Can You Do Equity Release More Than Once?

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Are you keen to learn about equity release? Curious if it’s possible to do it more than once? Then, this is the right place for you. Every month, our website guides over 7,000 people on the subject of equity release. We know it can be a bit tricky to understand, but don’t worry; our aim is to make it as simple as possible for you.

In this article, we’ll explain:

- What equity release is and how it works.

- How to get a fair quote for your home.

- The possible pitfalls of releasing equity.

- How many times you can take out equity.

- The chance of having more than one equity release plan.

Equity release could be a helpful way to use the value of your home, but it’s important to know all the facts before you decide. So, let’s take this journey together and make sure you’re well-informed.

How often can you take it out?

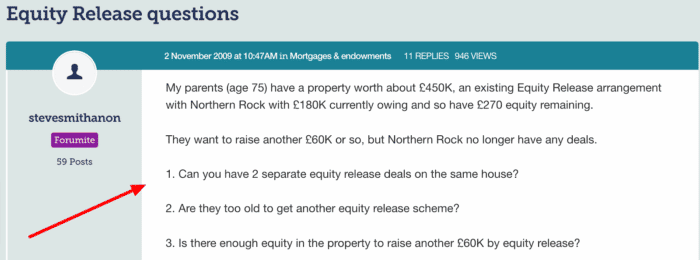

Can you do equity release more than once? It’s a question that crops up time and again on forums like these:

The answer is that you can take out a single equity release plan on your residential property only. You can only have one residential property at a time.

But does this mean you can’t do equity release more than once? Not exactly!

» TAKE ACTION NOW: Find out how much equity you could release

Is it possible to do it again?

Yes, it’s possible to take out an equity release plan more than once, but all plans taken out will need to be taken out on your current residential property.

There are three scenarios when you may take out equity release more than once within your lifetime. These are:

- Borrowing additional funds from your drawdown equity release plan

- Equity release further advances

- Re-equity release

Each of these has been explained in the sections below.

#1: Borrowing additional funds from a drawdown

Some equity release plans aren’t paid out as a lump sum loan. They can be paid out with an initial lump sum and a drawdown facility, which acts as a reserve pot of money you can access if ever needed.

Although a drawdown equity release plan is really just one plan, it can act as a second equity release loan if you choose to drawdown from the cash reserve.

#2: Further advance

An equity release further advance is when you ask your current equity release lender for more money that isn’t from a drawdown facility. For example, your property may have increased in value and you might then be able to access more of the equity by asking your current plan provider for more borrowing.

Technically, you will have done equity release more than once but remained on the same extended plan. You must receive equity release advice and have your property re-valued before you can proceed with this option.

#3: Re-equity release

You can also do an equity release more than once through a re-equity release, which is comparable to remortgaging.

You simply take out a new equity release plan with the condition that some of the money will be used to pay off your existing equity release plan and any applicable charges. You might do this for additional borrowing or for a plan with better terms and conditions that weren’t offered when you initially took out a plan.

How equity release could help

More than 2 million people have used Age Partnership to release equity since 2004.

How your money is up to you, but here’s what their customers do…

Find out how much equity you could release by clicking the button below.

In partnership with Age Partnership.

Can you have two plans at once?

No, you cannot have two equity release plans at once because the equity release loan must be the only debt secured by the property. Therefore, a second equity release plan could not be applied to the same property.

And you couldn’t add an equity release plan to another property because they can only be added to your main residence – not investment properties.

Can you be refused by a lender?

Yes, you can be refused equity release for several reasons. You may not meet the lender’s criteria in terms of age, or the property may be determined as unsuitable for the lender because it’s at risk of depreciation or will be difficult to sell in the future.

For example, retirement flats and properties prone to flooding may not be accepted for equity release.

Join thousands of others who release equity

Age Partnership have helped over 2 million people release equity from their home.

Mrs Wareham

“I am more than pleased to have taken out Equity Release with Age Partnership.”

Reviews shown are for Age Partnership. Search powered by Age Partnership.

Timescales

If you’re considering switching up your current equity release plan, you’ll probably want to know the timescales involved. They are comparable to the initial timescale when first taking out a lifetime mortgage. We’ve explained this in detail here.