Clearing Credit Card Debt: UK Laws Unveil A Loophole

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying your credit card debt? This is a common concern. Every month, over 170,000 people visit our site for help with debt problems.

This article will help you understand:

- How a balance transfer card can help clear credit card debt.

- The average credit card debt in the UK.

- The possible pitfalls of the credit card debt loophole.

- If you can write off some of your debt and how.

- The other loophole to clear credit card debt.

Debt can be tough to deal with. But remember, you’re not alone. We’ll explain your choices and help you find a solution that works for you. Let’s get started!

The Loophole

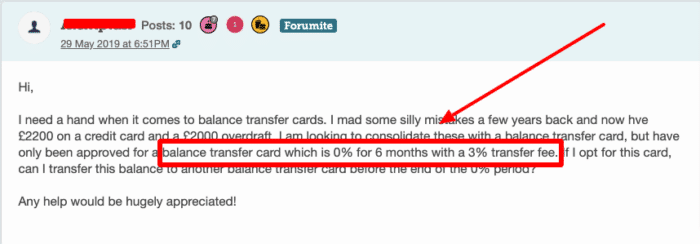

There is one loophole to assist you in clearing credit card debts in the UK, and it works through what is known as a balance transfer credit card. If you have a credit card debt, you might be able to open a special type of credit card that allows you to transfer the outstanding balance of your other credit card – or credit cards – to the new card.

This will be called credit card consolidation if you have more than one credit card debt. You should only transfer the credit card debt to the new card if the new card has better repayment terms.

For example, the new card might have a lower rate of interest and/or a grace period at the beginning, where you pay no interest at all.

To simplify, you clear the debt on your existing credit card but then open a new one with a new debt that works in your favour.

You can use my free calculator to see how different interest rates and payment periods will affect the total amount that you pay.

What Are the Possible Pitfalls?

When you are looking for a balance transfer credit card to help you with debt write-off in the UK, always ensure that the credit card will allow transfers from your existing credit card to the amount you need to transfer. You should also look out for balance transfer fees, typically around 2% of the money you need to transfer.

So, if you wanted to transfer a debt of £1,000 to the new credit card, a balance transfer fee of 2% would mean paying a fee of £20. The balance transfer fees differ between balance transfer credit cards in the UK.

You also need to keep an eye on when the lower interest rate – which is quite often 0% to entice you – ends because then it will go up, and often quite significantly. Also, be aware that if you spend using your balance transfer credit card, your purchases might not be included in the 0% rate.

Last but by no means least, never apply for multiple balance transfer cards at once for credit consolidation. This will harm your credit file and prevent you from getting accepted with any of them. Moreover, you might get accepted more than once and have a different problem.

Can Anyone Use a Balance Transfer Card?

Not everyone can use this credit card loophole because some people have a bad credit rating and won’t get accepted for a new credit card. If you cannot get a balance transfer credit card because you don’t meet credit score requirements, you should consider other debt solutions.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The Other Legal Way

There is one other way you can clear your credit card debt. If your credit card debts are over six years old and you tick a couple of other boxes, you can use a legal loophole to avoid paying.

The legal loophole to clear credit card debt I am referring to is officially known as statute-barred.

What Is Statute-Barred Debt?

A Statute- Barred debt is a debt that cannot be discussed in court. When a credit card company wants you to pay, and you refuse or simply can’t, they may take you to court and get a judge to force you to pay with what is known as a County Court Judgement (CCJ).

A CCJ allows the credit card company to chase you with bailiffs or Uk debt enforcement agents.

However, statute-barred debts are older debts that cannot go to court, meaning none of the above can happen, and nobody can ever force you to pay your credit card debts.

» TAKE ACTION NOW: Fill out the short debt form

Which Debt Qualifies?

To qualify your debt as statute-barred, your debt must be at least six years old. But there are some other conditions as well, namely:

- The credit card debt must not have been issued with a CCJ before.

- You must not have acknowledged that you owe the debt in writing within the last six years.

- You must not have made a repayment in the last six years.

If you did either of numbers 2 or 3 above, the clock resets, and you would have to wait for another six years before the debt becomes Statute-Barred.

My Debt Is Statute-Barred; What Now?

If you believe your credit card debt is statute-barred, you should seek confirmation of this first. To do this, it is best to talk to UK debt charities or speak with Citizens Advice.

These people will assess your situation and explain whether your debt is statute-barred.

If it is statute-barred, you can write to the credit card company telling them it is so and they should never contact you again, or it will be seen as harassment. Again, debt services such as the ones below can help you contact them and ask them to cease contact.

| Organisation | Website | Phone number |

| Stepchange | http://www.stepchange.org | 0800 138 1111 |

| National Debtline | http://www.nationaldebtline.org | 0808 808 4000 |

| Citizens Advice | http://www.citizensadvice.org.uk | England: 0800 144 8848 Wales: 0800 702 2020 |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Not all debt older than six years is statute-barred!

If you wait for your credit card debt to become statute-barred, you could wait a long time.

A debt becomes statute barred after six years, but only if a CCJ hasn’t been taken against you. If this is the case for you, you will still have to pay your debt which may now have racked up interest.

You may or may not want to consider your debt options.

Should I Just Wait Six Years?

Waiting for six years to use this credit card debt loophole is not a good idea unless you are already close to the six-year mark. You could end up in court with much bigger debts by avoiding debt notification.

Looking for debt solutions to pay off your credit cards is better than facing the risks of waiting.

Where Can I Find Help?

Check out the Money Nerd debt solutions page for information on ways to clear credit card debt with real solutions, and don’t forget to take advantage of free debt advice in the UK from debt charities.