Lowell Financial Debt Collection – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

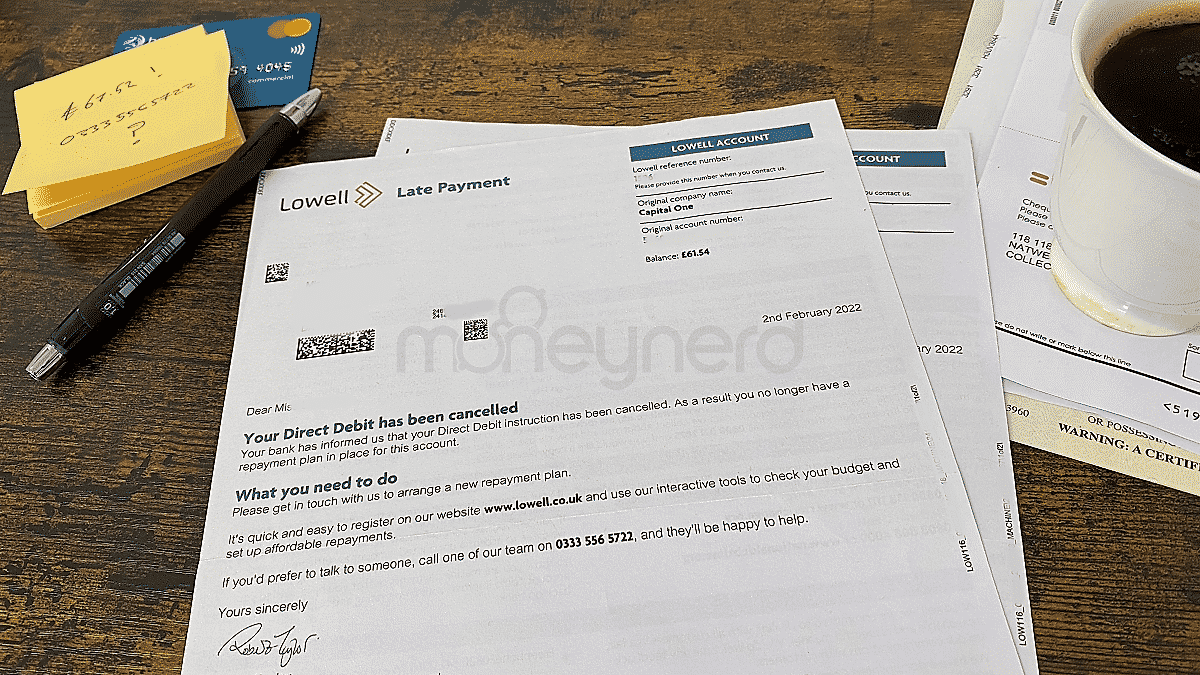

When a letter from Lowell Financial Debt Collection lands on your doormat, it can be a bit scary. But don’t worry; we’re here to help you understand what’s happening and what you can do about it.

Over 170,000 people visit us each month for advice on debt issues – so you’re not alone.

In this article, we’ll help you figure out:

- How to make sure the debt is really yours.

- What you can do if you can’t afford to pay.

- How to stop Lowell from contacting you too much.

- Ways to set up a payment plan or even get your debt written off.

Nearly half of people chased by debt collection agencies report experiencing harassment or aggression1, and even our team knows what it’s like to be chased by debt collectors.

So, let’s dive in and find out more about Lowell Financial Debt Collection and what you can do if they’re chasing you.

Why are they contacting me?

