When Do Debt Collectors Give Up? (According to UK Laws)

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Wondering when debt collectors might stop trying to get money from you? It’s a common worry, but you’re in the right place to find out. Each month, over 170,000 people visit our website looking for guidance on debt matters.

In this article, we’ll discuss:

- What a debt collector is and why they might be trying to get money from you.

- How long they can keep trying to get money from you.

- What could happen if you don’t pay your debt.

- How to talk to debt collectors and maybe even make your debt smaller.

- How to get help if you’re finding it hard to pay back what you owe.

You might be feeling confused about where the debt has come from or worried because you can’t afford to pay. Maybe you’re even wondering if the debt is real.

It’s okay to feel this way. In fact, research shows that 64% of UK adults find interactions with current debt collectors stressful1. We’re here to help you figure things out.

Why Are They Hounding You?

There are two reasons why you may find you are being chased by a firm of debt collectors. Firstly, one of your creditors may have asked a debt collection agency to collect the debt on their behalf. Secondly, your debt has been taken over by the agency itself, and they will pursue you and try and get you to pay it.

These are two subtly different scenarios. When a debt collector is acting as an intermediary between you and one of your creditors, it is still the creditor you owe money to. However, when a debt collector takes on your debt entirely, you then owe the collection agency.

Debt collection agencies buy billions of debt annually at rock bottom prices – at an average of 10p to £12, which means that the debt collector that purchased the debt will chase payment relentlessly to make a profit.

Can Debt Be Ignored?

In general, no – debts cannot be ignored. If you are liable for a debt, you need to find some way to settle it. Alternatively, you need to set up a repayment plan that you can afford, based on your current financial situation, and we go over this a little later in this post.

However, you need to check you are actually liable for the debt that you are being pursued for. If you were not the original signatory of the credit agreement, you should not be chased to pay it.

I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do You Need To Pay Them?

The simple answer here is yes, you do, as long as you are legally liable for the money you owe. That being said, later in this guide, we will explain how long a debt lasts before it is written off. If you can manage to avoid being found by the collection agency for this entire timeframe, you might be able to get away with not paying.

But this is easier said than done, as collection agencies are very good at tracing debtors and finding ways to contact them.

» TAKE ACTION NOW: Fill out the short debt form

What Happens if You Don’t Settle Your Debt?

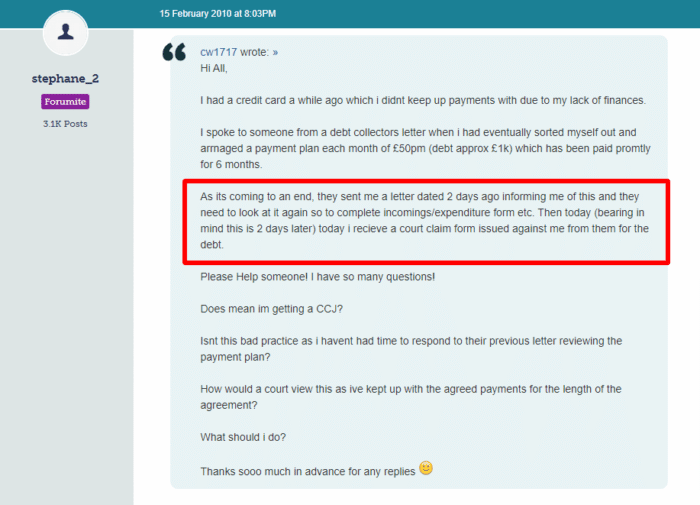

If you don’t settle your debt, or make arrangements with a debt collection agency to do so, then you will find that debt collectors will take an increasingly serious series of actions. We have listed these below.

- You will be sent letters, probably many letters, demanding that you pay your debt.

- The debt collection agency will telephone you at any number they can find. This will likely be done in the evening or at weekends.

- House visits may be made, in an attempt to get you to pay up. Again, this could happen either at the weekend or in the evening.

- A collection agency might issue a default against you, and this will have a negative impact on your credit score.

- A County Court Judgment (CCJ) might be sought against you, having an even worse impact on your credit score.

- As a precursor for having you declared bankrupt to facilitate getting repayments taken from your wages, when you are bankrupt, a statutory demand might be issued.

Debt Collectors vs Bailiffs

Although both debt collectors and bailiffs can visit your home, they have different rights when it comes to trying to collect a debt. It’s key that you know the main differences between debt collectors and bailiffs so that you don’t get taken advantage of.

Here’s a quick table summarizing what each one can and can’t do.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

How Long Can a They Chase You?

A debt collector can chase you as long as the debt is owed before it is written off. Debt is generally written off after 6 years.

However, there is a nasty kicker here. The 6 years run from the last date you had communication with the collection agency. From the last time you spoke to them or even acknowledged them.

Therefore, if you want to try and avoid paying a debt for the entire 6 years until it is written off, you need to make sure you have no phone or face-to-face contact with the collection agency. This will be very hard to do.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Negotiating With Them

Debt collectors would prefer that you paid your debt without taking you to court. The simpler the collection process is, the less it will cost them and the more profit they will make.

Therefore, it can be possible to negotiate an easier repayment schedule with a collection agency, based on what you can afford rather than what you owe. You could potentially use a standard letter template to begin the process of negotiation.