Apply For DRO Online – Step By Step Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Struggling with debt and looking for a way out? You’re not alone. Each month, over 170,000 people visit our website to learn about debt solutions, including how to apply for a DRO online.

In this helpful guide, we’ll cover:

- What a DRO is and how it can help relieve your debt

- Steps to apply for a DRO online, with or without a debt advisor

- The cost of a DRO and the proof you need to provide

- The consequences of getting a DRO

- The reasons why a DRO might be rejected

Some of our team have experienced debt worries too, so we understand how you feel. With our expert guidance, you’ll learn how to apply for a DRO online and start your journey towards a debt-free future.

How Can I Apply for a Debt Relief Order?

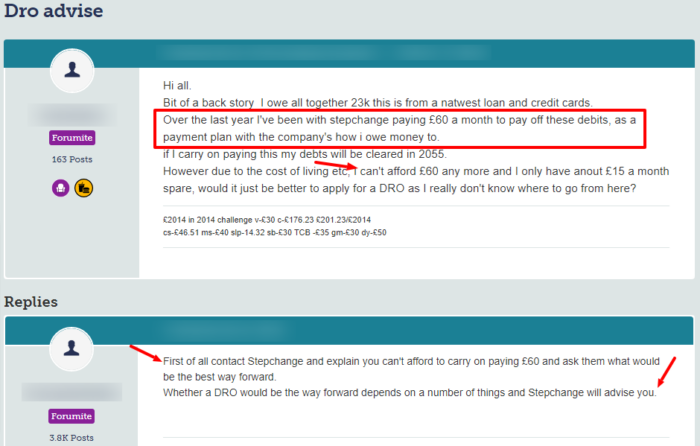

As this online message shows, many people are struggling with their finances and need advice about how to get them back on track.

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I Apply for a DRO Online Myself?

Moreover, they can assist you with the DRO online application process to ensure it goes through without any problems.

» TAKE ACTION NOW: Fill out the short debt form

How to apply online

Here’s a quick summary of how to apply for DRO online:

- Reach out to a debt advisor such as StepChange, Citizens Advice or National Debtline

- Work out your full income from your employment and or benefits

- Gather all the up-to-date balances on all the accounts you owe money to

- Work out your monthly expenses using a monthly budgeting tool

- Collect information about your employment and pensions

- Discuss the DRO and any other options regarding your debt with your debt advisor

- Complete the DRO application by sharing all your evidence and documents with your debt advisor

- Pay the £90 fee

- Your debt advisor will complete your paperwork and send off your application to the Insolvency Service

- Wait for the Outcome, which takes ten working days

Further information about debt relief orders can be found on the link below:

Glossary of terms

Insolvency – an individual or company that can no longer pay debts when they are due

Creditors – people or businesses you owe money to

Payzone – a payment service provider via fixed, mobile and virtual terminals

Why Do I Need a Debt Advisor for a DRO?

There are many benefits of a debt advisor for DRO applications. One of which is they have the necessary experience and knowledge of what’s required.

The debt advisor will ask you questions that will help your DRO online application.

The information you provide will determine whether you’re eligible for the debt relief order. You’ll also be able to learn about other debt solutions that might be better for you and your situation.

Finally, if agreed that a DRO is the best course of action, the debt advisor will complete the necessary paperwork on your behalf.

It isn’t possible to apply for a DRO online without completing this step.

What Proof Do I Need for a Debt Relief Order?

I’ve listed the required documents for DRO online application here.

- Last 2 months payslips

- benefits entitlement letter, or

- bank statements

These documents are to prove your income. You’ll also need to prepare the documents that provide accurate and up to date information on your creditors, such as:

- Energy suppliers including gas, water, electricity

- Council tax and benefit overpayments

- Loans

- Rent arrears

Gather all the latest statements from everyone you owe money to and any supporting documents.

The amount of money you own must include the full amount of the debt and not just any early settlement offers you may have open to you.

You’ll need to provide the debt advisor with details of your income and outgoing expenses. I have a free household budget sheet that will help you prepare for this.

Be sure to be accurate when working out your finances and when sharing the details with your advisor.

Sharing false information can result in a court summons.

Other Information Required to Apply

I’ve added a DRO application information checklist below:

- Full name and place of birth

- National Insurance Number

- Employer details if applicable

- Pension information including the name of the employer and the pension or your payroll number for each employer you have a pension with

- Details regarding formal insolvency solutions you’ve previously been subject to, such as an IVA or bankruptcy.

- Make, model, registration number and condition of any motor vehicle you own

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Much Does It Cost?

The DRO fee is £90. You must pay the £90 fee in cash at a post office or using Payzone.

The fee is non-returnable, even if your application is denied. But you can make the payment in instalments or all at once.

There are charities and trusts that may aid with the DRO fee.

Speak to your DRO advisor to find out if this financial assistance for a DRO fee is available to you.

Consequences of a DRO

Once you are accepted, the DRO typically stays in place for 12 months. Once approved, you won’t have to make payments to settle the debts (and interest) which are listed during that period.

After 12 months, you won’t have to pay the debts anymore.

It’s worth noting that the DRO impact on credit rating should not be overlooked.

Why Did My Debt Relief Order Get Rejected?

I’ve listed some DRO rejection reasons here:

- You may not have shared accurate information

- you might not be eligible for a debt

relief order

You must prove your eligibility for a DRO. A debt relief order is only an option for those who have less than £75 spare out of their income each month, after household expenses.

Additionally, a DRO is only available to those who owe up to £30,000.

A DRO is not an option for anyone who:

- Owes more than £30,000

- Has over £75 spare each month after household expenses

- Owns a home

- Have assets with a value of over £2000

There are certain debts that cannot be included in a DRO, including:

- Fraudulent debts

- TV license

- Fines for criminal offences

- Child maintenance

- DWP social fund loans