Average Car Debt in the UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re wondering about the average car debt in the UK, this article is here to help.

Car finance payments can be quite stressful, but don’t worry! You’re not alone. Each month, over 170,000 people visit our website looking for guidance on debt solutions.

In this easy-to-understand guide, we’ll cover:

- The current average car debt in the UK

- Information on loans for new and used cars

- The impact of missing car payments on your credit score and legal standing

- Where to find professional advice for car debt

- Frequently asked questions about car debt

It’s common to feel unsure about seeking help when dealing with car debt. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

But rest assured, we’re here to help you.

UK Statistics

» TAKE ACTION NOW: Fill out the short debt form

Debt Solutions Comparison

Dealing with car debt and missed payments can be scary. But don’t worry, there are different debt solutions available that can help you.

These are:

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

Loans for New Cars

Currently, almost £17.5 billion is borrowed every year to pay for new cars in the UK.

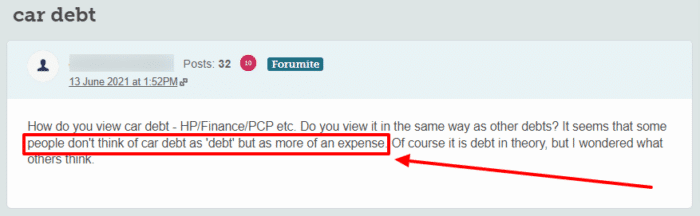

Some people don’t even view car debt as debt in the traditional sense.

Car debt is still debt so it is important to keep up with your repayments. If you don’t, you can end up with serious elgal issues to deal with.

This can also have a negative impact on your credit score.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Loans for Used Cars

From 2009 until 2022, the average amount of money borrowed to buy a new car increased from £11,964 to £25,039.

Are there legal repercussions for missing payments?

If you realise that you can’t afford to pay your car finance anymore, you should tell the car finance company.

In some situations, you might be able to negotiate an alternative payment plan.

You may even be able to voluntarily surrender your car, depending on the type of contract that you have. If you are unsure, you can read your contract or contact your car finance company to find out.

If you do nothing, you run the risk of your car being repossessed.

You will get a reminder after you miss the first payment.

You may get a second reminder if you miss another payment or you can be sent a notice of arrears. This arrears notice will tell you how much you owe and when you need to pay it.

If you do nothing and stay in arrears, your car finance company can send a default notice which will give you 14 days to pay off all the debt in full. If you don’t pay off the balance, your car agreement can be ended and your car repossessed.

The car finance company has the legal right to repossess your car if you don’t pay them back.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.