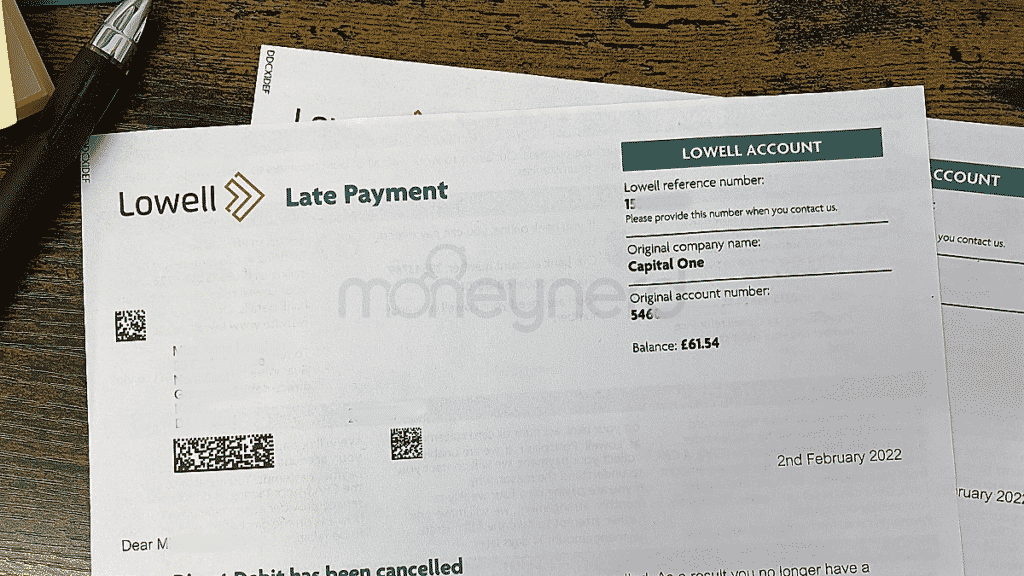

Lowell Group will be contacting you because they think that you owe them money that you have failed to repay. It is likely that you have unsecured debt and Lowell debt collection agency purchased it, in order to collect payment from you for it.

Debt collection agencies regularly “buy” billions of debt annually at rock bottom prices – at an average of 10p to £12.

They buy debts from other organisations, so the money they claim you owe will be originally owed to a different company. So just because you’ve never heard of Lowell, doesn’t mean you don’t owe them.

However, they could just be using scare tactics to try and get you to pay a debt that you aren’t liable for without realising.

This can be confusing, which is why it is crucial that you ask Lowell Financial to prove you owe the money first. We can help you do just that with our prove the debt template letter.

» TAKE ACTION NOW: Fill out the short debt form

Knowing Your Rights with Debt Collectors

It’s important to know what Lowell can and can’t do when it comes to demanding payment from you.

We’ve put together this table to give you a general overview. For a more detailed breakdown, make sure to check out our article on your rights with debt collectors.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Should You Pay?

Whether you should pay depends on several factors. If the debt is proven to belong to you and you can afford it then yes, you should pay or at least speak to Lowell about setting up a payment plan.

If the debt isn’t proven as yours or it has become statute-barred (more than six years old) then you should not pay the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens If You Ignore them?

If you ignore letters and phone calls from a debt collection agency they could take you to court. At court, a judge will decide whether you really owe the debt and could issue a court order forcing you to pay.

The balance of your debt owed could go up due to fees and interest if you keep ignoring them. If you get in touch and ask for some time to explore your options, they might pause any debt interest.

