Debt assigned to a CAIS member – What To Do?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you have debts that have been assigned to a CAIS member, and your name is on the Experian’s CIAS register, don’t worry – you’re in the right place to find answers.

Many people are in the same boat as you. In fact, over 170,000 individuals come to our website each month for advice on debt solutions.

In this article, we’ll help you understand:

- What it means when your debt is assigned to a CAIS member.

- How to start dealing with this issue.

- If you can write off some of your debt.

- Why creditors sell debts.

- What the next steps are for you.

We know how scary it can be to deal with debt problems, as some of our team members have been there. Let us help you navigate your situation and find the best way forward.

Where to start

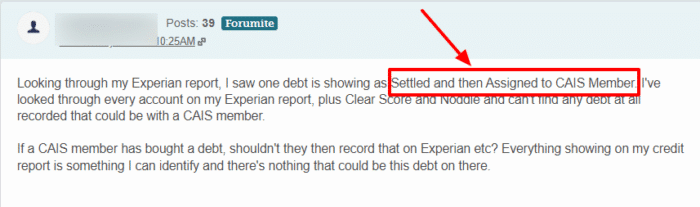

If you’ve received a letter about an outstanding debt claiming that your debt has been assigned to a CAIS member, you might be wondering what that means.

Debt Sold

When they say ‘debt assigned’, this effectively means that your debt or account has been sold on to a debt collector.

The original creditor will record the status of your account as being ‘debt assigned’, which basically reflects that the debt has been assigned or sold, to another company.

This means that moving on, you will now have to negotiate with a debt collection agency instead of the original creditor.

Lenders like to get their money back, but often, they don’t have the resources to continue chasing you for the money, so they often outsource to debt collection agencies.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

If you have a debt described as ‘debt assigned to CAIS member’, then you will have no further dealings with the original creditor.

The original creditor may mark the debt as ‘settled’ – but this doesn’t mean it has been written off. In their eyes, you no longer owe the money to them, but you now owe the debt collection agency or CAIS member. When you start repaying the debt collector, your payments will be recorded on your credit file.

But what does CAIS stand for?

Who Are They?

If you have a letter declaring ‘debt assigned to CAIS member’, you may be rightly wondering who or what a CAIS member is. CAIS stands for Consumer or Credit Account Information Sharing.

This is the name given to the shared database of credit history that is maintained by Experian.

Experian is one of the four leading Credit Reference Agencies in the UK. They supply credit reports to lenders and other companies to keep them informed about your financial status.

You may be wondering how or why they are getting this information. This information is shared with your consent and is often required whenever you apply for credit. This results in the companies affiliated with Experian can make a better-informed decision about you.

How to Deal with It

So, if you have a debt assigned to CAIS member, you now know what you should do. It may seem confusing, but with a bit of careful thought, you can sort it all out quickly and easily.

Debt collection agencies can be quite heavy-handed with their dealings with customers. If you feel like you’re being harassed, you should complain.

Get in touch with them first of all, and if they don’t respond, then you should escalate the matter to the Financial Ombudsman Service.

If you need more help with debt, seek free advice from many UK debt charities such as Citizens Advice, MoneyHelper or StepChange. They will help you figure out how to clear your debts free of charge.

Why do creditors assign/sell debts?

We all forget about debts or let some of those important ones slip through the cracks. When this happens, creditors will assign your debt to someone else if it’s in arrears.

Creditors specialise in lending money and collecting repayments. They don’t have much experience in chasing debts which are in arrears.

Debts that are regulated by the Consumer Credit Act can be sold or assigned to another company at any time after you stop paying.

Your original creditor will let you know if they have done this, and you’ll also get a letter from the debt collection agency advising that you now have debt assigned to a CAIS member.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Next steps

Now we have the basics down. We now know what debt assigned to CAIS member actually means. Let’s look at the next steps in dealing with the debt you owe.

Debts and debt collection can be really stressful and upsetting things to deal with. But with a little bit of forward planning, a cool head, and an active mindset, you will be able to deal with the CAIS member or debt collection agency, quickly and easily.

Be active

Once you have found out you now have debt assigned to CAIS member, you’ll want to see what you can do to sort it out.

Be sure to get in touch with them and explain your situation. By doing this, you will hopefully stop them from pressuring you into making payments.

Gather information

Once you know your debt has been assigned to a CAIS member, you’ll want to go through all the correspondence you might have received from the original creditor and the new debt collection agency.

Double-check any of the amounts they say you owe, and make sure that they match.

Don’t ignore them

Ignoring a debt collection agency if you’ve had your debt assigned to CAIS member will not make them go away.

Debt collectors are notoriously persistent, and they will continue to send you letters and call you. If you reach out to them before they have a chance to bombard you, you’ll be on the front foot, and you’ll be able to sort out your debt quickly.

Prove the debt

If you’re uncertain as to whether you owe the amount they say you do, you can ask them to prove the debt using a ‘Prove the Debt’ letter.

You can find some great ‘Prove the Debt’ letter templates on MoneyNerd. This will require them to prove that your debt assigned to CAIS member is legitimate and you do owe it.

Statute-barred status

Sometimes, debt assigned to CAIS members will be very old debts that you might have entirely forgotten about. These may even be so old that the debts can no longer legally be collected.

Often, with common personal debts, there is a time limit on how long they can be collected, which is usually 6 years.

It’s worth checking whether your debt assigned to CAIS member is statute-barred, as you may not have to pay them at all.

Pay them

If you are certain that the debt is yours, and it isn’t statute-barred, and you have the necessary funds to pay it, you should do exactly that.

This will stop them from sending any further letters or making any further calls about your debt assigned to CAIS members.

If you can’t afford to pay them in full, you should still contact them and explain your situation. They may agree to a repayment scheme, where you pay back the sum in more affordable instalments.