Average Credit Score by Age UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you curious about average credit scores in the UK and how they change with age? You’ve come to the right place for answers. Our article is here to guide you through this topic with clear and simple facts.

We understand that credit scores might seem tricky. Many people worry about their score and how it might change as they get older. But there’s no need to worry – we’re here to help.

Over 170,000 people use our website each month to get advice on money matters. We’ve got a lot of knowledge to share, and we’re pleased to say that we can help with any questions or worries you might have about credit scores.

In this easy-to-read article, we’ll be covering:

- How the average credit score changes with age in the UK.

- What a good credit score looks like.

- The top reasons for bad credit.

- How to make your credit score better.

- Helpful answers to frequently asked questions.

Our team knows how confusing money matters can be. We’ve all had to learn about them too, so we promise to explain everything in a way that makes sense. Let’s get started and learn more about credit scores in the UK.

By Age Group

Your credit score will vary depending on which agency you’re checking it with. However, all of these agencies use very similar methods to calculate their figures.

They will take into account factors such as:

- Your credit utilisation

- Length of credit history

- Types of credit in use

- If you pay your debt on time

- And other factors

Three of the most popular credit agencies are Experian, Equifax and TransUnion. Experian has a score range of 0 to 999, Equifax’s is between 0 to 1000, and TransUnion’s ranges from 0 to 710.

The figures below show the average credit score by age in the UK based on data from Experian.co.uk.

| Age Group | Average Score |

| 18-20 | 823 |

| 21-25 | 792 |

| 26-30 | 776 |

| 31-35 | 770 |

| 36-40 | 779 |

| 41-45 | 792 |

| 46-50 | 804 |

| 51-55 | 819 |

| 55+ | 863 |

People aged between 31 and 35 have the lowest average scores at 770.

Key takeaways from this data are:

- People aged 55 and over have the highest average credit score at 863.

- People aged between 31 and 35 have the lowest average scores at 770.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

UK Data

Recent data shows that the average credit score (based on Experian’s rating system) improved across the UK up until 2021.

- In 2019, the average UK credit score was 776.

- In 2020, the average UK credit score was 792.

- In 2021, the average UK credit score was 797.

- In 2022, the average UK credit score was 759.

- London has the highest average score at 893.

- Kingston-upon-Hull has the lowest average score at 702.

- In 2022, 5,049,129 people in the UK (approximately 9% of the adult population) were virtually invisible to the financial system because there was insufficient information available to rate them.

- 49% of UK adults have never accessed their own credit report. It’s wise to always check your credit file for any mistakes that could be giving you a poor score. If you see an error, have it corrected.

» TAKE ACTION NOW: Fill out the short debt form

What’s a good score?

Sticking with Experian, between 881 and 960 is considered a ‘good’ credit score. A rating of ‘excellent’ is given to anyone with 961 or above.

Those in the ‘good’ or ‘excellent’ brackets will have the easiest access to credit at the best interest rates, which can significantly improve or affect your credit score.

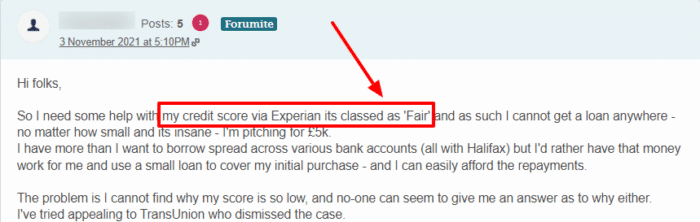

A rating of ‘fair’ is given to those with scores between 721 and 880. People in this range still shouldn’t have many issues obtaining credit. Whether you will be approved, however, depends on your personal circumstances and the lender’s criteria.

A score of 720 or below might pose problems for those seeking financing.

In 2022, the average UK credit score was 759.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Top reasons for bad credit

There are several reasons that your credit score might drop. Some of these are always within your control, whereas others can be hard to manage.

The top issues that can cause harm to your credit rating are:

- Failing to stick to a credit agreement

- Declaring bankruptcy

- Selecting the wrong credit card

- Having a County Court Judgement (CCJ)

- Consistently making only minimum payments on money owed, including student debt.

- Identity fraud

- No credit history