Equity Release Calculator – No Personal Details Required

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Are you trying to find out about equity release plans? Do you want to use a tool to work it out but don’t want to share your personal details? You’re in the right place. Each month, over 7,000 people visit our website for guidance on equity release.

It’s normal to feel confused about equity release, but don’t worry; we’re here to help. We can guide you on:

- What an equity release plan is.

- How to get a real quote without giving personal details.

- What percentage you can get on equity release.

- How interest on equity release is calculated.

- What happens after you release equity.

We’re experts in this topic, so we understand your concerns, and we’re here to answer all your questions. Let’s walk through this journey together.

In a nutshell

Equity release is a method of borrowing for older people who own their residential home without any debt secured against it, including a mortgage. It allows them to borrow significant amounts when they would otherwise not be able to due to their age.

But equity release plans are different for another reason. The homeowners don’t have to make any monthly repayments on the loan. The money borrowed against the equity is only repaid to the lender when the last surviving homeowner passes away or moves out of the property into an aged care facility or equivalent.

When either of these situations prevails, the lender can force the sale of the home to recover the money owed.

The most common type of equity release plan in the UK is called a lifetime mortgage. However, there is another plan called a home reversion scheme. You can read about both in our How Does Equity Release Work? guide.

Your home’s equity is at risk

Equity release plans can be a great help. But, there are some bad deals out there. In fact, many people entering equity release plans may not be getting the most out of their home’s value.

To get an idea of what a good equity release deal could look like for you, try our free equity release calculator below. It took me less than 60 seconds!

Alternatives

If you don’t meet the eigbiity criteria for equity release, there are other options available to you. For example, you could downsize, sell your assets, or get a lodger. However, the most common alternative to equity release is remortgaging.

Remortgaging is the process of moving your mortgage on your property from one lender to another. People often remortgage with the purpose of taking out a larger loan, releasing some of their home equity in the process.

Before remortgaging, you should ensure that you are able to repay a larger loan. To do so, you can use a remortgage equity release calculator. You should also make sure that you meet all of the eligibility criteria before applying.

What percentage can you get?

Standard lifetime mortgages will allow the homeowner to take a loan equivalent to 20%-60% of their home equity. As they must have paid off all debts secured by the property to qualify, this is the same as 20-60% of their current property’s value.

There may be some lenders willing to offer more and there might even be some plans offering up to 100% equity release on properties that are almost certain to increase significantly in value over the following decades.

How equity release could help

More than 2 million people have used Age Partnership to release equity since 2004.

How your money is up to you, but here’s what their customers do…

Find out how much equity you could release by clicking the button below.

In partnership with Age Partnership.

What can affect the maximum percentage?

The percentage of equity you’re able to access with an equity release plan usually depends on the value of the property, its anticipated future value, and your age. The latter can be an important factor when the lender determines how much of your equity you can access.

If you have a terminal illness, you might want to consider an enhanced lifetime mortgage. These products allow the homeowner to access more equity than usual, often to help with medical bills and improve the quality of later life.

Can you be turned down?

Yes, you can be turned down for an equity release plan for many reasons, including if you don’t meet the lender’s age requirements or if the property is valued below a certain amount.

Certain aspects of a property can also result in an equity release rejection, including if the property’s roof is (partially) flat or if unauthorised building work has been carried out. Lenders will also assess whether the property is at risk of damage, such as from flooding.

What is the typical interest rate?

The standard interest rate applied to a lifetime mortgage is between 2% and 8%. You might find more competitive and higher interest rates offered by some equity release providers.

Home reversion plans don’t charge any interest at all. They work by giving the homeowner a percentage of their equity as a loan, which is repaid with a fixed percentage of the property’s future property sale. Thus, the lender doesn’t need to apply interest to ensure a profit is made, providing the property value doesn’t decrease severely.

How is the interest calculated?

The amount of interest you’re charged on a lifetime mortgage is calculated based on the size of your loan, your age, and details about the property. You might be given a fixed interest rate or a variable one. But an important thing to note is that the interest is likely to be compounding.