Best Way to Pay

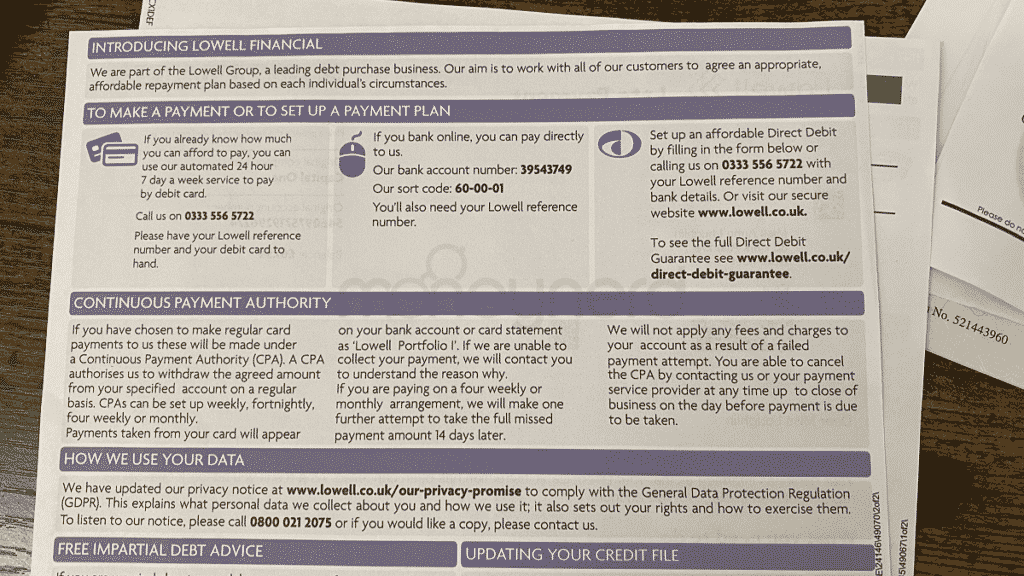

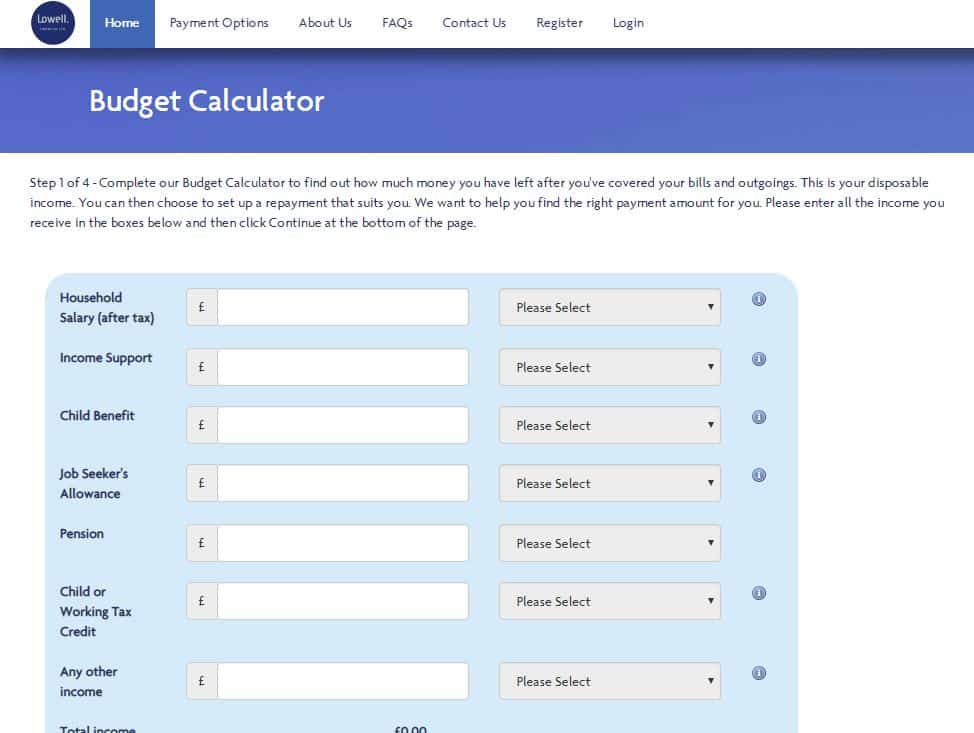

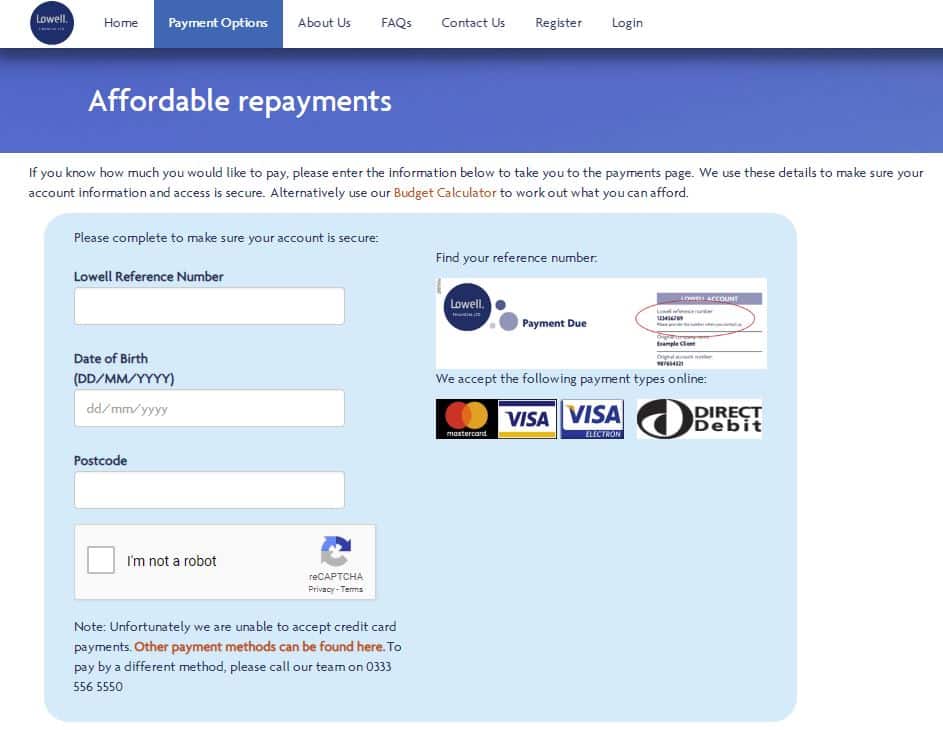

You can make a payment to Lowell over the phone or online. They even have a website tool that can help you work out what you can afford to pay back each month (see below). Or you could use our free budgeting guide!

Next, check out their payment options page (their site has easy navigation).

Here you can enter your Lowell Financial reference number that you likely received at the top of any letters.

Make sure you note down the reference number of your payment, so next time they call you you can tell them that you’ve already paid (it may take some time for this payment to be reflected on your account).

As you can see it’s relatively simple to make a payment providing you have the reference number and card to hand.

Will they use Bailiffs?

The short answer – Maybe. Lowell Financial Ltd are not bailiffs themselves and it would be a legal offence for anyone to pretend to be one.

I recently spoke to the Mirror about debt collectors vs bailiffs 3. While a bailiff may be permitted to take your possessions, a debt collector never can. All they are allowed to do is demand payment, potentially escalating to a county court judgement (CCJ). That’s where a bailiff comes in.

So to sum up, a debt collector might eventually bailiffs, but you can avoid this by cooperating.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is It possible to write off my debt?

It is possible to write off some or 100% of the money you owe to Lowell Group Debt Collection. The right method to use will depend on your personal circumstances.

Some ways to write off part or all of the debt include:

The other method is to use a law called Statute Barred, which states some older debts cannot be taken to court. Without court action, Lowell Financial can never force you to pay. The debt isn’t exactly written off, but it is as good as.

For more information on writing off debts with this law, read our Statute Barred guide with a free letter template.

Can I stop them from calling me?

Yes! Like with all debt collection agencies, you can provide contact preferences to reduce the number of calls and texts you receive. If the agency doesn’t respect these wishes you could make a complaint to the FOS.

