Average Medical Student Debt UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you keen to know about the average medical student debt in the UK? You’re in the right place. We understand your curiosity, as it’s a topic that affects many people.

Every month, our site guides over 170,000 visitors on debt-related matters. This article will provide answers to your questions, including:

- The average medical student debt in the UK.

- Ways to possibly reduce some of this debt.

- Why medical school costs so much.

- The average earnings of medical professionals.

- What to do if your debt is too much to manage.

We understand the worry that comes with high debts, as many of us have been in similar situations. We’re here to help you understand what this means for medical students now and in the future.

Let’s learn more about medical student debt in the UK.

What’s the average debt of medical students in the UK?

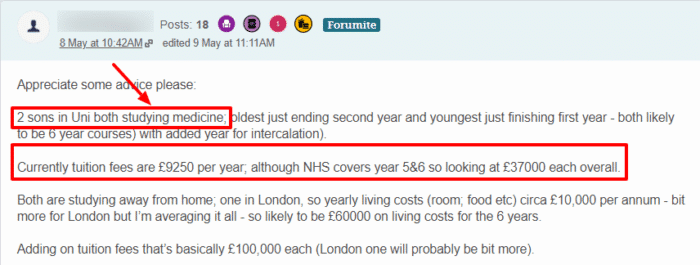

In the UK, medical students will rack up between £50,000 and £90,000 of debt. This will vary depending on how long they were a student and where they studied.

- In 1997, the average student debt from medical school was only £6,758.

- In 2013, before annual tuition fees increased from £3,290 to £9,250, the average debt of a medical student in the UK was £16,167.

- In 2019, the average debt for a medical student rose to £43,700.

- The average medical student is unlikely to ever repay their student loan debt in full.

» TAKE ACTION NOW: Fill out the short debt form

The high cost of medical school

There are significant extra costs for studying medicine as opposed to other fields. This is in part due to the longer length of courses, as well as the high cost of books and equipment.

The intensity of the curriculum does not allow medical students the same amount of time to pursue part-time work as other students. These factors contribute to the average amount of student loan debt for medical school.

- In 2019, 70% of medical students in the UK said they couldn’t afford basic necessities.

- In 2019, just under half of medical students said they would run out of money before the end of the year.

- 5.5% of medical students have considered leaving school due to financial concerns.

- Two-thirds of medical students cut back on essentials, such as heating, food or professional clothes, to save money.

- Applications for hardship funding are on the rise for medical students.

The average medical student is unlikely to ever repay their student loan debt in full.

How a debt solution could help

Get StartedSome debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

Monthly income £2,504 Monthly expenses £2,345 Total debt £32,049 Monthly debt repayments

Before £587 After £158 £429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How much does the average medical professional earn?

High future wages can help offset students’ stress surrounding medical school debt.

Being able to earn a good income will naturally make the repayments easier, even for those with the highest levels of student debt.

Within the NHS, wages naturally vary for different types of medical professionals. Additionally, wages typically increase as people move through their careers into more senior positions.

The following figures are correct as of 2022.

- In foundation training, doctors earn a basic annual salary of £29,384 to £34,012.

- In specialist training, doctors earn a basic annual salary of £40,257 to £53,398.

- Doctors working within a speciality earn a basic annual salary of £50,373 to £78,759.

- Consultants earn a basic annual salary of £88,364 to £119,133.

- Salaried GPs earn a basic annual salary of £65,070 to £98,194.

- A general surgeon will earn a basic annual salary of at least £40,257.

- A newly qualified nurse will earn a basic annual salary of £25,000.

Salaried GPs earn a basic annual salary of £65,070 to £98,194.

Doctors who work in the private healthcare sector can expect to earn even higher salaries.

Many doctors choose to work for the NHS and engage in private practice, which can be a big boost to their salaries.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.