How Much Debt Can I Have and Still Get a Mortgage?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re unsure about how your debt may affect your chances of getting a mortgage, you’ve come to the right place. Each month, over 170,000 people visit our site for guidance on similar worries.

In this clear and simple guide, we’ll explain:

- How mortgage lenders use your Debt-to-Income ratio to decide if you can have a mortgage.

- What a good Debt-to-Income ratio looks like.

- Ways to work out your own Debt-to-Income ratio.

- How to lower your Debt-to-Income ratio.

- If having a guarantor could help you get a mortgage.

Having debt and thinking about a mortgage can be hard, especially with current market conditions.

You see, recent reports reveal that in 2024, around 1.6 million households will encounter substantial payment hikes as their fixed-rate mortgage deals come to an end.1

Don’t worry; with our expertise and your effort, we can help you find the best way forward.

What Do Lenders Look At?

There are several factors affecting mortgage applications for people in debt which I’ll explain here.

Mortgage lenders’ criteria for loan approvals include:

- Looking at your credit history

- What your income is

- The level of your monthly expenditures

- The value of a property

- The amount you want to borrow

Can I borrow with debt?

The amount of money you can borrow depends on what you can afford. This is why mortgage lenders perform affordability assessments.

An affordability assessment would factor in the following:

- What your credit score is

- How many times you applied for a mortgage which involves a hard search

Hard searches impact your credit rating. So every time you apply for a mortgage and it’s refused, it’ll show up on your credit history. Albeit, temporarily.

Affordability assessments help mortgage providers get a better idea of what you can afford in monthly payments.

Plus, the importance of credit history in mortgage applications must be stressed.

Hence, they will only approve you for a mortgage if they think you’ll be able to comfortably afford it.

This means that if you have outstanding debts and most of your income is going towards paying them, then you may not be able to borrow a lot of money.

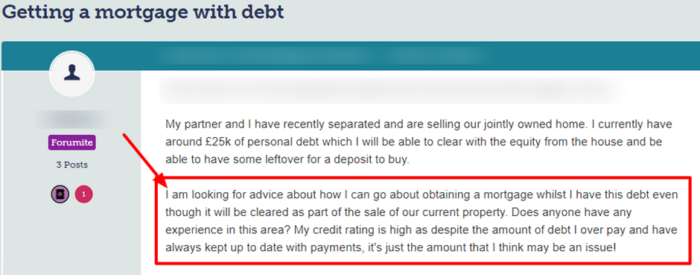

A good example is shown in the message posted by a person on a popular forum.

Source: Moneysavingexpert

What is My Debt-to-Income Ratio?

Understanding debt-to-income ratio helps you know whether a mortgage provider would consider your application.

Your debt-to-income (DTI) ratio is a financial measure which estimates what your debts are compared to how much you earn every month.

It’s what mortgage providers use when reviewing mortgage applications.

Lenders try and look for applicants with lower debt-to-income ratios because they believe they will be able to manage their monthly payments more effectively.

Please note that while your credit utilisation rate does affect your credit score, it does not affect your DTI ratio.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is a high ratio good or bad?

If your DTI ratio is high, it’s usually a good idea to devote a few months to lowering it before getting a mortgage.

As such, a high DTI ratio indicates to a lender that you currently have too much outstanding debt compared to your income.

This suggests to them that you’ll have a lot of trouble making any additional monthly payments and thus, your chances of securing a mortgage would be low.

You may still be able to secure a mortgage with a high DTI ratio but you’ll have to convince your mortgage provider with a detailed plan as to how you intend to make your monthly payments.

You may even need to consider mortgage products that are specially designed for those in your financial circumstances. These products usually include a guarantor mortgage.

You can use my free guarantor mortgage calculator to take a look at an estimate of your borrowing ability.

This is a guidance tool only and not an assessment. For an accurate mortgage assessment, consult an online mortgage broker. Do not rely solely on this calculator’s results.

In short, the impact of high DTI ratio on mortgage applications is considerable.

Is a low number good?

A low DTI ratio indicates to a lender that you practice good financial discipline and don’t have a hard time balancing your debts with your income.

The lower your percentage is, the better your chances will be in securing any line of credit you want including a mortgage.

How Do I Calculate It?

Calculating your DTI ratio is fairly simple. I’ve listed the steps to calculate your DTI ratio below.

First, you must add up any debt payments that you make every month. It includes student loans, credit card loans, child support, and car loans.

