Can You Switch Energy Suppliers with Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

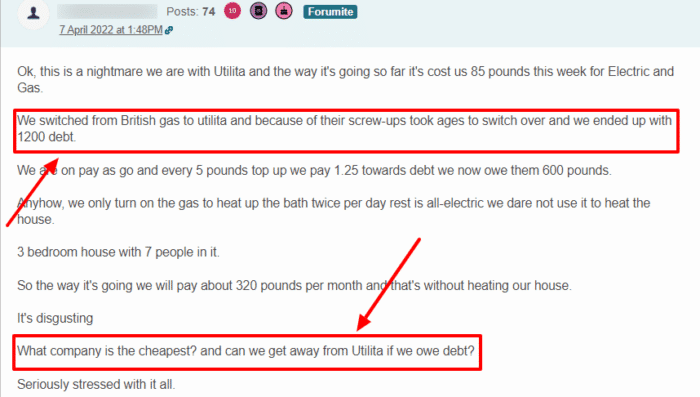

Are you wanting to switch energy suppliers but worried about a debt you might have? You’re in the right place to find answers. Each month, more than 170,000 people come to our site for guidance on their debt questions, just like you’re doing now.

In this helpful guide, we’ll cover:

- The rules for switching energy suppliers when you have a debt.

- How much debt is too much for making a switch.

- Steps to take if you’re finding it hard to pay your energy bills.

- Grants and allowances that could help you out.

- How to handle unaffordable debt.

Our team knows what it’s like to have debt, as some of us have been in your shoes, so we understand how you feel. We’re here to give you the information you need to make good choices.

Let’s dig in and find out more about switching energy suppliers when you have a debt.

Things to Know

If you owe money to your current energy supplier, you don’t always have to pay it back before switching to another supplier.

But then, when is it mandatory to pay off debt before switching? To make sure that your energy supplier isn’t being unfair, you’ll need to know the rules for energy provider switch with arrears.

You can only switch energy suppliers in debt if you meet the following conditions:

1. The 28-Days Rule

If you’ve been owing money to your gas or electricity supplier for more than 28 days, you’ll have to pay it back before you switch to a new supply. In this case, your current supplier can stop you from switching.

If your debt is only 28 days (or less) old, you can switch your energy suppliers easily.

However, this does not apply to cases where your debt may actually be the supplier’s fault. For instance, your supplier may have accidentally sent you incorrect energy bills, only to realize later that you needed to pay more.

In such a case, the supplier cannot stop you if you want to switch to a new supplier. However, you’ll still need to pay them the due amount whenever you receive their final bill.

» TAKE ACTION NOW: Fill out the short debt form

2. The £500 Rule (Prepayment Meter)

The above rule is only for people who do not pay in advance for their gas and electricity supply. There’s a different rule for consumers who use a prepayment meter to pay bills in advance.

The only time you cannot switch energy supply is when you owe more than £500 for electricity or £500 for gas.

However, if you owe less than £500, your supplier cannot stop you from energy switching. In this case, a protocol called the Debt Assignment Protocol would have to be followed, according to which your new supplier will transfer both your debt and the supply.

Keep in mind that you’ll need to make a request for this beforehand.

Bonus Tip: It’s wise to pay off your energy arrears before switching suppliers. This is because your supplier may send information about your account history (e.g. late payments, unpaid dues, etc) to credit reference agencies. This will lower your credit score and may affect your ability to get credit in the future.

Remember, you can only switch energy suppliers if you owe £500 or less for gas or electricity. You must also ask the new supplier to agree to transfer your debt along with your supply.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can They Disconnect My Supply If I Don’t Pay?

If your energy bill is unpaid after 28 days from the date you received the bill, your supplier can start action that could lead to disconnection. However, they will only disconnect your supply as a last resort.

Gas and electricity companies will first offer you a range of payment methods to help you pay your arrears. I suggest you take up some of these options or agree to an affordable way of paying your energy debt.

Now if you still don’t pay or miss an instalment on an agreed arrangement, your supplier could start the process of cutting off your supply.

However, they must give you seven days’ notice in writing that they will disconnect your electricity supply because you have not paid your bill. The energy supply disconnection rules for gas are the same.

Contact debt charities like Citizens Advice or Step Change if your supplier is threatening to disconnect your supply. Your local council can also help you to avoid disconnection, so I suggest you contact them as well.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.