Can’t Afford Council Tax – Here’s What You Can Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried because you can’t pay your council tax, we are here to help. This article will guide you with clear and simple steps you can take.

Over 170,000 people turn to our website each month for advice on how to deal with debt. We understand your worries about legal action over council tax debt. We’re here to provide answers, so you can feel safe again.

In this article, you will find help on:

- Steps to take if you can’t pay your council tax.

- Understanding what council tax bands mean.

- How to ask the council to write off your council tax debt.

- What happens to your credit score if you don’t pay council tax.

- The law and not paying council tax.

Research shows that the average council tax debt among those seeking support from Citizens Advice has remained stable at £1,100 over the last year.1 We’ve provided useful advice to many people in a similar situation as yours. We want to help you figure out what your next steps should be and what your options are at the moment.

Let’s dive in.

Can you get away with not paying council tax?

Nearly everyone in the UK renting or owning property has to pay tax to their local authority, subject to their property council tax band.

The UK council tax bands dictate how much needs to be paid each year. These payments to the council cover local essential services and maintenance.

There are many council tax exceptions based on individual circumstances, such as being a full time student, under 18s, or some disabled persons. And you may be able to claim a discount for various reasons. These include:

- Those living in halls of residence or a care home are exempt.

- If you live alone in the property, you will receive a 25% discount.

- If you work away from home and your property is empty, you can get a council tax empty property discount of 50%.

- If everyone in the property is a full-time student, you pay no council tax.

The bottom line is that most of us who are 18 and over will have to pay. From my personal experience, anyone occupying the property is liable to pay council tax. So tenants, too, have to pay unless your rental agreement includes the bill.

» TAKE ACTION NOW: Fill out the short debt form

What happens if you can’t pay tax?

Even with a reduction, some people cannot keep up and end up owing unpaid council tax.

If you are struggling to pay council tax, it is recommended to get advice from a charity and speak with the local council directly. They might be able to help change your repayment frequency or agree on a council tax repayment plan. This can ease the pressure and help you with managing council tax debt.

However, if you ignore your council tax arrears, you can expect a letter from the local council in the post.

They will request you repay the money quickly (typically in 7 days). If you ignore their letter, they could try to make you repay the remaining money owed in the full year’s bill. In other words, they would be asking for a lump sum payment.

And if you still fail, the council can take you to court to enforce the debt. Remember, you may be able to negotiate with the council at any stage to stop them from taking further action against you.

In court, the judge will look over any evidence and decide whether you are liable for the debt. If they deem it so, you will be given a court order, known as a liability order.

The council might add their own legal fees to what is owed.

At this point, you will be instructed to repay immediately or make an arrangement to pay in instalments if you have a low income or receive benefits.

Once paid, get a receipt!

If you are still not able to pay and are worried about legal proceedings, contact a debt charity for support. There are many debt solutions available, so please be sure to explore them in depth. Here’s a list of some of them.

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

And if you still fail to repay after a liability order is issued, the following steps are likely:

- The council enforces the order and may use the court to take payment directly from benefits, such as employment and support allowance. Or they enforce it by employing a bailiff.

- The bailiff will allow you to repay in full or sign an arrangement (CGA) to pay in instalments secured against your valuables by a certain date (minimum of seven working days, including Saturday). This means your valuables will be repossessed and sold if you do not keep up with payments. You will owe bailiffs fees even from this point.

- If you do not clear the debt by the date given and fail to accept a CGA, the bailiffs can come to your home and attempt to seize goods. The financial costs at this point increase significantly.

If bailiffs cannot seize goods or recover the money owed, the council can apply to the Magistrates’ Court to summon you for a hearing. If it gets this far, it is possible to be sent to prison for 90 days, but only if you have willfully neglected or rejected paying the bill.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can bailiffs force entry?

In most cases, enforcement agents cannot force entry into a house to seize goods. The agent can walk through open or unlocked doors, even if the debtor is not home.

At this stage, the agent may still give you an opportunity to repay in full with a debit or credit card.

The only time a council tax enforcement agent can force entry to recover council tax is if the debtor agreed to a CGA and defaulted on a payment – and they have given notice about their intentions.

If the goods are inside the property, the agent can use reasonable force without harm to enter the property and take the items they legally now own.

They cannot take items you need for employment, such as work tools or computers. Also, bailiffs won’t take your car if you tell them that you need it for work and you’re a critical worker or that you need to take someone critically ill to the hospital. But it’s up to the bailiff to decide if your individual circumstances warrant giving you a break.

You can get advice from a trusted charity if you think an enforcement agent has acted wrongfully.

What to do if you are struggling to pay your council tax

If you do not have the money to pay your council tax bill, you should speak with the council as soon as possible to see if there is a way they can help, possibly with a repayment plan.

Most of the time, they will show empathy and try to find a solution with you. However, this willingness varies with each council. It might be worth making an accurate budget before getting in touch for council tax support.

They will be able to assess your situation to see if you are eligible for a discount as well. Most councils have a council tax reduction scheme (CTR) specifically for cushioning those undergoing financial difficulties.

Council tax reduction eligibility is nonetheless based on individual circumstances. For example, living alone, with someone studying full time, or if you receive benefits like a jobseeker’s allowance, income support, universal credit, or pension credit could earn you a council tax reduction.

This can make it easier to pay future bills, and the council can backdate credit to refund you what you should have claimed.

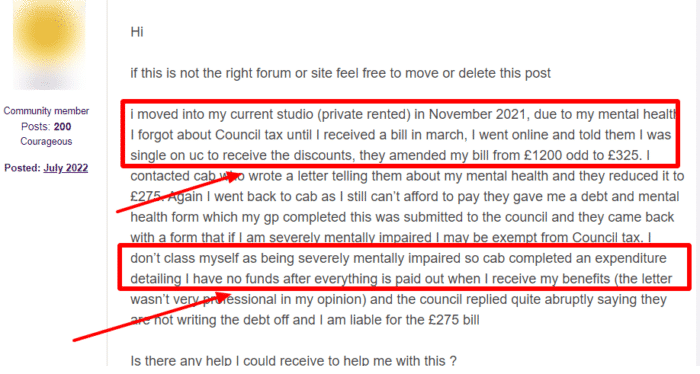

If you can’t pay your council tax arrears due to low income or some personal circumstances like this forum user, you can get help. Contact the council to see what reduction you can get, and speak to trusted debt charity services (e.g. Citizens Advice Bureau) for impartial council tax arrears advice.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I write off council debt?

There are ways to write off a council tax bill using debt solutions.

Some of the solutions used to write off these types of debt are Debt Relief Orders and Individual Voluntary Arrangements.

A DRO is an option for people with limited disposable income (<£75 per month). It prevents people chasing you for money in writing or over the phone for one year. After one year if your financial situation hasn’t improved, all debt is wiped. So a council tax debt relief order is worth exploring if you’re drowning in debt.

An IVA is slightly different and you will need to repay some of your debt. It’s for people with multiple larger debts and enough money to make a sizable repayment (£100 minimum) each month.

This payment is split among all creditors for five years before all outstanding amounts owed are wiped. Each creditor must accept the IVA proposal to be included.

Be aware that if the debt reaches the stage of court orders or bankruptcy, these will be recorded on your credit file and can harm your ability to obtain further credit.

Find more information on these and other solutions with us. And don’t forget there are some excellent charities waiting and willing to help you.