Can the same debt be defaulted twice? Quick Answer

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if the same debt can be defaulted twice? You’ve come to the right place for answers! Each month, over 170,000 people visit our website to understand debt problems just like this one.

In this article, we’ll show you:

- What a defaulted debt means

- If a debt can be defaulted twice

- How an old debt might show up in your credit report

- Steps you can take if you’re struggling with debt

We know that dealing with debt can be hard; some of us have been there too. But don’t worry! We’re here to help you understand your debt situation better.

Is it possible to happen?

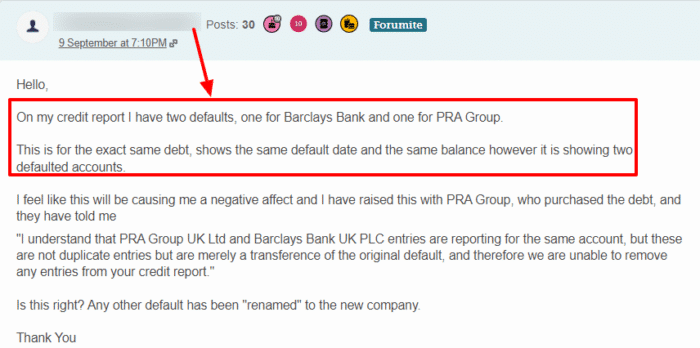

There are many reports across the internet about people having the same debt defaulted twice. Can this really be done though?

» TAKE ACTION NOW: Fill out the short debt form

In this case, Barclays sold the debt to PRA Group, but both companies reported the same default to a CRA.

Usually, the original entry will be replaced by the new owner’s entry, but this does not always happen, and you can end up with two entries which give the impression of two defaults.

Remember, a default will appear on your credit report for six years.

Can an old debt reappear on your credit report UK?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Double default

The next steps

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.