So, what’s a compounded interest rate? In terms of borrowing, it is when the interest added to the debt each month is applied to the loan amount and any interest already accumulated. Because interest keeps making the debt grow, the next amount of interest is always more than the previous amount of interest added.

Therefore, compounded interest rates make the equity release debt grow quicker. But they are a good thing when applied to savings accounts because you earn interest on the interest paid to you as well.

What is the difference between pay monthly and interest roll-up options?

Rolled-up interest isn’t paid back each month, whereas pay monthly interest is repaid each month as the name suggests.

Standard lifetime mortgages roll up the interest because no monthly repayments are required at all. This means the interest simply gets added to the total equity release debt each month.

However, there are some variations of a lifetime mortgage that allow the homeowner to pay off their monthly interest, namely an interest-only lifetime mortgage. This can be a good option if you want to make sure the debt doesn’t escalate into a bigger debt, and it safeguards some of your wealth for estate beneficiaries in the future.

How do you calculate the cost?

To calculate the cost of an equity release plan you’ll need to know:

- Your loan amount

- The interest rate applied

- How many months the equity release plan is active (naturally, you won’t know this as it only ends when you pass away or move out, but you can apply periodic estimates to see how the debt grows over time)

This is made easier with an equity release calculator.

Join thousands of others who release equity

Age Partnership have helped over 2 million people release equity from their home.

Mrs Wareham

“I am more than pleased to have taken out Equity Release with Age Partnership.”

Reviews shown are for Age Partnership. Search powered by Age Partnership.

Online calculator without personal data

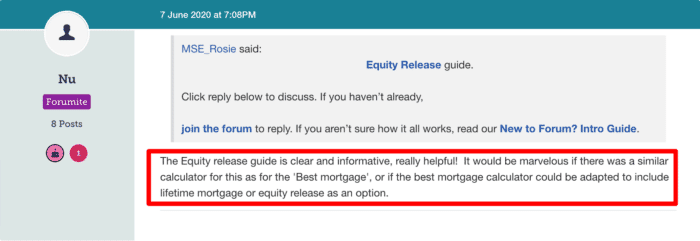

An equity release calculator is an online tool that helps people considering a lifetime mortgage to see how such a debt will get bigger. There aren’t many of them around compared to standard mortgage calculators, just like this user points out:

Source: https://forums.moneysavingexpert.com/discussion/comment/77261479#Comment_77261479

But MoneyNerd does have an equity release calculator for you to use without having to enter personal details. You can apply your own (non-personal) information to see how fast a lifetime mortgage debt grows.

Is it a con?

If you read some of the equity release horror stories online, you can be forgiven for thinking that it’s all a con. It’s certainly true that repaying a lifetime mortgage that has been active for a long time is expensive, easily costing more than double the original loan.

Nevertheless, these plans aren’t a con when they’re provided by lenders that are authorised and regulated by the Financial Conduct Authority, and especially members of the Equity Release Council.

The Equity Release Council commits lenders to provide guarantees to homeowners. For example, no matter how big the debt grows, the lender cannot take more than 100% of the property’s future sale proceeds.

Some people can really benefit from using a lifetime mortgage, but it’s essential to get professional equity release advice beforehand. In fact – it’s compulsory!

How to compare plans

You can compare different equity release plans by doing your own research or using lifetime mortgage comparison sites, such as the equity release supermarket. You could also speak with a loan broker who specialises in lifetime mortgages.

Things to consider

Equity release will involve a home reversion or a lifetime mortgage, which is secured against your property and will reduce the value of your estate and impact funding long-term care. Our equity release partner, Age Partnership provides a personalised illustration to explain the full details. The money you release, plus the accrued interest is then repaid when you die or move into long-term care. Advice is required before proceeding with equity release and any existing mortgage must be repaid. Age Partnership provide initial advice for free and without obligation. Only if your case completes would Age Partnership’s advice fee of £1,895 be payable. Other lender and solicitor fees may apply.