How Far Back Can Tax Credits Claim Overpayments?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about old tax credit overpayments that HMRC may claim?

We understand the stress it can cause, but you’re not alone in this situation. Over 170,000 people visit our website each month seeking guidance on topics such as this one.

In this article, we’ll help you understand:

- How far back HMRC can claim tax credits overpayments.

- Your responsibilities as a claimant.

- What tax credits and tax credit overpayments are.

- What you can do if you have a tax credit overpayment.

- How HMRC recovers debts.

We have a team of experts who have been through similar situations. They know how daunting it is to deal with tax credit overpayments, and they’re here to guide you and make the process less scary.

Let’s dive in and learn more about dealing with HMRC and tax credit overpayments.

Disputing HMRC

If you want to dispute your tax credits overpayment and up-to-date legal advice for tax credit overpayments, one option is to get professional advice.

What are tax credits?

Tax credits are a government payment to help people if they work and do not earn over a certain threshold and/or have children.

Thus, they are split into working tax credits and child tax credits.

You can make a single claim or claim as a couple. If you apply with a partner, your combined income and circumstances will be means-tested.

There are certain criteria that you must meet to be eligible for payments. You may be able to apply for Universal Credit from the DWP if you are not eligible.

Your responsibilities as a claimant

As part of your tax credit claimant responsibilitiein the UK, you must inform HM Revenue and Customs (HMRC) of any changes in your circumstances to avoid overpayments or underpayments of benefits or tax credits.

Doing so can ensure you receive the correct financial support and avoid potential penalties for incorrect claims.

Things you must report include:

- Changes in income

- Changes in employment status

- Changes in relationship status

- Changes in living arrangements and address

- Children

- Health and disabilities

What are tax credit overpayments?

Overpaid Tax Credits are when the government pays you more than you are eligible to receive.

Overpayment of tax credits usually occurs because:

- HMRC estimated your future household income incorrectly

- You claimed with a former partner

- You did not inform HMRC of changes to your circumstances during the tax year

- Someone made a mistake processing your claim

Most calculations are made at the end of the tax year.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What can you do?

If you think you have received a tax credit overpayment, it is important to ask HMRC’s tax credit office to investigate your income early.

If you have an overpayment and don’t act, HMRC may ask you to repay and begin a debt recovery process.

You can contact HMRC on 0345 300 3900.

Don’t wait until the end of the year to notify them of changes; otherwise, dealing with an HMRC overpayment will be much more complex.

» TAKE ACTION NOW: Fill out the short debt form

Do you have to pay it back?

Every claimant will need to repay any tax credits overpayment to HMRC, and it is highly unlikely they will get away without paying, even over a longer period.

There are many ways to repay a small or large tax credit overpayment, which makes it affordable for your household.

Negotiating tax credit overpayment repayment can seem scary, but ignoring it will worsen things.

If you had an old joint claim with a partner and have been informed of overpayments, each claimant will be asked to repay 50% of the overpayment.

How will HMRC Recover debts?

HMRC will write a letter to inform you they calculate that overpayments have been made.

The letter states that you must repay your total HMRC tax credit overpayment. There are many methods of HMRC debt recovery, depending on the claimant’s current situation.

For example:

“I still receive tax credits”

HMRC will take payments from your future tax credit payments, meaning you will repay the debt over the course of many months.

Your income and household circumstances will decide if HMRC will recover 10%, 25% or 50% of your future payments. But a 100% deduction could be applied if you claim the child payment.

“I now receive Universal Credit”

The debt will be recovered from your ongoing Universal Credit.

“I don’t receive any tax credit award or DWP benefits.”

HMRC will send the claimant a notice to repay the overpayment debt; they will have 30 days to pay. This is known as direct recovery because you pay the money back yourself.

If paying back the HMRC overpayment debt is difficult, you might be able to agree on a way to repay in instalments. You can ask HMRC for more time to pay when they use direct recovery.

You could use the services of a debt management company to help. Or use free equivalent services from some of the excellent charities throughout the UK.

Work out a budget before agreeing!

If you are asked to repay directly, you can use bank transfers, cheques, or agree to a direct debit.

If the debt is too big and you want to agree on a repayment plan to spread the cost, you should make a budget first.

A monthly budget will help you discover what you can realistically repay without causing financial hardship and the possibility of other arrears accumulating elsewhere.

You should do this before picking up the phone to speak with HMRC so you already know what type of instalments you can and cannot agree to.

Working out a budget may also work to your advantage, as HMRC will see that you have already considered your finances and show you are doing your best to repay.

Other things that you could speak to HMRC about include:

- Instalment Plans: HMRC may allow you to spread the repayment over several months through an instalment plan. This means you can pay off the debt in manageable monthly amounts, easing the strain on your finances.

- Deferred Payment: If you are facing immediate financial hardship and cannot start repaying right away, you may be able to negotiate a deferred payment arrangement with HMRC. This allows you some breathing space before you begin the repayment process.

- Payment Holidays: In certain circumstances, HMRC might agree to a temporary payment holiday, where you don’t make any repayments for a specific period. However, interest may still accrue during this time.

