Average Mortgage Payment UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you interested in knowing the average mortgage payment in the UK? This guide is here to help. We’ll explain what you need to understand about mortgage payments. We’ll talk about:

- The average mortgage payment in the UK.

- How the place you live can change your payment.

- How interest rates affect your mortgage.

- The difference between fixed rate and variable rate mortgages.

- How overpaying can help you save money.

We get it. It’s not easy to understand all this, but don’t worry. Each month, over 170,000 people come to us for advice on their money worries. We’re here to guide you.

If you’re worried about debt, we’ll also talk about how to handle too much of it and give you tips on how to legally write it off. We’ll also explain how much debt might be too much. This guide is here to help you make smart choices about your money.

Let’s dive in.

Average Mortgage Payment UK Statistics

- The average spent on mortgage payments is around £733 a month.

- Monthly UK mortgage rates have increased by 31% in the last ten years.

- The average first-time buyer deposit is £58,986 – increasing by £11,677 since March 2020.

- Between January and March 2021, the number of mortgages with arrears of more than 2.5% of the remaining balance increased by 15 each day.

- After the first quarter of 2021, there were £1.56 trillion in outstanding home mortgage loans, a 3.6% increase from the previous quarter.

- New mortgage obligations are £77.5 billion, up 15% from last year.

- Mortgage arrears dropped to their lowest level since 2007 at only 0.94% in Q3 2019.

- Gross mortgage advances totalled £83.3 billion in Q1 2021, a 26.5% increase from Q1 2020 and the highest amount since Q4 2007.

- The rate for a 10-year mortgage in April 2021 was 2.58%.

- This is a slight increase compared to March 2020, when it was 2.36%.

- In March 2021, the average home price in the UK peaked at £256,000.

- From July 2018 to June 2019, there were 469,000 remortgages on homes.

- Of these mortgages, 231,000 were remortgages with equity taken out, and 238,000 were remortgages for refinancing.

- In the UK, 39,000 homeowners remortgage their homes per month on average.

- In Q1 2019, remortgages accounted for more than a third (38.9%) of residential loans.

Regional Differences in Mortgage Payments

UK mortgage market trends vary depending on the region; London and the southeast generally have higher payments than the north of England.

Below is data from Halifax by region as of January 2021. Please note these figures are averages, and amounts can vary depending on factors such as deposit, the property’s price and interest rates at the time of purchase.

- London: £1,752

- South East: £1,138

- South West: £731

- East Anglia: £773

- East Midlands: £675

- West Midlands: £703

- Yorkshire & Humber: £618

- North West: £633

- North East:£564

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

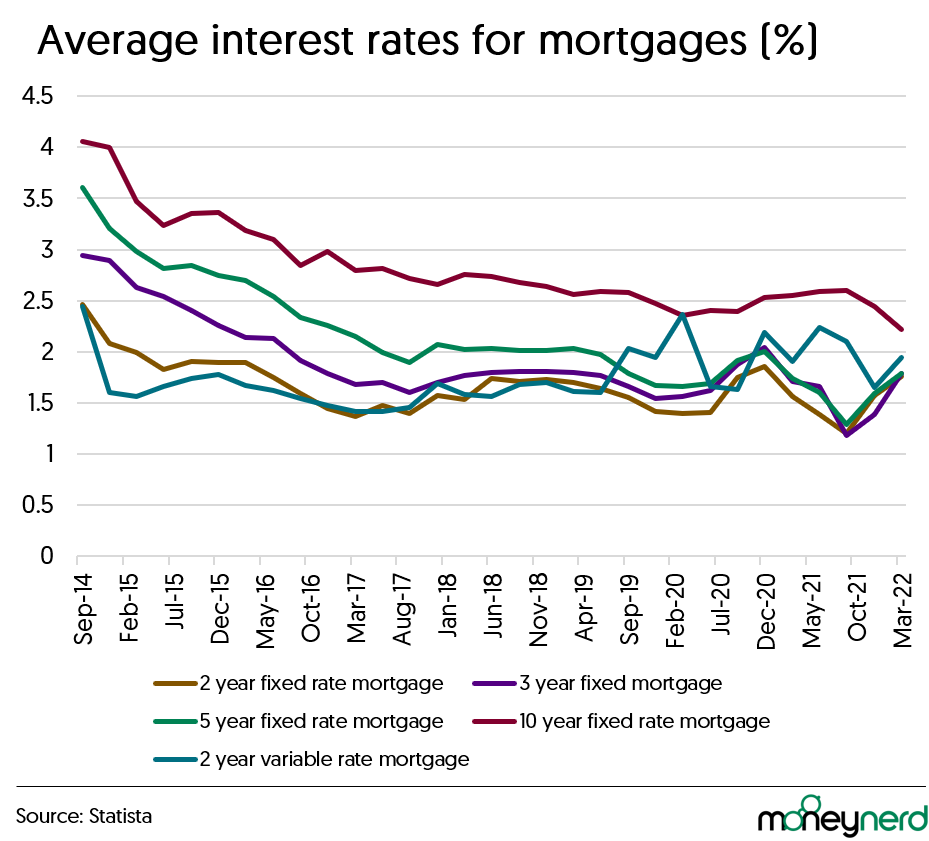

How interest affects your mortgage payments

If you’re like most people, you view your monthly mortgage payments as a way of paying for your house. However, a significant portion of the funds really goes toward paying interest.

