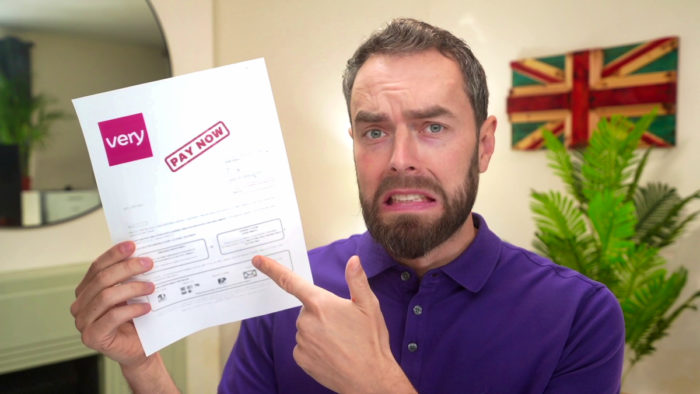

Very Debt – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering whether you should pay your Very catalogue debt and what to do if you can’t? You’ve come to the right place. Each month, over 170,000 people visit our website for advice on dealing with debt.

In this clear guide, we’ll explain:

- What Very catalogue debt is

- How to go about repaying a Very debt

- What happens if you don’t pay your Very debt

- Options for managing your Very debt

- Where to find help and advice on debt

We understand that being unable to pay a catalogue debt can be stressful. It can be tough to know what to do or who to speak to. Citizens Advice says that catalogue shoppers who miss payment deadlines get charged very high fees, sometimes more than twice what they borrowed.1

But you’re not alone; we’re here to help you understand your options and make the best choice. So, let’s begin exploring your Very debt management plan.

How do I repay?

You’d typically enter into a monthly repayment schedule with the creditor to repay your Very debt. You pay off the debt in monthly instalments to clear the balance you owe. This would involve making a minimum payment each month.

Although this Very payment option sounds achievable, there is a downside to it. When you pay the minimum every month, the amount mostly covers the interest charged to your account. This makes it take longer to pay off the principal balance. In short, it does not resolve the debt, which is harder to pay off. Plus, it puts you at risk of falling into ‘persistent debt’. And there could also be Very late payment fees added.

That being said, it is critical to consider a few things before you take out a Very credit. Ask yourself the following questions:

- Do I really need the item? Is it worth taking a catalogue credit for?

- Do I have the discipline (and means) to make the repayments on time and continue to cover my regular expenses?

- Can I afford the interest if I fall behind in payments?

- Can I buy the item cheaper elsewhere?

- Can I get cheaper credit elsewhere (e.g. a bank)?

» TAKE ACTION NOW: Fill out the short debt form

Options for paying it off

When you want to pay off your Very debt, there are options worth considering. I’ve listed a few here.

An informal agreement

You can tell Very that you can’t meet the scheduled payments, and they could agree for you to pay less. This could give you a little time to work things out. It’s not a legally binding agreement. Plus, Very could opt-out when they want to at any time. Also, the company is not obliged to agree.

Take out a consolidation loan

You could apply for a consolidation loan to pay off your Very debt. It could be a good option if you have other debts to pay. The amount you owe creditors is covered in one manageable monthly payment.

The downside to this option is that it could extend the amount of time it takes you to pay off your debts. My advice: think carefully before going down this route and seek impartial debt advice from an independent not-for-profit organisation.

Opt for a balance transfer

There are many credit card offers available with a 0% APR for a fixed amount of time. When you switch to interest-free credit cards to help pay off a Very debt, it could help get you back on track. Remember, APRs for catalogues can be 20% to 40%.

The downside to this option is that eventually, you’ll have to pay off what you owe on your credit card too!

I must also caution here that the 0% APR offer is typically promotional and will expire after a certain period. After that, the interest rate can rise considerably, which could lead to more debt if the balance is not paid off during the offer period. Be sure to read the fine print.

Choose to pay more in one instalment

If you can afford to pay off a more significant portion of what you owe on your Very debt, do so. I suggest you get in touch with Very Support and ask if you can make a one-off lump sum payment.

For a full list of all the available debt solutions out there, please look at the following table.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if I don’t pay?

Very can take you to court to recover the amount you owe. So you could get a County Court Judgement (CCJ) levied against you. This affects your credit history, meaning your ability to borrow, get a loan, credit card, or mortgage may be impacted. Also, a CCJ will remain on your credit report for six years.

Your account with Very will also be closed so you can’t buy any more goods.

Because catalogue debts like Very are non-priority debts, they should be paid only after you’ve cleared housing bills and living expenses. Also, unlike hire purchase agreements, you won’t have to return the item if you fall behind in Very payments.

I’m unable to pay. What can I do?

Stay calm, and don’t panic, although your instincts may tell you to. The best thing you can do is seek help. With the right advice, a Very debt may not seem so daunting. Plus, there are debt solutions that offer free advice and can help you get out of a hole.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Very Contact Details

| Website | very.co.uk |

| Registered office | 1st Floor, Skyways House, Speke Road, Speke, Liverpool L70 1AB |

| Phone number | 0800 11 00 00 (Customer Care Team, Complaints & Automated Payment Service) 0800 092 9042 (Financial Difficulties / Persistent Debt) 0800 0151 290 (Identity Theft Team) 0800 068 6903 Fraud Response Team |

| Operating hours | Monday to Friday 8 am – 6 pm Saturday 9 am – 4 pm |

References

- Citizens Advice – Catalogue customers hit hard for missing interest free deadlines