PO Box 189 Huddersfield HD8 1DY – Who’s Contacting Me?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you holding a scary letter from ‘PO Box 189 Huddersfield HD8 1DY’? This address is used by Lowell Financial, a well-known debt collection company.

Many people worry about what to do when they get such a letter. 64% of UK adults feel stressed when dealing with current debt collectors.1, so you’re not alone.

Don’t worry! In this article, we’ll explain:

- What to do if Lowell Financial says you owe them money.

- How to check if the debt is really yours.

- How to stop Lowell Financial from bothering you.

- Ways to set up a plan to pay back the money.

- How you might be able to write off some of your debt.

Some of our team have had letters from debt collectors like Lowell Financial, too. In fact, over 170,000 people visit our website each month to learn more about debt.

We’re here to help you understand how to deal with debt collectors. Let’s dive in!

Have You Had Letters From Them?

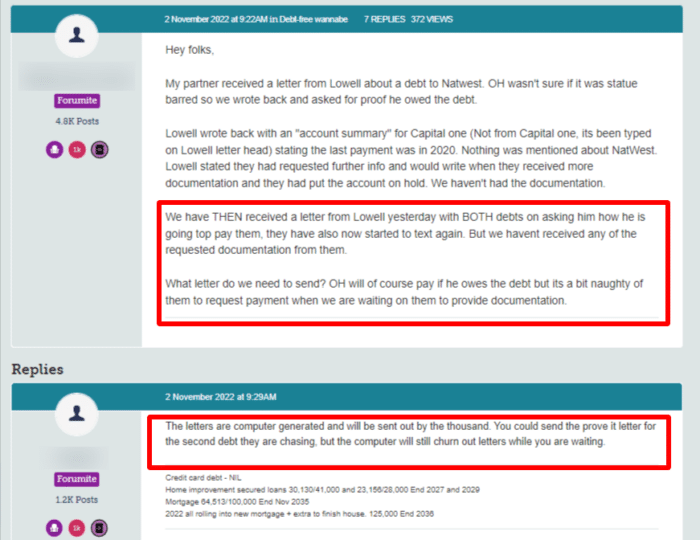

Debt collectors regularly send out computer-generated letters to try and contact a debtor. It is not unknown for letters to arrive almost weekly. Especially in the case of Lowell Financial, which is known to be somewhat aggressive in the way they pursue debts.

Don’t ignore them!

I always recommend responding to debt collectors — even just to question the debt’s validity.

You have the right to request proof of your debt. They have to prove it, or they can’t charge you.

While Lowell have the right to contact you about your debt, they can’t do it unreasonably and should stick to your communication preferences. If they carry on writing to you excessively, you can make a complaint. I detail this procedure below.

This person talks about statute-barred debts in their query. Understanding statute-barred debts can be tricky so I recommend that you speak to a debt charity to find out for certain if your debt is statute-barred.

A debt becomes statute-barred if it has been 6 years – or 5 years in Scotland – since you last paid towards or wrote to your creditor about your unsecured debt. You don’t need to do anything else, your debt will automatically become statute-barred.

This means that the debt is not enforceable.

It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred! Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

Why Would One of These Firms Be Contacting You?

The reason Lowell Financial would be contacting you is because a creditor you owe money to has passed your debt over to them for collection. Basically, it is part of the debt recovery process.

In the case of Lowell Financial, they may have bought the debt from the creditor, and aim to collect the money for themselves.

This is quite common. In fact, debt collection agencies buy billions of debt annually at rock bottom prices — at an average of 10p to £1!2

Some examples of the kinds of debts these firms might be chasing are given below.

- Credit card debt.

- Personal loans, either secured or unsecured.

- Car finance or hire purchase.

- Unpaid utility bills or cellphone bills.

- Rent arrears to a private landlord.

- Catalogue debt.

» TAKE ACTION NOW: Fill out the short debt form

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Have You had a Claims Form Pack From the Local County Court?

If a debt collector such as Lowell Financial is not able to get in touch with you to work out how you can repay the debt, they may begin the process of having a county court enforce repayment. Before they do this, they have to follow the following procedure:

- Letter of claim: Farifax or Lowell must try to reach a payment agreement with you first. This is a pre-action protocol for debt claims. They need to offer you several repayment options and give you 30 days to decide and contact them back.

- Default notice: If you haven’t reached a repayment agreement, Fairfax or Lowell must now send a default notice. This is the final warning before legal action can begin.

If they have followed these two steps and you either haven’t replied to them or haven’t stuck to an agreed payment schedule, a CCJ claim form can now be issued.

I recommend getting some legal advice. Contacting any of the charities at the bottom of this page will make sure that you are dealing with the CCJ claim in the right way. Dealing with the claim correctly is very important because your personal financial circumstances will be taken into consideration by the judge.

After a CCJ is issued, it is visible on your credit report for 6 years and you will probably find it difficult to get credit during this time.

Did the County Court Issue a County Court Judgment?

If you ignore the claim form pack and don’t fill in and return any of the forms, then the court is going to issue a CCJ against the debt. Once this is done, you will be legally liable for the debt and must pay it according to the order.

The court will send you a notification that a CCJ has been issued against you. At this stage, you need to pay the debt as you have been ordered. If you don’t further action will be taken and this is not good – CCJ enforcement is taken seriously.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will Baliffs Visit Your Home?

If you still don’t take action once the CCJ has been issued, you will likely get a notice of enforcement from the county court bailiffs. This is sent at least 7 days before they will visit your home to enforce repayment of the debt.

When the bailiff visits your home, they will want you to pay the debt as the CCJ ordered. You can pay by credit/debit card, cheque, cash or any combination of these to make up the full payment.

If you don’t pay the bailiffs, they are going to want to take goods from your home. These goods will be sold off at an auction, and the proceeds used to pay off the debt.

Keep in mind that bailiffs are typically allowed to charge a fee for visiting a debtor’s home. I’ve prepared a simple table to give you a sense of the average fees that bailiffs might charge. Check out this article to learn more about your rights when dealing with debt.

| Action | Fixed fee | % Extra to pay for debts over £1,500 |

|---|---|---|

| Compliance (written communication) | £75 | None |

| Enforcement (visiting your home) | £235 | 7.5% |

| Sale (removing and selling belongings) | £110 | 7.5% |

| Action | Fixed Fee | % Extra to pay for debts over £1,000 |

|---|---|---|

| Compliance (written communication) | £75 | None |

| Enforcement 1 (visiting your home) | £190 | 7.5% |

| Enforcement 2 (if they visited and you didn’t make/keep an agreement you set with them) | £495 | None |

| Sale (removing and selling belongings) | £525 | 7.5% |

How Do I Complain About Fairfax Solicitors or Lowell Financial?

If you think that either Fairfax Solicitors or Lowell Financial has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Fairfax or Lowell directly so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Lowell or Fairfax may be fined. You could even be owed compensation.

Fairfax Solicitors are also members of the Solicitors Regulation Authority. This means that they must stick to the SRA’s guidelines. If they don’t, you can make a complaint to the SRA too.