give you back more control in the situation.

How to Make a Complaint

Our article on this subject explains the complaints process in more detail.

There are debt charities throughout the UK that can help with what details to gather, the nature of the complaint, and who to complain to.

Remember, it is vital to get the advice of a professional on the best option for you in your own circumstances.

The best free debt advice organisations to contact include: