County Court Bailiff Fees

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Stressed about a bailiff company knocking on your door? You’re not alone. Each month, over 170,000 people seek advice from our website on money matters, and we’re here to guide you through this difficult time.

Understanding County Court Bailiff Fees, updated for 2023, can be a bit tricky. So, we’ve broken it down into easy steps for you in this article:

- Learn what a County Court Judgement (CCJ) is and how it works.

- Find out about the role of a bailiff in enforcing a CCJ.

- Discover how much bailiffs charge in the UK and how their fees are regulated.

- Explore ways to potentially write off some of your debt.

- Understand your rights and options if you’re struggling with unaffordable debt.

Our team knows the worry that comes with dealing with bailiff companies. We’ve been there, and we understand your situation. We’re ready to provide the information and support you need to navigate this.

Let’s start this journey together and find the best way forward for you.

How much do they charge?

1. Notice of Enforcement

2. Enforcement

3. Sale

Miscellaneous costs

» TAKE ACTION NOW: Fill out the short debt form

Do I have to pay it?

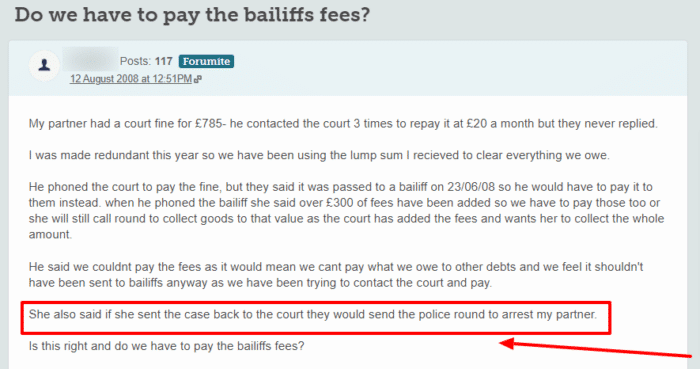

But, generally, yes, you do need to pay bailiff fees even if you think that they shouldn’t have been added. Take a look at this example.

Bailiffs can’t arrest you! Only the police have the legal authority to detain you and they aren’t going to get involved in a civil case like this.

Can I claim back the charges?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Are their fees regulated?

As of 6 April 2014, bailiff charges have been standardised. Now that they are the same, ensuring fair bailiff charges is much easier.

This means that they have to follow the pricing structure I have gone through above. If you have also been charged court fees, you can check that this is correct with the Court Service website.

It is rare, but sometimes bailiffs can charge the wrong amount. This is why it is essential that you check your bill and collect receipts for anything that you pay.

Are there ways to avoid them?

If you have noticed that you are struggling to pay your debts, you might be able to use debt solutions to avoid bailiffs.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What do I do if the bill is wrong?

If you think that your bill is incorrect, you need to complain to your original creditor.

You can use my free letter template to help you write the letter. I recommend writing rather than phoning because there will be physical evidence for you to rely on if you need to take the dispute further.

You can ask that your creditor gets the bailiffs to cancel some of their fees or to give you a refund if you have already paid too much.

Possible reasons for complaint include:

- The percentage fee charged in Stages 2 or 3 was wrong

- The fixed fee that you were charged at any Stage is wrong

- You have been charged for something that the bailiffs didn’t do

- The bailiffs haven’t given you receipts for their disbursement costs, and you think they’re wrong

- The bailiffs charged you fees when they couldn’t – eg they have lost their license.

If your creditor doesn’t help you, you may need to get an order from a judge.

If you are considering any type of court action, you need to seek legal advice immediately. The debt charities that I have linked below will be able to guide you on your best next steps.