Ardent Credit Services Debt Recovery – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

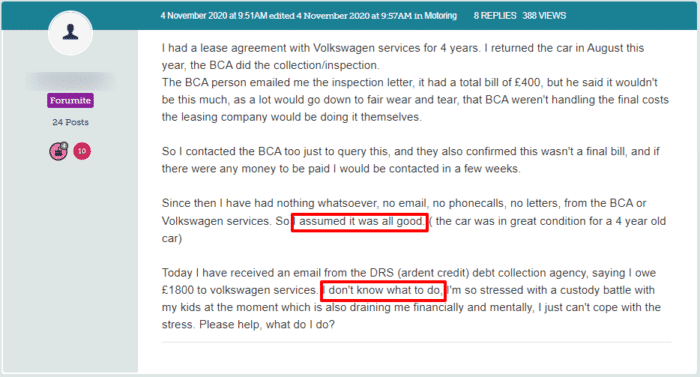

Did you get a surprise letter from Ardent Credit Services about a debt? Are you worried and confused about where this debt came from?

You’re not alone. Every month, over 170,000 people visit our website for help with debt problems.

In this article, we’ll explain:

- Who Ardent Credit Services are, and why you’re getting letters from them.

- How to check if the debt they say you owe is truly yours.

- What actions Ardent Credit Services can take if you don’t pay.

- Ways to stop Ardent Credit Services from contacting you.

- Options to manage or even get rid of the debt.

We understand how scary it can be to get letters from a debt collector. After all, nearly half of the people who deal with debt collection agencies have experienced harassment or aggression1.

Some of our team have been in your shoes. We are here to help you find a way through this.

Why Are You Getting Letters from Ardent Credit Services?

Ardent Credit Services are attempting to recover an outstanding debt that you owe.

This may be a missed payment on a credit card or loan or perhaps an unpaid bill on an online platform such as eBay.

From what we’ve seen, one of the most well-known companies to employ Ardent Credit Services is Vodafone. So it may be an unpaid phone bill they are chasing you for.

The lender to whom you owe the money has employed Ardent Credit Services Ltd to chase the debt on their behalf.

This is quite common, as debt collection agencies buy billions of debt annually at rock bottom prices – at an average of 10p to £1! 2

» TAKE ACTION NOW: Fill out the short debt form

Typical Debt Collection Process

We know it can feel scary to receive letters from Ardent Credit Services. But don’t worry; this is quite normal, as it’s part of the first stage of the debt collection process.

We’ve put together this table to help you better understand the debt collector timeline. It’s important to be aware of the key stages and actions involved to learn how to manage your situation.

For more information, be sure to read our detailed guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

How to Check if the Debt is Legitimate (and Yours!)

Before you even consider a repayment plan, there are three simple steps you need to take to be sure the debt is legitimate:

1. Check whether the debt is yours

First things first, check whether the debt is yours and not a scam.

If you don’t remember the debt, use a reputable credit report agency such as Credit Karma to see if the debt is listed on your credit report.

If it’s not, Ardent Credit Services Debt Recovery may have made a mistake.

2. Request proof of the debt

Next, we recommend writing to Ardent and requesting they prove the debt they claim you owe. To do this, they will need to send you the original copy of your credit agreement or proof of the loan.

If they simply write back stating the debt without also giving physical proof, this is not sufficient and until they can prove the debt owed, they cannot ask you for payment.

This is a more common situation than you would think!

Ardent Credit need to prove that this debt exists and that this person is liable for it. If Ardent can’t, this person is under no obligation to pay.

3. Check if the debt is Statute Barred

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable.

It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for a while.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if You Ignore the Letters?

It’s a bad idea – the consequences of ignoring debt collectors that make things worse!

We don’t recommend ignoring letters from Ardent Credit Services Debt Recovery, as it will not make them go away. Since they have been employed by a third party, it’s their responsibility to make reasonable attempts to contact you and recover the debt.

If you ignore letters or calls from the debt recovery agency, they may send agents to your home.

And if this still goes unanswered, they may take your case to court to recover the funds owed. Even if you’re pretty certain the amount owed is wrong, it’s always best to make contact to get the matter sorted.

What Legal Action Can They Take Against You?

Like most debt recovery companies, Ardent Credit Services will do all they can to recover the debt by sending you letters or calling you.

This is the easiest and cheapest way for them to recover the debt.

However, if the debt owed is substantial, they may take you to court to recover the amount owed. In this case, there are a few steps they can take to recover the debt:

1. Issue a County Court Judgement

If you refuse to pay the debt or they fail to contact you, Ardent Credit Services can apply for a County Court Judgement.

This compels you to make monthly payments and if you fail to, Enforcement Agents can be sent to your home to recover assets equal to the debt owed.

Read more about the legal rights of Enforcement Agents here.

2. Apply for an Attachment of Earnings Order

Ardent can also apply for an Attachment of Earnings Order which will recover the debt owed directly from your wages.

This will not apply if you are unemployed, self–employed, in the army, navy or air force, or a merchant seaman.

3. Apply for a Charging Order

They could also apply for a Charging Order which would secure the debt against your house. This is rare but if it does happen, your home becomes collateral for the debt owed.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should You Pay if You Can’t Afford it?

If you’ve done all the checks outlined above and the debt is yours, it is your responsibility to pay it. However, that does not mean you should put yourself into further debt to get it paid off.

It’s also important to figure out the maximum amount you could afford to repay each month before agreeing to a final figure.

They may offer a monthly repayment that seems affordable, but may end up putting you in more financial difficulty down the road.

If you are facing financial hardship, you may benefit from a debt solution. We have listed some options at the bottom of this page.

What are Your Options to Get Rid of Debt Owed to Them?

There are a couple of different options available to you. What’s best will depend on your circumstances, so we recommend speaking to a debt charity.

They will be able to walk you through all of the debt solutions available in the UK and help you work out what will be best for you.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

How Do You Stop Ardent Credit Services Ltd From Contacting You?

You can’t make them stop contacting you completely.

They do have the right to contact you to chase the money you owe. Even so, they can’t harass you or call you at unsociable hours.

They are also not allowed to pressure you into paying the debt if you’re struggling financially.

Also, if they do visit you at home, they have no right to enter your home without invitation and have to leave when asked.

Our financial expert, Janine, says: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights. They have no power to enter your home or take any of your possessions.’

Although you can’t stop them contacting you altogether, you can contact Ardent Credit Services Ltd and express your contact preferences.

Once these have been given, they must not contact you in any other way.

How to Make a Complaint

If you think that Ardent Credit Services has been unreasonable or behaved inappropriately, you can make a complaint.

You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Ardent so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Ardent may be fined.

You could even be owed compensation.

Ardent Credit Services Contact Details

| Website: | https://www.ardentcredit.co.uk/ |

| Registered Office: | 1st Floor, Moorgate Point, Moorgate Road, Knowsley Industrial Park, Liverpool L33 7XW |

| Telephone: | 0151 545 1500 9am – 5:30pm Monday to Friday |