How to Dispute Your Debt in the UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Welcome to our complete guide on ‘Disputing a Debt UK 2023’. If you’re feeling worried about a debt that doesn’t seem right, you’re not alone. Each month, over 170,000 people come to us for advice on debt issues just like yours.

In this guide, we’ll help you understand:

- What it means to dispute a debt.

- When and how you can dispute a debt.

- The role of different agencies in debt disputes.

- Possible outcomes of a debt dispute.

- Steps to take if you’re struggling with unaffordable debt.

We know how stressful it can be to deal with a debt you believe is incorrect. as some of our team members have faced similar situations, so we truly understand what you’re going through. Rest assured, we are here to provide guidance every step of the way.

Let’s start your journey to resolving your debt issue today.

When Can You Dispute a Debt?

Before you attempt to dispute a debt, you need to make sure you meet a few requirements.

In short, you should check your debt dispute eligibility.

The first thing you need to check is if you’ve accepted liability for the debt.

If you’ve agreed to pay the debt back in the past or even opted for a debt solution that covers your debt, you’re liable to repay that amount.

Secondly, if a debtor is charging you an amount that you don’t think is right. Or if you think it is more than you agreed, you should go through all the paperwork related to the debt.

You may find proof that the actual amount owed is less than what your creditor is charging you. If so, you can take the issue up with them.

Lastly, if you’re looking to dispute a debt because a debt collector called you and asked for the money, don’t immediately assume that you don’t owe the debt.

Instead, check if your creditor has sold your debt to the debt collection agency. You’ll find out if you now owe repayments to them instead of your original creditor.

If you’re having trouble determining whether or not you can dispute a debt, you can seek advice from an independent charity such as StepChange or Payplan. Alternatively, you can find which debt solutions might work for you by filling out our debt form.

Am I Eligible? – 7 Criteria to Meet

This section will address the seven criteria you can use to dispute your debt.

Understanding your rights in debt disputes is essential.

If you feel like you don’t owe what you’re being asked to pay, it may be useful to understand if you’re eligible to dispute the debts.

Criteria for debt disputes include:

- If you were underage when you signed the agreement

The first criterion is if you were not of age when you signed the credit agreement.

If you were under eighteen when you signed your credit agreement, your agreement isn’t valid under the law. Provided an adult did not co-sign the agreement.

Check if you have any proof that you were not eighteen when you signed the agreement, and if so, you can dispute your loans.

- If you didn’t sign an agreement at all

If you didn’t sign a credit agreement at all, it could be a valid reason to dispute your debts.

A credit agreement is a legal document that affirms that you are agreeing to the promise of repayment at some point down the line.

If the agreement doesn’t exist, you can dispute your debts.

- If you were pressured/coerced into signing the agreement

The corporate world can be very tricky to navigate.

You could have to deal with sales representatives and business managers who lead you to believe they’re doing you a service.

If you think that your arrangement was unfair because representatives coerced you or pressured you to agree to the deal, you could potentially use this as a reason to dispute the debts.

- If you didn’t understand the credit agreement

If you didn’t understand what you were signing, you can use that as a reason to dispute the loan.

The law states that creditors/lenders have a responsibility to provide clear data and information on what they’re signing you up for, and the nature and specifics of the agreement.

If your creditors used misleading or complex language on purpose, and you didn’t recognise or understand it, you could challenge the loan.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

- If your name isn’t on the agreement

If you read the credit agreement and don’t find your name on it, you’re not legally responsible for paying back the loan.

In such a circumstance, if the creditor or a debt collection agency is contacting you and chasing you for repayment instead of someone who’s legally responsible, you can dispute the loan and take the issue up in court.

- If what you’re being asked for doesn’t match the agreed conditions

It’s a straightforward principle: you should only have to pay what you agreed, nothing more.

If your creditor tries to cheat you into giving them something you didn’t agree to, you have a right to dispute the loan.

Under the law, there’s a period of fourteen days in which you may choose to cancel the agreement if you find that you’re not getting what you agreed on.

In this instance, the law is on your side.

- If the credit agreement has incomplete or incorrect information

Your creditors are legally responsible for ensuring that all the information on your credit agreement is correct and that no information is missing.

If you find clearly incorrect information, or if there’s some missing information on the credit agreement, you may be eligible to dispute the loan.

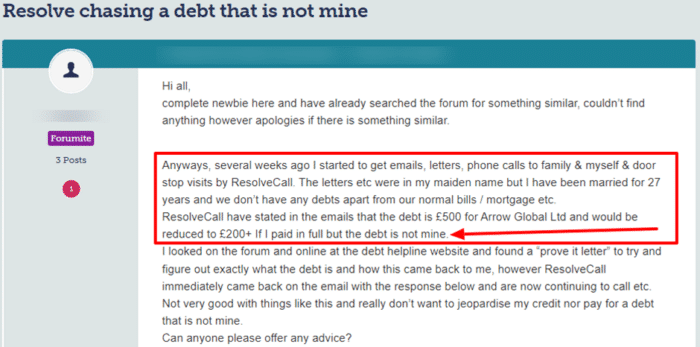

Case study: debt collector chasing wrong person

Source: Moneysavingexpert

My Creditor Sold Off the Debt… Is this Disputable?

Selling debts usually isn’t an issue where a dispute can be made.

In short, disputing sold off debts is possible and the good news is that your rights remain the same regardless of whether your creditor sold your loan off to a debt collector or not.

If you don’t recognise the loan and you think you don’t owe them money, you can choose to dispute it.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How To Dispute a Collection That Has Been Sold

Most of the time, it is 100% legal to sell your debt to a collection agency, even if you had come to a repayment agreement with the original creditor.

As such, you’ll likely be unsuccessful if you want to dispute the selling of your debt.

However, challenging sold off collections is possible if the debt is not yours, or its amount is incorrect.

For example, if you do not recognise the debt, or you believe that the balance is too high, you can write a debt dispute letter to the agency.

Does filing a dispute hurt your credit?

A dispute against a debt won’t impact your credit score.

However, when certain information on a credit report changes because of a dispute, it will impact your credit score.

In short, the impact of disputed debts on credit scores depends on the outcome.

» TAKE ACTION NOW: Fill out the short debt form

Writing a Letter

A debt dispute letter is a letter that you can send to a debt collection agency to have them prove you owe money they claim you owe.

Writing an effective debt dispute letter is important because it shows you’re serious.

If you’re being hounded by a collection agency a dispute letter is one way to make them back off, especially if you know they can’t prove that you owe them a certain amount.

What To Write To Dispute a Debt

You should ask the collection agency to provide evidence of your liability for the alleged debt.

If they can’t do that, you should request that the agency send you written confirmation that the matter is closed.

I’ve listed the key elements of a debt dispute letter here:

- You must state the reference number they assigned to your case

- You should also attach a copy of any letter the collection agency has sent to you

- If they don’t reply to you within a few weeks, you can file a complaint with the FOS

Possible outcomes

If there are any changes made following a debt dispute, you may find it helps your credit score.

For example, removing inaccurate details on a credit would see your rating improve. However, the opposite is true if you lose a debt dispute.