Can You Balance Transfer Someone Else’s Credit Card Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Having trouble with credit card debt? You’re not alone. Each month, over 170,000 people visit our site for advice on how to handle their debts. We’re here to help you understand your options and find the best way forward.

In this simple guide, we’ll explain:

- How you can transfer someone else’s credit card debt.

- The potential costs of doing a balance transfer.

- How to reduce debt by transferring balance from one card to another.

- Things to remember when transferring someone else’s debt to your account.

- Other choices if balance transfers aren’t right for you.

We know dealing with debt can be tough. But don’t worry; with our expert advice, you’ll understand your options. Whether your debt is big or small, we’re here to help you find a way to manage it.

Let’s dive into the details and help you make an informed decision.

How Does It Reduce Debt?

The key to reducing your debt using a balance transfer is that many credit cards have extremely high-interest rates. This can cause the amount you owe on a certain card to skyrocket quickly.

Balance transfers can help you mitigate this problem through debt consolidation. The idea is to transfer the outstanding balance from your current card to a card with a low or 0% interest rate. As I mentioned, typically, people do this for themselves, i.e., both cards are in their name, and they transfer the balance to reduce their debt.

While this is a very sensible debt management solution that can work if you’re successful in obtaining a card with little or 0% interest, it’s often not possible since credit card companies are often apprehensive about issuing low-interest cards to people with poor credit scores.

If you’re a person that’s struggling with debt, likely, your credit score will not be very good, and it’ll definitely be difficult for you to secure a card with a low-interest rate.

Of course, if you can secure one despite your poor credit score, all the more power to you. You can begin utilising it to minimise your debt.

Keep an Eye Out for Fees

You should also look for the balance transfer fee and the credit card fee structure, especially any hidden fees. Most companies charge a fee when you transfer a balance from one card to another. This balance transfer fee is typically 2 – 3% of the total transferred balance. If it’s large, you may be paying a lot in balance transfer fees, so remember this as part of your financial planning strategy.

Can I Do It With Another Person’s Card?

The short answer is yes.

However, only some providers allow third-party balance transfers. These providers may also limit whose card you can transfer the balance from.

For example, the person transferring the balance must be your spouse or close relative to meet the eligibility criteria.

Remember that only the person taking on the debt, i.e. you, can authorise the balance transfer and will take on full financial responsibility.

The card to which the balance is being transferred may be a new credit card you’re applying for or a credit card you already have.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do I Do It?

Transferring the balance from someone else’s credit card is pretty much the same as a regular balance transfer.

You must provide the name of the credit card, the credit card number, and the amount being transferred to your account to complete the balance transfer process.

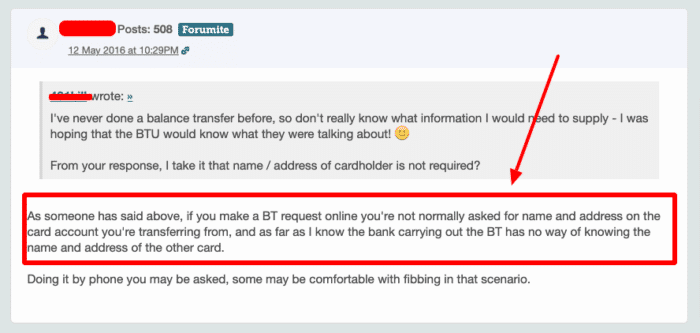

If you’re applying for this balance transfer online, likely, you won’t be asked for the name of the credit cardholder; You will most likely only be asked for the credit card number in an online application.

However, if you’re applying for it over the phone, you will likely be asked for the cardholder’s name by customer support.

» TAKE ACTION NOW: Fill out the short debt form

What are Some Things to Remember?

I’ve already mentioned the balance transfer fees. They can rack up to a significant amount if the amount of money you’re transferring is large.

You may have to discuss who will pay the balance transfer fees with the person whose debt you’re transferring.

Other than that, the single most important thing you need to worry about is the fact that now that the outstanding balance has been transferred to your account, you are the one who’s liable for the debt.

This means that if a payment is missed or paid late, you are the one the credit card company will contact to inquire about it. You will be solely responsible for the debt since it will be in your name now.

It doesn’t matter if you’ve had an informal agreement with the person whose debt it originally was. According to guidelines set and regulated by the Financial Conduct Authority, you’re the one who’s responsible for taking care of the debt now and liable for any legal implications of the debt.

Since the debt is in your name now, it will also have an effect on your credit score. Any missed or late payments will affect your credit score drastically. Thus, this is something to consider before you take on someone else’s debt on your account. If payments are missed, you could end up with a CCJ against your name and even have enforcement agents, or bailiffs, on your case.

Hence, it’s important that before you transfer someone else’s outstanding balance onto your account, you make sure that:

- You trust them completely to make the repayments to you so you can forward them to the credit card company.

- You don’t have a problem paying off the debt from your own pocket on behalf of the other person in case they are unable to or if they refuse to.

Although you are legally responsible for the debt now, this does not mean that you have to pay it yourself.

In most cases like these, the balance transfer reduces the debt for the original debtor.

Before you transfer the balance to your account, you talk with the original debtor thoroughly about their plan for paying off the debt so that you’re both on the same page.

Talk about how much they will pay towards their debt each month.

You can also ask them to set up a direct debit so that they can make payments to the credit card provider themselves each month.

It’s a good idea to get the agreement in writing and record the original debtor’s payments towards their debt. They could come in handy in case any disputes arise later.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Alternative Debt Solutions

Plenty of other options are available if you want to help someone with credit card debt but can’t or don’t want to take on the legal burden.

The debtor can look into formal debt solutions such as a debt relief order, an IVA or, in the most severe cases, bankruptcy. These all have their own advantages and disadvantages, so I advise reading through my guides and getting advice from independent debt advice services to make sure they are choosing the right one for their situation. These include:

- Stepchange

- National Debt Helpline

- Citizens Advice