Charging Order Interest Rate – Everything You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering about the ‘charging order interest rate’? If so, this is the right place for you. Each month, over 170,000 people visit our website seeking clear advice on debt solutions.

In this simple guide, we’ll explain:

- What a charging order is

- Why a creditor might ask for a charging order

- How charging orders can affect you

- What the rules are around charging orders

- Other ways to sort out debt problems

We know that dealing with debt can be tough. You might be worried about how a charging order could affect your life. But you’re not alone; we’re here to help you understand the process and make good choices.

What Exactly Is It?

A charging order is issued by a court and is the first step in a creditor attempting to have you sell your home to pay your debt to them. At this point, unless you can have the debt written off, you need to take action quickly.

Once a charging order is in place, the Land Registry is informed. This means that any attempt to transfer ownership of the property will trigger the conditions of the charging order. Note that at this stage, even if the original debt was unsecured, it is now secured against your property.

Why Does a Creditor Apply for One?

If a collection agency such as Cabot Financial or Lowell Financial is chasing you to pay a debt, they might decide to seek a charging order against you. Doing so will apply leverage, and force you to start paying the debt, at least this is what they hope.

Once a charging order is in place, you are legally obliged to address the debt. If you don’t, the creditor can take the next step, and apply for an order for sale, which will mean you have to sell your property and settle the debt in full.

» TAKE ACTION NOW: Fill out the short debt form

Limitations

There are a number of limitations placed on charging orders under UK law. Most of these come from the Limitation Act 1980. Below, we look at what some of these limitations are.

In general, a judgment debt is limited to 6 years. Put simply; interest can only be added to the original debt for up to 6 years after the judgment is issued. This is not the case for charging orders, and this is an important consideration. Interest can be added until the debt is paid off, no matter how long it takes.

Under UK law, it is not possible to apply for a fresh judgment on a debt within 6 years. However, a charging order is not seen as a fresh judgment, it is simply securing the debt that a previous judgment was made on.

Under the Judgments Act 1838, express provision is made for judgments, such as a charging order, to allow interest to be added to the debt from the date the judgment was made to the date it is settled in full.

The takeaway here needs to be that once the charging order is in place, you are going to be charged interest on the debt until it is paid. Nothing you can do can change this. By now, you should understand that having a charging order issued against you is going to mean you have to find a way to repay the debt and do so as quickly as possible.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Consequences

A charging order can significantly impact your financial health, credit rating, and future borrowing capabilities in several ways. Let’s delve deeper into the broader consequences of having a charging order:

- Paying off the debt connected to the charge order could take a big chunk of regular income, making it hard to meet other financial obligations.

- The total amount due increases because interest keeps adding up on the charging order. This makes the financial burden last longer.

- A charging order and the County Court judgment (CCJ) that normally comes before it will be kept on your credit report for six years.

- Future debtors are likely to be wary of people with a CCJ and charging order on their credit report.

- If you have a charging order against your home, it might be much harder to get a mortgage or remortgage.

- Mortgage lenders might see you as a high-risk borrower, which could change your loan-to-value ratios and interest rates.

Statutory Interest

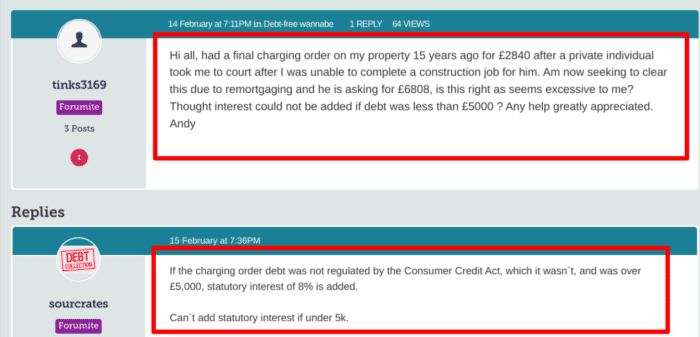

Charging orders that apply to a debt of more than £5,000 will make provision for the creditor to add statutory interest. This is at a flat rate of 8% per annum. In some cases, this might actually be beneficial if the original debt was at a much higher interest rate.

This interest is added from the date the judgement was made, and the charging order was issued. Interest will be added until you have paid back the entire debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Interim Versus Final

There are two types of charging orders. An interim one and a final one. They are subtly different, so we have outlined each below.

- Interim charging order – can be issued without a court hearing. It secures debts against your property but does not yet lay out the conditions and limitations of the charging order in stone.

- Final charging order – will usually require a court hearing. You can challenge the order and also apply to have the conditions changed before they are made firm.

The Timeline of an Order for Sale

Having a charging order issued against you is the precursor to forcing you to sell your home through an order for sale. But there is a very exact timeline for this to happen, as I show below.

- Creditor applies for and is issued a County Court Judgement (CCJ) against you.

- The creditor applies for an interim charging order to secure the debt against your home.

- You have 28 days to challenge the charging order; if you do, a date for a court hearing will be set.

- You must provide the court with all of the evidence and facts you wish to present at the hearing no less than 7 days prior to the hearing.

Attending Court Hearings

It’s crucial to consult a solicitor or a legal advisor, even if it’s just for an initial consultation, to understand your standing and potential arguments. While the below guidance is no replacement for professional legal advice, you may find it helpful:

- Gather all relevant documents: the original debt agreement, any communication between you and the creditor, payment records, and any other documents. Organise them chronologically for ease of reference.