The rate for a 10-year mortgage in April 2021 was 2.58%.

This is due to two factors.

First, because mortgages are for huge sums of money, they come with high-interest rates, especially at first. Larger amounts of money incur more interest fees than smaller amounts at the same interest percentage rate.

The average first-time buyer deposit is £58,986 – increasing by £11,677 since March 2020.

Secondly, since mortgages have a long lifespan, the interest has a lot of time to rise. This is due to the importance of the interest rate and the potential benefits of a shorter mortgage. However, regardless of the rate you secure, a significant portion of your earnings will be used to pay mortgage interest.

Use one of the many mortgage payment calculators online to see how much your monthly mortgage payments could be.

Fixed Rate vs Variable Rate Mortgages

The type of mortgage you choose can significantly influence your monthly payments and total costs over the life of the loan. The two most common types of mortgages are fixed-rate mortgages and variable-rate mortgages.

- Fixed-Rate Mortgages:

A fixed-rate mortgage is a loan whose interest remains constant throughout the loan term.

One of the main advantages of a fixed-rate mortgage is that your monthly payments will stay the same over the life of the loan. This predictability makes budgeting easier and provides a sense of financial security, as you won’t be affected by interest rate fluctuations in the market.

Since the interest rate remains fixed, the total interest paid over the loan term is predetermined. In the loan’s early years, a larger portion of the monthly payment goes towards interest, while the principal repayment increases over time. Consequently, fixed-rate mortgages are generally associated with higher initial interest rates than variable-rate mortgages.

- Variable-Rate Mortgages:

A variable-rate mortgage is a loan whose interest rate fluctuates periodically based on changes in an underlying benchmark.

With a variable-rate mortgage, your monthly payments can change as the interest rate adjusts. When interest rates are low, your payments may be lower, but if rates rise, your payments could increase, potentially leading to financial uncertainty.

Since the interest rate can change, a variable-rate mortgage’s total costs are more uncertain than fixed-rate mortgages. If interest rates rise significantly during your loan term, you could pay more interest than initially anticipated. However, you might benefit from lower overall costs if rates remain low or decrease.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

The average length of a mortgage

Typically, it takes 25, 30, or 35 years to pay off a mortgage. The average mortgage duration UK is 25 years, but 30 and even 35-year mortgages are starting to gain ground. Because mortgages are the most expensive loans you can get, they are also the longest.

In March 2021, the average home price in the UK peaked at £256,000.

Longer mortgages are appealing because monthly mortgage payments are reduced. As a result, it is easier for people to qualify for a mortgage, enabling them to move up the property ladder. But this means they will pay significantly more over the course of a lengthier mortgage.

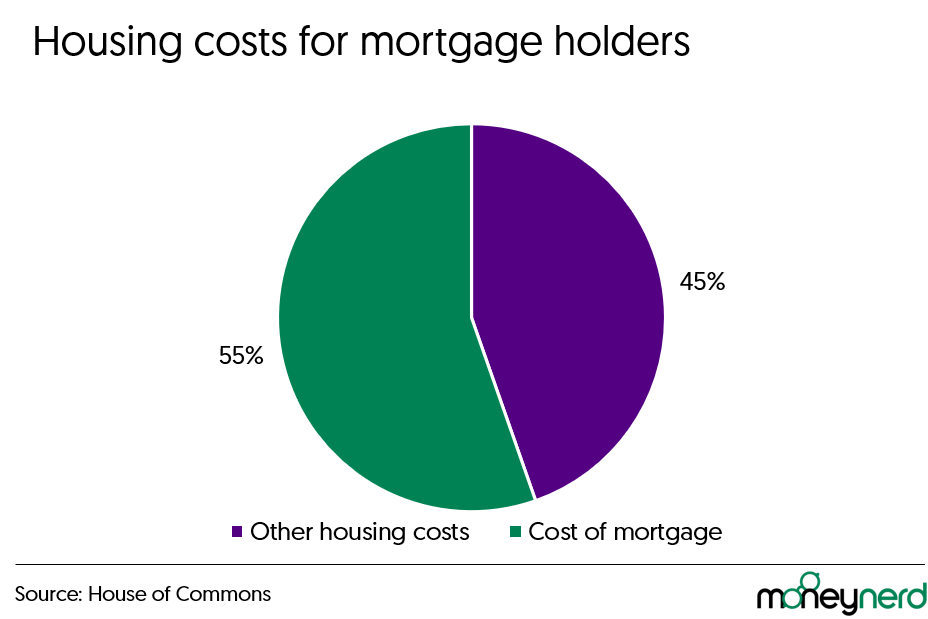

Average UK Housing Cost

The average household in the UK spends £7,000 per year on utilities, communications, and television services, as well as other costs associated with running and maintaining the home, such as insurance and council tax. On top of that, many people have to pay their mortgages. The average monthly mortgage payment is about £733.

The average spent on mortgage payments is around £733 a month.

» TAKE ACTION NOW: Fill out the short debt form

Conclusion

The amount of money you have to pay back each month on your mortgage can vary greatly depending on your personal situation, the amount of money you need to borrow, and the region in which you live.

Mortgage guarantee schemes and other options can help candidates who might not have been accepted. Working with a specialised private broker can greatly improve the chances of acceptance.

Every homebuyer needs to be aware of the total cost of their mortgage, including both monthly payments and the total cost of the mortgage over the duration of the mortgage.