Can Councils Backdate Council Tax? How Far Can They Go?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with council tax debt can feel hard. But, don’t worry, you’ve come to the right place for answers. Each month, over 170,000 people visit our website seeking advice on their debt issues.

In this easy-to-read article, we will help you understand:

- What happens if you can’t pay your council tax.

- How council tax bands work.

- How to ask the council to cancel your council tax debt.

- What the law says about not paying council tax.

Among those seeking support from Citizens Advice, the average council tax debt has remained stable at £1,100 over the last year.1 So, if you’re feeling overwhelmed, know that many others are facing similar challenges.

With our experience, we’ll help you find a path out of your council tax debt. Let’s get started.

Can a council backdate council tax?

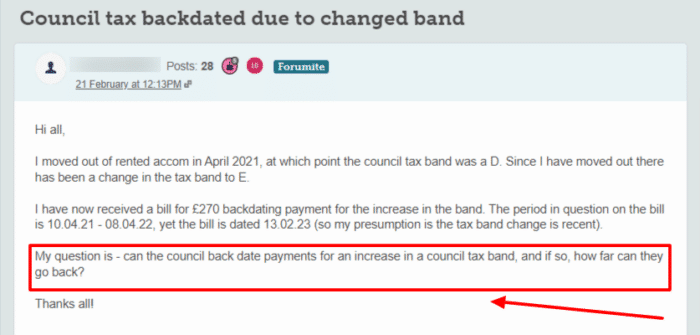

If your home has ever changed tax bands, you might be wondering if the council can backdate charges like this forum user.

Can you backdate a council tax refund?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can the council backdate council tax underpayments?

» TAKE ACTION NOW: Fill out the short debt form

How far back can council tax be recovered?

How long can you be chased for a council tax debt?

Council Tax Debt Solutions

Here are some debt strategies for handling council tax arrears. Knowing these options can make a significant difference in overcoming financial struggles.

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

What happens if you don’t pay your council tax?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will the council take me to court?

What happens If I ignore a liability order?

Has paying your council tax debt become too difficult?

Can I Write Off My Council Tax Debts?

You might be able to write off some of your council tax debts wiht a debt solution.

Even if these debts can’t be covered, getting a debt solution might help you get back in control of your finances enough to pay back the council.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible.

Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.