Can a debt collector take my car?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried because a debt collector has sent you a letter? You may be asking, “Can a debt collector take my car?” Don’t worry; you’re in the right place for answers.

Over 170,000 people visit our website each month looking for answers to their debt questions. We have lots of information to help you.

In this article, we will cover:

- Whether a debt collector can take your car.

- What a County Court Judgement (CCJ) is.

- The role of a bailiff in debt collection.

- Different types of debt.

- How to manage your debt with digital tools.

We know this is a hard time for you. Some of us have had debt collectors chasing us too and understand it’s very scary, but we’re here to help you learn more.

Let’s discuss your options.

Can a debt collector take my car?

The short answer to this is no, vehicle repossession over a debt won’t happen. At least not straight away, and not without your consent. A debt collection agency rarely has any additional powers compared to your original creditor.

So, although they can come to your house and ask you to repay your debts, they can’t really enforce very much to begin with.

Unlike a bailiff, debt collection agencies cannot seize your property to cover the cost of a debt. As we’ll see, this is an important distinction. With a debt collection agency, they can continue trying to persuade you to pay, and they may eventually be able to force legal action against you.

How to stop a bailiff taking your car

Preventing vehicle seizure can be challenging. Although there are several instances when a bailiff cannot seize your car or other vehicle.

I think it’s worth knowing these circumstances, as it could mean that you can stop them from taking your car. Here’s what you need to know.

They cannot take your vehicle if the following applies:

-

It has a Blue Badge, is needed for your job and worth less than £1,350, or is also your home (such as a campervan).

-

It’s a hire purchase, contract plan, or conditional sale vehicle. If you’re unsure as to whether this applies, you can check the HPI check website.

- The vehicle isn’t parked at your home, place of business, or on a public road or car park.

So, with that in mind, there are a few things that you can try:

-

Move your vehicle. To stop a bailiff from seizing or clamping your vehicle, you can move it from your driveway. A locked garage or a friend/family member’s driveway is off-limits.

-

Arrange a payment. If the bailiff comes to take your car, you can agree to pay what you owe within two hours of them issuing the demand.

- Agree to a controlled goods agreement. This type of agreement is essentially a regular payment that settles your debt.

If you do have your vehicle clamped, you shouldn’t try and remove the device or move your vehicle. It is illegal to do so. That said, I think it’s always best to try negotiating with bailiffs to prevent them seizing a vehicle.

Once your vehicle has been taken, there is still time for you to reclaim it before they sell it. However, you’ll usually have to agree to a payment if this is the case.

If you think that a bailiff has broken the rules by clamping or seizing your car, you can contact Citizens Advice for more information and assistance.

Plus, I’ve found that seeking independent advice from any of the leading UK charities if you feel you’re not being treated fairly is worthwhile.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Managing your debt with digital tools

The charity National Debtline offers digital tools for debt management worth checking out. The tool provides tailored advice and is available 24/7.

» TAKE ACTION NOW: Fill out the short debt form

What is County Court Judgement?

A County Court judgment (CCJ) is an order issued by the court that makes you liable to pay a debt. If a creditor or debt collection agency wins a court case, a CCJ is registered against you by default if you don’t attend a hearing.

Moreover, you have two weeks to respond when you get a County Court Claim form. As such, it’s not a good idea to ignore it.

CCJ consequences can leave you struggling to get credit further down the line until it expires in 6 years.

What Happens If You Ignore Your Debts: County Court Judgement (CCJ)

If a debt collection agency or creditor takes legal action against you for your debt, you might end up with a County Court Judgement (CCJ).

This is essentially a court order demanding you pay what you owe. If you continue to ignore the matter, an enforcement agent (bailiff) could be sent to your house. This is where things get more complicated.

The Role of a Bailiff in Debt Collection

An enforcement agent or bailiff can take your vehicle to cover the cost of your debt. However, there are certain requirements, rules, and regulations that apply to this.

Below, we’ve outlined some of the main bailiff rights and limitations that you need to know about the process:

-

A bailiff is allowed to take your vehicle, providing they have the correct documents and authorisation.

- They can take it from your home, where you work, or from a public highway.

- However, they can’t take it from private land unless they have a warrant that details that exact location.

- When taking a vehicle, they have to confirm it belongs to you by checking with the DVLA.

- They cannot take a vehicle that’s under a hire purchase agreement.

- They can take a vehicle that is jointly in your name.

- If you don’t hand over the keys, they can clamp the vehicle to recover at a later date.

- If debt recovery via bailiffs is authorised to take the car, they must give you two hours’ notice to come up with a repayment plan.

- When taking your car, they must give you a full inventory and documentation of what they’ve taken.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Understanding the different types of debt

There are different types of debt which fall into four different categories when it comes to financial liabilities. I’ve listed them here:

- Secured debt

- Unsecured debt

- Revolving debt

- Instalment debt

Then there’s secured vs Unsecured debts. Plus, there’s good debt and bad debt. For example, bad debt includes:

- Credit card debt

- Car loans

- Personal loans

- Payday loans

- Loan Shark deals

Your debt type dictates how a creditor may deal with the amount owed.