If you believe that a debt collection agency is contacting you in an inappropriate manner (i.e. you are getting too much contact from them), you can send them a letter specifying when and how you’d like to be contacted.

If you’re looking for a way to deal with your debts for good then you might consider using one of the UK’s 7 debt solutions.

How do I make a complaint about them?

From my experience, the fastest way to complain about any regulated company is to follow their Complaints Procedure, by giving them a call and officially letting them know the issue. If this doesn’t resolve your problem, then you can escalate it to the Financial Ombudsman Service (FOS).

Any complaints should be first directed towards Lowell Financial so they have a chance to put things right.

If they don’t reply in a satisfactory way, or don’t respond within 8 weeks, then provide the FOS with as much detail and evidence as you possibly can to explain your experience. The more you can provide the better chance you have of making a strong case against.

The FOS have a lot of authority and can make a big difference if your complaint is justified.

Who is Lowell Telecom?

If you’ve received a letter talking about an account labelled “Lowell – telecom”, it’s likely that you owe a debt to a telecommunications company. This could be an unpaid phone bill or you’ve got debts with your broadband provider.

If you don’t recognise the debt or can’t remember being in debt, ask them to prove the debt is yours by sending a prove it letter. If the debt is truly yours, they won’t have any problem proving this debt to you. However, if they cannot prove the debt you are not liable to pay.

Lowell Group Debt Collection Contact Details

Below are the best ways we can find to contact Lowell Financial. Many debt collection agencies have multiple phone numbers, so we’d recommend trying all of them if the first doesn’t work.

| Website: | www.lowell.co.uk |

| Phone numbers: | 0333 556 5552 0333 556 5701 |

| Post: | Lowell Financial, PO Box 13079, Harlow, CM20 9TE |

| Office Address: | Ellington House 9 Savannah Way, Leeds Valley Park West, Leeds LS10 1AB |

| Opening times: | 8am-8pm Monday to Friday, and 8am-2pm on Saturday |

| Email: | [email protected] |