Am I Liable for My Partners Debt? vs Spouse’s Responsibility (UK)

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your partner’s debts? Do you wonder if you have to pay them? You’re in the right place to find answers. Each month, over 170,000 people visit our website to learn about debt solutions.

In this simple guide, we’ll cover:

- What it means to be liable for your partner’s debt.

- Steps to take if your partner has debt.

- How joint loans can impact you.

- Whether your partner’s debt can affect you.

- Advice on dealing with debt after a breakup.

Our team understands your fears. Some of us have been in the same place, worried about a partner’s debt. We’re here to help you find the right solutions.

Do I Have to Pay?

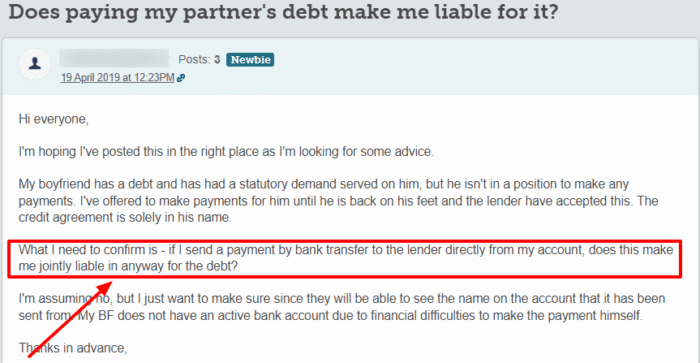

Your relationship with a person does not make you responsible for returning the borrowed money that they independently take.

Unless you’ve taken a joint loan of money, share a joint bank or credit card, you have no financial obligations to your partner’s debts.

Where joint loans are concerned, all the involved parties are equally responsible for paying the debt off. If your partner fails to return the money, you will be held accountable.

But since you aren’t responsible for paying off the complete debt alone, you can take the matter to the court of law, and ask your spouse to make their payment.

What is a Joint Credit Application?

Joint credit applications refer to any application made to get any form of credit facility, such as a credit card loan, or any other joint debt, that is to be shared by more than one person.

In joint credit, the assets and estates of both the involved parties are looked into for financial information. Similarly, both the persons involved are equally responsible for the approval or non-approval of shared credit applications or loans.

This means that if one person has a bad credit record due to a bad history with debts, they can get a joint loan approved due to the other person’s good credit rating.

Sometimes, however, one person’s bad credit might have a negative impact on the loan’s approval and might hinder the person with a better credit rating from obtaining joint credit.

However, you should know that as far as joint credit applications are concerned, you cannot apply for them from the very start.

The primary body applies for an independent credit facility, and then later on adds the other person as a co-signer to receive the facility on joint names.

After co-signing any credit facility, both bodies become equally responsible for any facility taken on their joint names, and their credit files also become co-scored. In other words, co-signing results in shared financial liabilities.

Before sharing debt in marriage, be pretty clear about your partner’s financial and spending habits.

If your partner took a loan on their own, you’re not responsible for it, even if you choose to help them clear the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens If You Marry Someone With Debt?

Even if you’re married to someone with debt, neither you nor your credit scores will be affected by their poor financial history.

However, if you look at the situation from another perspective, their bad credit scores will pose a few issues for you.

For instance, it might result in the non-approval of an important joint loan that you might want to take later. In this case, credit score influence on a partner is significant.

So long story short, marrying someone with poor credit history is not fundamentally awful – but it could have some consequences depending on what financial products you might be interested in taking out in the near future.

» TAKE ACTION NOW: Fill out the short debt form

Dealing with It After Separation

Any joint debts that you took with your partner stay co-signed even if you end up separating. This means that both parties share responsibility for these debts.

Therefore, if one party fails to make the payments, the creditor will ask the other party to cover the amount, making you liable for your ex-partner’s debts.

But there’s more; if your ex-spouse refuses to make their share of the payment, you can take your case to a court of law and demand an equal share from them.

If you think asking for half the payment from you is unfair to your monetary conditions, you can take this case up with the courts as well.

If you made credit agreements when you were together, they remain so in the eyes of the law even after you have separated.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Can I Do To Help?

If your partner is in debt, their debt will not affect you.

However, you should still try to get them out of debt and help them get a good credit score. That way, you can ensure you do not suffer from their bad credit if you have to co-sign any credit facility.

Here are some practical ways of helping a partner with debt issues:

- Help them make a budget to manage their finances.

- Get them on track to make timely payments for the owed money owed via a debt management plan (DMP).

- Ask your partner to move their debts into one place to pay them off through debt consolidation.

- Help them arrange an individual voluntary agreement (IVA) which will see them pay off the debt in more affordable payments for six years.

- They may qualify for a debt relief order if the debt is less than £20,000. A DRO will allow them to write off the debt after a year, providing they keep to the terms and conditions of the order.

If your partner is still struggling with debts, ask them to seek impartial help from an independent debt charity like StepChange, MoneyHelper, or National Debtline.