Will a Satisfied CCJ Affect My Credit? Pay Off Debt?

For free and impartial money advice you can visit MoneyHelper.

For free and impartial money advice you can visit MoneyHelper.

Are you wondering if a satisfied CCJ can improve your credit score? You’ve come to the right place for answers. Each month, over 170,000 people seek advice from our website on debt matters, including this one.

We understand your worry about the long-term impact of a CCJ on your credit. That’s why in this article, we’ll explore:

- How to check if you have any CCJs.

- The effect of a satisfied CCJ on your credit score.

- How debt write-off works.

We have the knowledge to guide you through, as many of us have faced similar issues with debt.

Let’s dive in and learn more about how a satisfied CCJ can impact your credit and what you can do about it.

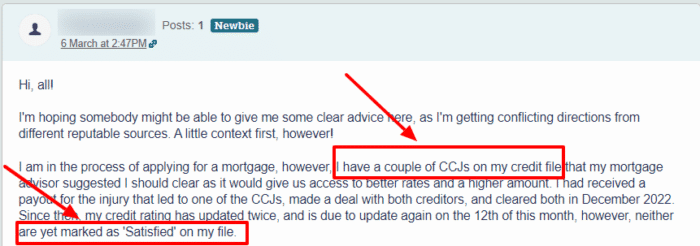

Does satisfying a CCJ improve credit score?

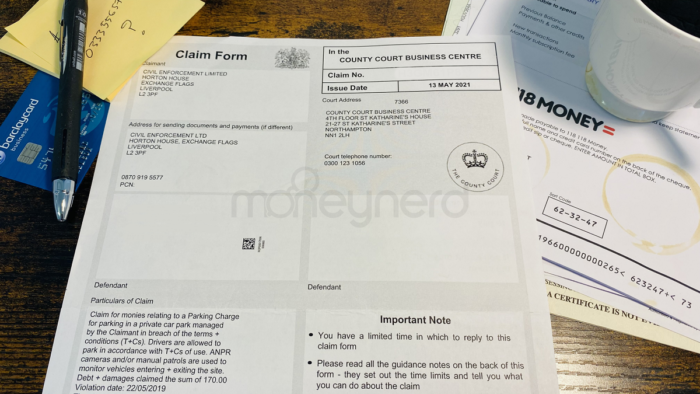

Having a CCJ added to your credit report is one of the most damaging entries that can be made, along with bankruptcy.

Your credit score will deteriorate because of the CCJ, and this might put future lenders off giving you credit.

Once the CCJ has been marked as paid, it shows you have repaid what you owe and it can somewhat improve your current credit score.

But that change will take some time to reflect.

So how long does a CCJ affect your credit score? It will impact your credit score until the CCJ expires in 6 years.

Find out how quickly your credit score will increase after you repay your debts.

» TAKE ACTION NOW: Fill out the short debt form

How much does a satisfied CCJ affect your credit score?

Full payment on your CCJ may affect your credit score positively, but it doesn’t generally make a huge difference in the immediate future.

Due to the seriousness of being taken to court to get you to pay, the difference between an active and cleared CCJ is negligible.

How to Get A CCJ Removed

Our partners at the CCJ Removal Service have a ton of experience with getting CCJs removed.

They will cover the whole process for you – listening your story and advocating for you every step of the way.

The Process

Step 1:

- Establish your legal grounds for removal.

Step 2:

- Mediate with your claimant to establish the terms they’d agree to “Set Aside” the judgement under.

Step 3:

- A barrister drafts the agreement between the parties to get your CCJ removed.

Step 4:

- The court removes or “sets aside” the CCJ from your public record.

It’s a surprisingly simple process.

Fill out our form to get help from our partners at CCJ Removal Services.

Will paying a CCJ remove it from your credit file?

Now, you may be wondering if paying a CCJ will have it removed from your credit history.

Unfortunately, not until the 6 years are up. But lenders will see that the debt was paid.

So repaying your debt in full after the 30 days timeframe will not get the CCJ removed from your credit history.

Satisfied CCJ – what’s next?

How does a CCJ affect credit score when a debt is satisfied?

If you received a CCJ and then fully paid off the money owed, your credit report can be updated to show that the County Court Judgement has been paid in full. This will be available to any lender or creditor looking at your file after you apply to get credit from them.

What if you can pay CCJ within 30 days? Will paying up clear a CCJ?

A County Court Judgement will not be added to your credit report if you make a full payment in the first month since the CCJ was issued.

This is the only way to remove a CCJ from your credit file.

Even after you’ve made the payment, the CCJ will still be entered into the Register of Judgements, Orders and Fines for the public to view.

Get a copy of your credit report from any credit reference agency to check for the status of your CCJ, It should show the CCJ marked as satisfied.

Note that if you don’t pay the full amount within a month, it will stay on your credit report for the full six years.

So, yes, a county court judgement does affect your credit rating as long as it appears in your credit file.

How to get a paid CCJ marked as satisfied

The only way to clear a CCJ from a credit file is to pay the money or apply to set the CCJ aside.

You can get your CCJ marked as satisfied by providing evidence of full payment – possibly a bank statement – to the court.

You can also apply for a certificate to show you have paid the CCJ in full. You will need to contact the court to apply for Certification of Satisfaction, namely the HM Courts and Tribunals Service.

There is a fee for this service, currently costing £14.

This certification may be beneficial if you plan on applying for a mortgage or other types of credit in the future.

So, in summary: To have a county court judgment marked as satisfied, inform the court (with proof of payment).

Then they will let the Registry Trust Ltd know, who will then inform the credit reference agencies (Experian, Equifax, etc).

As a result of this, the CRAs will update your credit report.

Now if you’re wondering: ‘Will a satisfied CCJ improve my credit score?’ Yes, it should. A satisfied CCJ shows that you’ve fulfilled your financial obligations.

Great! So, how much will my credit score go up when a CCJ is removed?

The answer is by a few hundred points, which could be as many as 200 points. However, the improvement in the credit score will vary based on other factors in your credit history.