Second, you must add up your gross monthly income. It includes not only your salary but any other form of income you have such as investments or rented properties.

Keep in mind that you should NOT subtract any taxes or other deductions from your monthly income when calculating your DTI ratio.

Then, all you have to do is divide your total debt payments with your total monthly income.

Here’s an example for you:

Suppose that you pay £400 each month towards your car loan and £400 towards your credit card debt. Then, your total debt payments would be:

£400 + £400 = £800.

Now, suppose that your gross monthly income is £4000. Then, your DTI ratio would be 20% (800/4000 = 0.2).

Keep in mind that the DTI ratio is typically expressed as a percentage.

What do Lenders Consider to be a Good Number?

As I mentioned earlier, when you apply for a mortgage, your mortgage provider will assess your financial situation.

The preferred DTI ratio for mortgage lenders is an important factor that should not be overlooked.

This will include assessing your credit history as well as asking you about any other debts you may have such as credit card debt.

Your DTI ratio is also something that they will calculate and use to judge whether or not they should approve your application for a mortgage loan.

Keep in mind that you must provide complete proof in the form of bank statements during your mortgage application process.

It proves your gross monthly income as well as the payments you make towards your debts such as credit card debt, student loans, or car loans.

Once the lender has the information about your finances, they will calculate your DTI ratio for themselves.

Most mortgage providers prefer to see a DTI ratio of less than 36%. Of this 36%, no more than 28% should be going towards your monthly mortgage payments.

For example, this would mean that if you had a gross monthly income of £4000, then your mortgage payments should not exceed £1120.

For most lenders, if your total DTI ratio exceeds 36%, it could be difficult for you to get a mortgage.

You may still get it if you can explain to the lender why you’ve accumulated so much debt and if you have an effective debt solution in place to address it.

If your DTI ratio is higher than 43%, it’s likely that you will not qualify for a mortgage loan no matter what you do.

» TAKE ACTION NOW: Fill out the short debt form

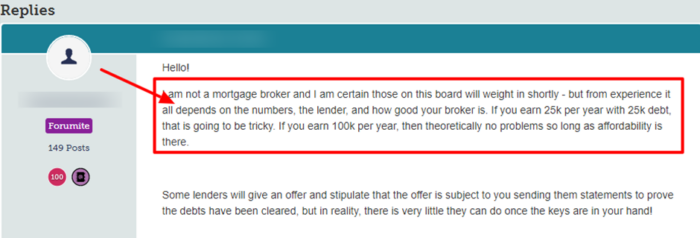

The role of a broker

You could approach a few mortgage brokers who may be willing to offer you a mortgage.

However, their rates are not going to be competitive and you could end up paying a lot more than you’d hoped to.

It may not be the best option if you’re already struggling with your finances.

In short, assistance from mortgage brokers for loan approval when you have debt could be an expensive choice.

What can I Do to Lower It?

I just discussed how to calculate your DTI ratio above. Now, I’ll cover the various techniques to reduce your DTI ratio.

Using that information, you can see that there are mainly two ways to lower your DTI ratio:

- By Lowering debts for better DTI ratio.

- Explore ways to increase gross monthly income.

Reducing your debts can go a long way in lowering your DTI but that’s easier said than done.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is it a good idea to transfer credit card balances?

If you have credit card debt, you may be able to reduce it by transferring your balance onto another credit card that has a lower interest rate.

Balance transfer on credit cards can be a prudent way to effectively reduce the amount of debt you have.

However, you must keep in mind that balance transfers on credit cards often have their own fees which you should be aware of.

Curb your spending to reduce debt

You can also opt to reduce your living costs by assessing your spending habits and eliminating any unnecessary costs.

You should consider your needs versus your wants and try to hold off on your wants until you can get your finances in order.

After a few months of practising financial discipline, you may find that you have extra money. You can then use this money to take care of your debts and thus, lower your DTI ratio.

To increase the amount of money you earn every month, you could opt for any of the following:

- Get a second job or try freelancing.

- Work overtime at your main job.

- Ask your employer for a pay rise.

- Learn a skill or complete a course which will enable you to secure a job at a higher salary.

Can I get help with debt?

Yes, you can get debt help in the UK by contacting a leading charity or a debt management company.

Several major UK charities that provide debt advice. Alternatively, debt management companies provide debt management assistance in the UK.

It’s worth noting that charities provide free debt advice, whereas you’d have to pay if you approach a debt management company.

For more information and advice on how to lower your DTI ratio, you can contact an independent charity such as StepChange or Payplan.