Debt collectors vs bailiffs

The comparison between debt collector and bailiff is significant. As we’ve seen, there are some fairly significant differences between these two terms.

However, people have a habit of using them interchangeably. As such, it’s worth knowing the difference between the two, particularly if you’re wondering whether a debt collector can take your car.

Detailed Look at Debt collectors

A debt collector is someone working on behalf of a debt collection agency. They’re sometimes known as field agents or doorstep collectors. Although it sounds like a fairly intimidating term, the functions of a debt collector are limited.

If you default on a loan or have outstanding payments due, the creditor may hire a debt collector to recover the money. But their legal powers are equal to the original creditors’.

Alternatively, they might sell the debt on to one of these companies. From here, the debt collector will try to recover the money.

They can visit your home to settle the debt. Once they pay you a visit, they have no legal powers to take your possessions or force you to pay. Debt collectors have no more powers than a creditor. As such, they cannot seize your car.

Can bailiffs take my car?

Bailiffs are now known as enforcement agents. However, many people still use the term bailiff.

Unlike a debt collector, the legal powers of bailiffs include the seizure of goods to recover debts. They’ll have court-mandated powers to collect things like council tax, parking fines, and similar.

When they visit your property, they have the power to take certain items to match the cost of what you owe. Your car is part of their remit, providing that it’s at least partly in your name and not a hire purchase vehicle.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

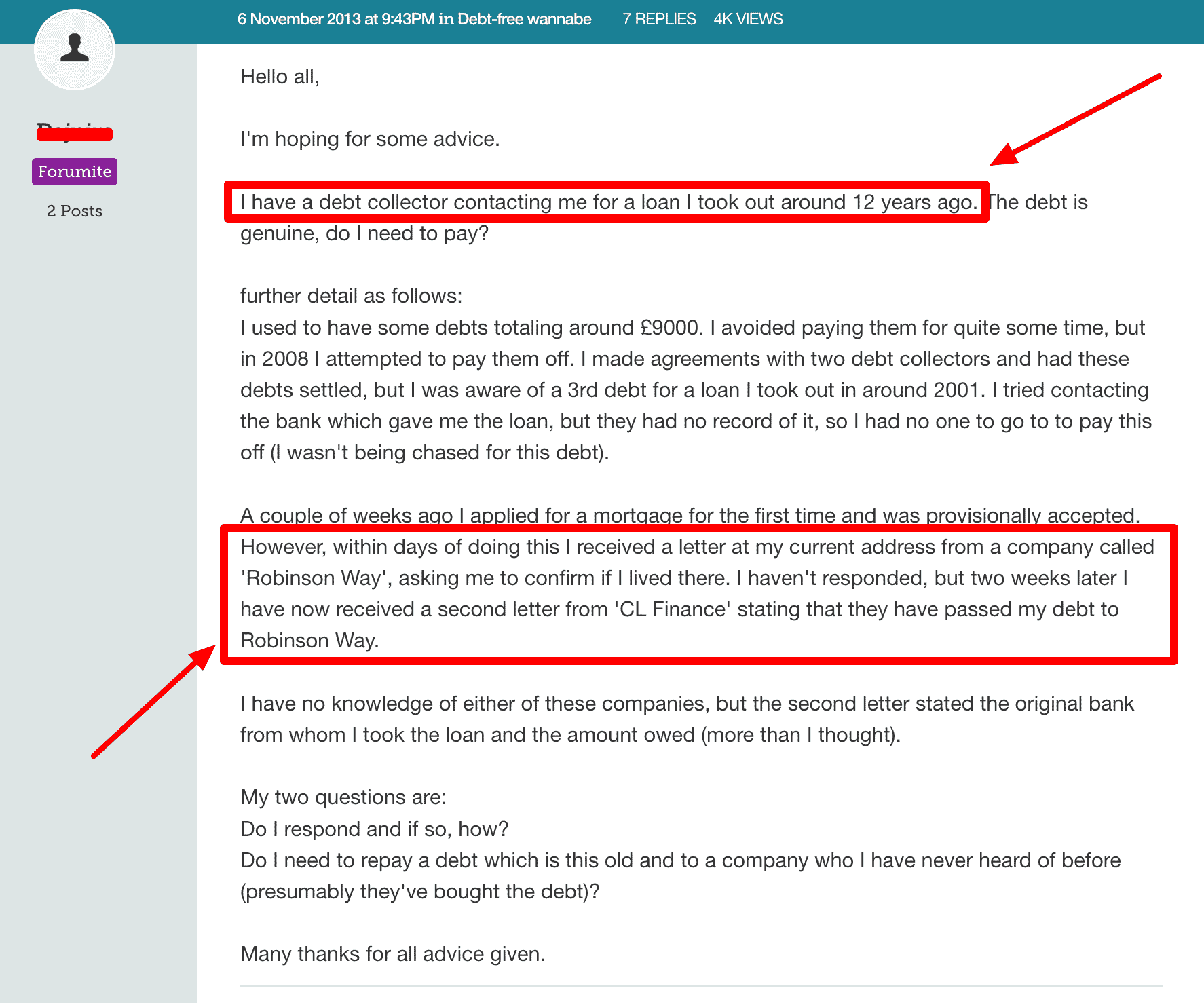

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.