Can I expect Bailiffs for Private Parking Fines?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about bailiffs showing up at your home due to private parking fines? We know how stressful this can be.

After all, over half of the people surveyed by StepChange mentioned that dealing with bailiffs actually made it harder for them to pay off their debts. Many say that they even had to take out more credit to pay the bailiffs.1

But don’t worry; you’ve come to the right place. In this article, you will find:

- An explanation of private parking fines and how they work.

- If you need to pay these fines.

- The laws around private parking charge notices.

- How private companies can make you pay.

- Ways you could reduce your debt.

Each month, over 170,000 people visit our website to find information on debt and parking fines, so you’re not alone!

We understand your worries and we’re here to give you clear and simple information so you can deal with this tough time.

Can You Expect Bailiffs for Private Parking Fines?

A parking management company cannot instruct bailiffs to recover the amount owed. They can, however, send in debt collectors.

Under UK law, a parking management company is only obliged to:

- Give notice to the keeper, who should

- Tell the driver, and then

- Give the notice to the driver

Paragraphs 4 to 12 of Schedule 4 of the Protection of Freedoms Act 2012 cover the law on parking charges issued on private land.

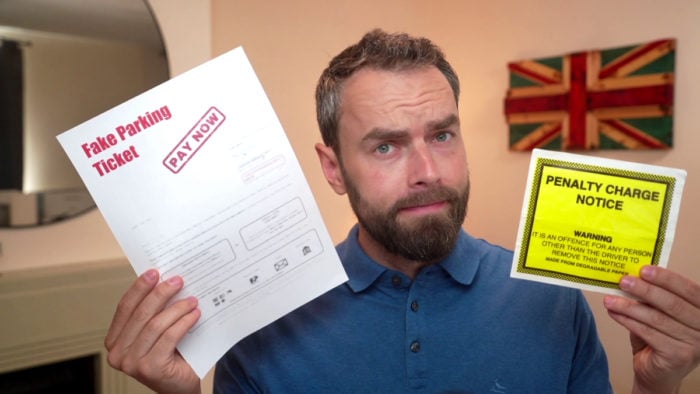

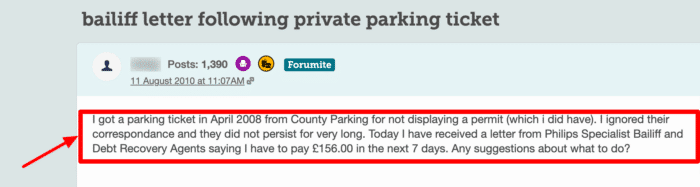

Here you can see this forum user on MoneySavingExpert has received a private parking fine, and they are worrying that bailiffs will come to their home.

Debt collectors and bailiffs are different.

Unlike bailiffs, debt collectors cannot come to your house to collect debt – you can send them away if they do.

Even if you send the debt collector away, you still need to deal with the debt, as ignoring it will only make the problem worse.

Bailiffs vs. Debt Collectors

We’ve put together this table to help you better understand the main differences between bailiffs and debt collectors.

If you’d like to learn more about how bailiffs operate, be sure to read our specialized guide.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

Can a private company force you to pay?

A private parking management company can force you to pay if you are the vehicle’s registered keeper, and a court has ruled you must.

This can happen when the actual driver’s details are not known.

» TAKE ACTION NOW: Get legal support from JustAnswer

You’ll receive letters from the operator demanding payment. Each letter will be more aggressive in tone than the one before.

You could get lucky, and the operator decides to drop the case. But they could start court proceedings against you.

You’ll be sent a Defendant’s Response Pack when the operator takes you to court.

You must make sure you defend it.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Don’t ignore Parking Charge Notice correspondence

We always recommend responding to debt collectors – even just to question the debt’s validity. You have the right to request proof of the debt. They have to prove it or they can’t charge you.

Don’t assume the fine is yours, but make sure you either contest the fine or pay it.

You can choose to appeal a private parking fine. You can escalate your parking fine appeal if your first appeal gets rejected.

The process can differ between private car park operators, depending on whether they’re a member of the BPA and follow the BPA code of practice or whether they’re a member of the IPC.

Can private parking companies use bailiffs?

As mentioned earlier, a private parking operator can’t instruct bailiffs to recover the amount owed.

However, the operator can chase you for payment through the County Court. They can apply for a County Court Judgement (CCJ) to be issued against you.

We recommend you don’t let things get this far, as the legal consequences of unpaid parking fines are not worth it.

First, it will ruin your credit history, and the CCJ will remain on your records for 6 years. Secondly, you may end up paying more!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can UK car park management take you to court?

The rules on parking on private land are managed by the International Parking Community (IPC) and the British Parking Association (BPA). They’ve established the rules on how private operators should manage car parks for landowners.

You can be taken to court if a Parking Charge Notice remains unpaid.

But if an operator broke the ‘rules’ when issuing it, the case may not succeed. That said, it’s a gamble you have to weigh up.

If you win, your case will be struck out. But if you lose, you’ll end up with a CCJ on your credit history.

Note: A parking management company has to pay their own solicitor’s fees whether they win the case or not.