Guide on How to Delete Your Very Account: Closing Steps

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

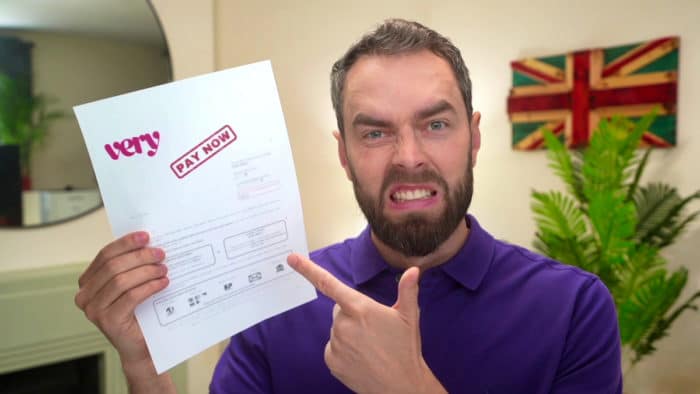

Are you curious about how to manage your Very catalogue debt? Wondering what to do if payment becomes a challenge?

You’ve come to the right place. Every month, over 170,000 people visit our website looking for guidance on handling their debts.

In this easy-to-understand guide, we’ll talk about:

- Understanding your Very catalogue debt

- The correct steps for repaying your Very debt

- The outcome if you fail to pay your Very debt

- Different ways to manage your Very debt

- How and where to find help and advice on debt

We know that dealing with the inability to pay a catalogue debt can be scary and confusing. It’s hard to know what steps to take or who to ask for advice. Citizens Advice says that catalogue shoppers who miss payment deadlines get charged very high fees, sometimes more than twice what they borrowed.1

But remember, you’re not alone in this. We’re here to help you understand your options and decide the best course of action.

Why should you delete your account?

My Very Account doesn’t cost me anything, so why should I delete it?

Well, there are multiple reasons why you might want to cancel your account:

- Very.co.uk is sending you hundreds of annoying marketing emails.

- You are tempted to spend far too long looking through the site and making purchases.

- Your bank account details may be saved to the site, making buying stuff far too tempting. It can be a great way to control impulse buying.

- You’re not happy with Very customer service or product variety.

- You want to reduce your online spending to save more money.

No matter the reason, it is not wrong for you to delete your Very.co.uk account.

» TAKE ACTION NOW: Fill out the short debt form

Will Closing My Account Affect My Credit Score?

After closing your Very account, you may see a reduction in your credit score. However, this is normal. You don’t have to worry about it. The change in your credit score isn’t a direct consequence of closing the account but rather a result determined by your repayment history. So the impact largely depends on your broader financial history.

If you have a positive repayment history and look after your account well, your credit score will likely have been positively affected. However, open accounts tend to carry more weight than closed accounts when determining your credit score.

Therefore, after closing your account, your credit score may drop as the positive influence from your account is reduced. After closing your account, Very is also obligated to delete or anonymise your personal data according to GDPR regulations. So, any other information they have about you will be erased from their system.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will I Still Owe Payments?

Any amount owed to Very is still due even when the account is closed. They might still come after you for the arrears. Even worse, Very could get a court action against you, forcing you to pay. My advice is: verify that you’ve cleared your credit card arrears before closing the account.

If you’re struggling to make your monthly payments, contact Very to see if they can allow you to pay in more affordable instalments. You can also reach out to a trusted debt charity (e.g. Citizens Advice Bureau) to seek help for free. There are many options at your disposal. To learn more about debt solutions, please check out the table below.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

Can I Reopen My Account Later?

You may be able to reopen a closed Very credit card account provided you closed it yourself, and you have no missed payments. Even if they closed it for you, you may still have an option to reopen it. Just contact Very to get it reinstated.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Two Ways to Delete Your Account:

Once you’re certain that deleting your Very.co.uk account is the best decision for you (we’re not here to push you in either direction, as it’s important that you take control of your finances for yourself), there are two ways to do so.

The two ways to delete your Very.co.uk account are: by deactivating your account on the Very website or by deleting it through email.

From my experience, the Very account deletion process is as follows:

Cancelling account via the website:

- Go to Very.co.uk and log into your account as you normally would.

- In account settings, you will need to find and start a conversation with a ‘Very Assistant’.

- This is a chatbot, so ask it to ‘delete my very account’, and it will forward you to a human chat advisor.

- It may take a little while to get in touch with you, so I suggest you stay patient. When they do reply, ask them to delete your account.

- The chat advisor may ask for some proof that the account is yours, but if you can answer the questions truthfully, they will certainly be able to delete your account for you.

- To finish, you just need to confirm that you want to delete your account, and that’s it.

Very.co.uk Contact Details

| Address: | 1st Floor, Skyways House, Speke Road, Speke, Liverpool L70 1AB |

| Phone: | Customer Care Team, Complaints & Automated Payment Service 0800 11 00 00 Monday to Friday: 8 am – 6 pm Saturday: 9 am – 4 pm |

| Website: | https://www.very.co.uk/ |

Cancelling through your email:

This is often considered the easier and more direct way. All you need to do is:

- Log into your email and send a new email to [email protected].

- Set the subject line as something like ‘delete my very account’ or ‘request to delete my very account’.

- To be sure, send your account username or email, and the Very Team will remove your account from their database.

References

- Citizens Advice – Catalogue customers hit hard for missing interest free deadlines