How Long for Your Credit Score to Go Up After Paying Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you keen to know how long it takes for your credit score to go up after paying off debt in the UK? You’re in the right place. Each month, over 170,000 people come to our website for guidance on debt solutions, as they have worries about debt just like you do.

In this article, we’ll cover:

- What a credit score is and why it’s important.

- How your credit score might change after you pay off debt.

- Ways to make your credit score better after you pay off debt.

- How long it could take for your credit score to go up after you pay off debt.

- What happens with settled debts and how they affect your credit score.

We understand how you feel about debt, as some of us have had debt worries too. We know it can be tough to deal with. But don’t worry; we’re here to help you understand and improve your credit score.

Let’s start learning about credit scores, debt, and how to make things better.

What Is the Timeline for Rebuilding Credit?

The length of time it will take for your credit score to improve after you pay off the debt will depend on multiple factors, some out of your control.

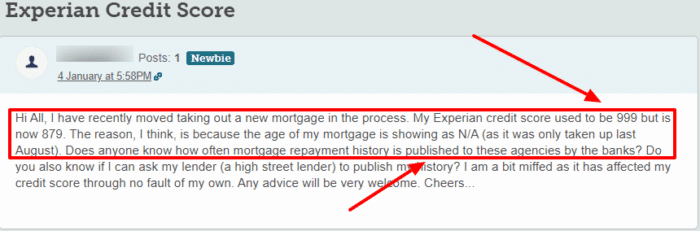

The first is how quickly your creditor updates your credit report. Most of them are very fast and will mark that the debt has been paid off within a month. This means your score could improve within a month of paying off the debt. However, you may have to wait a few more months – and manage your finances well – to see a significant improvement.

How long is a piece of string in this case? Around 1-3 months, typically.

» TAKE ACTION NOW: Fill out the short debt form

How Is It Rated?

Your credit score is rated between 0 and 999 for Experian and 0 to 1000 on Equifax, with five categories to determine your overall score. For example, your score can be categorised as excellent, good, average, poor or very poor.

The three biggest credit rating agencies in the UK usually have the same categorisations based on your score, but there could be some differences in their credit scoring model.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Several things go into the calculation of your credit score, including:

- Your payment history

- Your credit utilisation

- Length of credit history

- Types of credit in use (e.g. mortgage, credit cards, etc.)

- Recent applications for credit

Remember, this is not an exhaustive list, and there are a few adjustments you can make to improve your credit score.

Are All Kinds of Debt Bad?

The answer to this question depends on what you mean by ‘debt’.

If you are asking if having credit (such as a loan or credit card) is bad for your credit score – absolutely not.

Indeed, if you have credit and are paying back on time and the correct amount, this is very good for your credit score and will make it go up. It shows responsible borrowing.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Having no credit history is much worse than showing you can pay back the money you borrowed on time.

Why, you ask? Well, having credit and paying back as promised shows that you can handle your finances and stick to an agreement. This is called positive credit behaviour.

But if you are asking if ‘debt’ is bad for your credit score and you mean debts from unpaid loans and credit cards, then yes, this is probably bad for your credit score.

It shows you failed to keep to an agreement and repayments and will probably send your credit score down as a warning to any other loan company or bank that may consider lending you money.

» TAKE ACTION NOW: Fill out the short debt form

Ways to Improve Your Rating

There are many ways to achieve this. Here are some examples of ways to improve your credit score after paying off your debts:

- Keep up with other credit repayments

- Keep up with bills and other contracted repayments

- Look for debt solutions for other existing debts

- Don’t apply for lots of unnecessary credit or bank accounts (applications can affect your score too)

- Use credit card builders to gradually bring up your credit score

Where Can I Check It for Free?

In the UK, you have a right to access your credit report for free from any credit reference agency. However, this only gives you a snapshot of your credit history and doesn’t include a credit score.

The three major agencies all have paid-for services if you want a more in-depth look at your credit report.

If you don’t fancy paying the subscription, there’s a workaround. Sign up for their 30-day free trials to uncover your credit score for free. Just don’t forget to cancel the subscription before the trial ends.