Remember that HMRC’s primary goal is to recover the outstanding amount while ensuring that you are not pushed into financial hardship.

By being proactive and engaging with HMRC, you increase your chances of finding a repayment plan that suits your circumstances and alleviates the stress of the situation.

What happens if you don’t pay?

If HMRC cannot recover the overpayment and you refuse direct recovery, they can take enforcement action, usually by employing bailiffs to go to claimants’ homes.

If you are dealing with bailiffs, you could benefit from our dealing with bailiffs letter template!

Alternatively, in England and Wales, cases HMRC are chasing will be passed to the DWP. In Northern Ireland, they can be passed to the DfC.

They will use enforcement action by reducing your DWP or DfC benefits, using bailiffs, or taking money from your employment income by changing your tax code.

Can you go to jail?

If you know you have received a tax credit overpayment and don’t do anything about it, you could be committing benefit fraud.

The potential penalties for tax credit fraud include a prison sentence or a large fine, forcing you to repay what you owe. The potential penalties for tax credit fraud

Do you have to pay back tax credit overpayment?

You have to pay back legitimate tax credit overpayments.

If you are made aware that you have received a tax credit overpayment, you should try to rectify the situation as soon as possible.

You will likely have several repayment options, such as paying in instalments.

However, if you believe you are being wrongly chased for tax credit overpayments, you can formally dispute HMRC’s claim.

HMRC Tax Credit debt dispute process

If a claimant receives a letter from HMRC saying they owe back overpayments, they can dispute HMRC’s claim.

You can appeal against the overpayment within three months of receiving the letter, either online or in writing.

The tax credit overpayment dispute procedure can be tricky, but a charity will assist for free.

After you have sent your dispute, you will get a decision with the reasoning for the decision. You’ll also be asked to repay an amount relating to the decision.

You may dispute this decision again.

But you must send evidence or information to show why you disagree with the decision.

HMRC states that disputes are only successful less than 10% of the time when admin errors are made.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long can they pursue a debt?

Some HMRC debts do not become Statute Barred, meaning a claimant can be chased for decades.

The standard timeframe for HMRC to investigate claimants is four years. But nothing is stopping them from pursuing much older debts.

Can tax credits be Statute Barred?

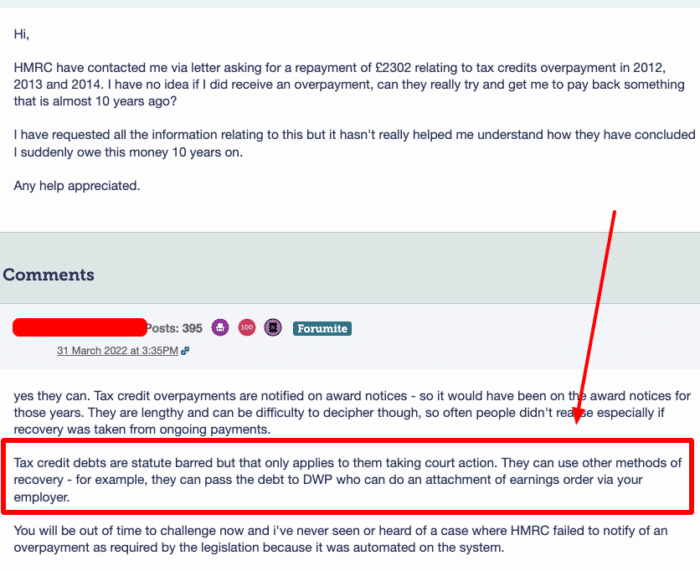

Technically, credit overpayment can become Statute Barred, meaning they cannot start court action after six years.

This is due to the Limitations Act 1980, which prevents older recovery cases from going to court to protect the legal system from becoming overwhelmed.

But these debts are more complicated, and there may be other ways for your debts to be recovered by HMRC.

It’s unlikely you will avoid enforcement action before the time limit. National Debtline is renowned for being good at helping in these cases.

Can tax credit overpayments be written off?

It is possible to get a tax credit overpayment written off.

If you owe tax credit overpayment but are experiencing financial hardship or mental health issues, you should contact HMRC with evidence of your situation and ask them to consider writing off tax credit overpayments.

HMRC is obliged to handle your case sympathetically to avoid causing further distress.

They may agree to write off your debt or stop the recovery process for 12 months. After the initial 12 months, HMRC will review the recovery options again.

Further support is available!

Claimants can find further support and assistance with charities or help by speaking with some respected debt management companies.

Be careful when choosing the services of one of these providers for support for handling tax credit overpayments because not all of them have good reviews, and some can charge hefty fees.

You may be better off using a free charity service. I’ve added the details of some below.

| Organisation | Website | Phone number |

| Stepchange | http://www.stepchange.org | 0800 138 1111 |

| National Debt Line | http://www.nationaldebtline.org | 0808 808 4000 |

| Citizens Advice | http://www.citizensadvice.org.uk | England: 0800 144 8848 Wales: 0800 702 2020 |