- Identify the aspects you want to challenge or bring to the court’s attention. These might include disputing the debt amount, highlighting any unfair treatment, or illustrating attempts to resolve the debt.

- Identify the aspects you want to challenge or bring to the court’s attention. These might include disputing the debt amount, highlighting any unfair treatment, or illustrating attempts to resolve the debt.

- Construct a realistic and detailed repayment plan to propose to the court. Ensure that it is financially viable for you, clearly illustrating how you’ll manage the repayments.

- It’s essential to stay throughout the hearing. Listen attentively and respond clearly and concisely when questioned.

- Clearly articulate your points and stick to the facts. When presenting your repayment proposal, be direct about your financial situation and willingness to resolve the debt.

- If any aspect of the outcome is unclear, ask for clarification immediately or seek legal advice to understand your next steps.

Selling a Property

You can sell a house with a charging order in place, but it can be more complicated, and may take longer than a standard sale. When you sell a property with a charging order, the proceeds of the sale will be used to pay off the debt owed to the creditor. Here are some tips to make it a smoother process:

- Get your home evaluated by a professional. This will help you figure out how much it’s worth and how much wealth you have. This information will be very helpful when you’re talking to your creditors.

- Talk to your creditor: You need to let them know that you want to sell your home. You could talk to them about a payment plan or a settlement deal to get the charging order or CCJ taken off your record.

- Get legal help: Getting legal advice will help you get through this process with the right knowledge. Solicitors can help you make sure that the sale of your home is legal and done correctly.

- Tell possible buyers the truth: It’s important to let possible buyers know about the charging order or CCJ right away. This can help build trust and keep things from going wrong later on.

- Be flexible with your selling price. If you’re trying to sell a house that has a charging order or CCJ, you may need to be more flexible with your price. If someone wants to buy your property, be ready to discuss and think about lowering your asking price if you need to.

- Get your papers in order: Make sure you have all the paperwork you need, like your charging order or CCJ paperwork. This can help move things along faster and give possible buyers more information to help them decide.

- You might want to stage your house. It can help it sell faster and for more money. You might want to hire a professional home stager to help you make your home more appealing to people who want to buy it.

Alternative Debt Solutions

Here’s an overview of some alternative debt solutions common in the UK:

1. Individual Voluntary Arrangements (IVAs):

Pros:

- Protected Assets: IVAs often allow individuals to retain possession of significant assets like their home.

- Fixed Term: It has a fixed term, usually five or six years, after which the remaining debt is typically written off.

- Creditor Interference: Once the IVA is in place, creditors should not contact you directly and must go through your Insolvency Practitioner.

Cons:

- Credit Rating: An IVA will be recorded on your credit file and will impact your credit rating for six years.

- Public Record: IVAs are listed on the public Insolvency Register.

- Strict Budgeting: IVAs require a strict budgeting regime, and all your surplus income will go towards your debts.

2. Debt Relief Orders (DROs):

Pros:

- Write-Off Debts: A DRO enables you to have your debts written off after a year if your financial circumstances have not changed.

- Affordability: DROs are a cheaper alternative to bankruptcy for those who cannot afford the latter’s application fees.

- Limited Interference: Creditors named in the DRO can’t take further action without permission from the courts.

Cons:

- Asset and Property Limitations: You cannot apply if you own a property or assets worth over £1,000.

- Surplus Income: You can’t have a disposable income of more than £50 per month.

- Restrictions: DROs impose several restrictions, such as not being able to direct a company, which last until the DRO is discharged.

3. Bankruptcy:

Pros:

- Fresh Start: Bankruptcy allows you to make a fresh financial start once it’s discharged.

- No Legal Action: Once you’re bankrupt, creditors cannot take legal action against you.

- Debt Relief: Most debts will be written off, providing relief and a route towards financial stability.

Cons:

- Asset Liquidation: Your valuable assets, including your home and vehicle, can be sold to pay off debts.

- Public Record: Bankruptcy will be listed on the public Insolvency Register.

- Adverse Credit Impact: Bankruptcy will be noted on your credit file for six years and may impact your ability to obtain credit in the future.

4. Debt Management Plan (DMP):

Pros:

- Single Monthly Payment: A DMP consolidates your debts into one monthly payment, simplifying your finances.

- Flexible: Unlike IVAs, DMPs are generally more flexible and can be adjusted according to your circumstances.

- Less Formal: DMPs are not legally binding, which means they can be easier to set up and change.

Cons:

- Longer Repayment: As payments are usually lower and spread out, it may take more time to clear your debts.

- Interest and Charges: Some creditors might continue to add interest and charges, increasing the total debt amount.

- Impact on Credit Rating: Your DMP will be noted on your credit file and can impact your creditworthiness.

Conclusion:

Every debt solution comes with its own advantages and disadvantages, and the right option for an individual will depend significantly on their specific circumstances, total debt amount, and available assets. It’s vital to obtain expert advice from a qualified debt advisor or a registered insolvency practitioner to explore these options fully and understand the potential implications of each route.

Getting Help With Debt

By now, you should understand that being issued with a charging order is about as serious as debt problems get. You can’t just bury your head in the sand and ignore the charging order, although I know it is very tempting to do so. The Citizens Advice Bureau (CAB) will be able to give you advice on how to deal with your debts, such as a debt management scheme. They can also put you in touch with other professionals who can provide you with more in-depth legal and financial advice. And make no mistake; you will need both if you intend to challenge a charging order that a court has issued to one of your creditors.