Affordable Car Insurance For Cancelled Policies for you

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you struggling to find car insurance after your policy was cancelled? You’re not alone. Every month, over 9,300 people visit our website seeking help on this very issue.

In this article, we’ll guide you through:

- The reasons why car insurance policies get cancelled.

- How a cancelled policy affects your chances of getting insured again.

- The difference between having penalty points and driving convictions.

- Ways to get affordable car insurance even with a cancelled policy.

- Why it’s important to be honest with your insurance company about your past.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

This can be quite concerning, but we’re here to help you understand and navigate this tricky situation.

Let’s dive in.

What are the reasons for car insurance policy cancellation?

Your car insurance policy can be cancelled or voided for several reasons, and it doesn’t necessarily have to be due to fraud.

Whenever the insurance company finds out you have violated any of the stated terms and conditions, they can immediately cancel the policy.

Some common reasons for insurance termination are:

- Missed payments

- Licence suspension

- Innocent non-disclosure

- Deliberate non-disclosure (fraudulent intent)

- Paperwork mix-ups

- Not understanding the terms of insurance

- A change in personal circumstances

Let’s look at these circumstances in detail.

1. Missed Payments

Suppose you miss a payment for any reason (even due to a bank error). In that case, your insurer will send a notification showing your outstanding balance and the deadline for your payment to avoid cancellation.

However, if you do not take timely action by contacting them or paying before the deadline, the policy will eventually get cancelled.

2. Licence suspension

A suspended driver’s licence means you’re considered a high-risk driver. And not all insurance companies want to cover such drivers.

If your policy is cancelled due to a suspended licence, you will often have to purchase high-risk car insurance when you renew your licence.

The cause of your licence suspension and the length of suspension can also affect how readily you get suitable insurance.

However, there is still budget-friendly car insurance for a drink-driving ban.

Other reasons that could lead to licence suspension include the following:

- Distracted driving

- Unpaid fines

- Too many demerits

- Impaired driving

- Driving without a valid insurance policy

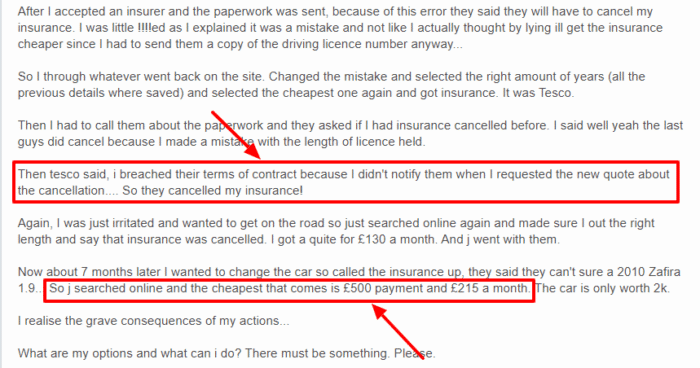

3. Innocent non-disclosure

This occurs when you fail to disclose some information during your application, and your insurer finds out after providing the insurance.

However, the insurer doesn’t allege that you concealed the information intentionally (with fraudulent intent).

The insurance company may withdraw their insurance as they may find you unfit for their coverage after discovering more about your circumstances.

4. Deliberate non-disclosure

This is deliberately concealing some information from your insurer during the application, such as your insurance history.

5. Paperwork mix-ups

Suppose your signed paperwork didn’t get to your insurer for whatever reason. Or they got the wrong documents due to documentation errors.

They may cancel the insurance policy as they don’t have any evidence of your agreement.

6. Not understanding the terms of insurance

If you don’t fully understand your insurance’s stated terms and conditions and later realise their meanings, you may not agree to all the terms.

Your insurer may cancel your policy if they find out you do not understand their terms and conditions or object to any of them later.

7. A change in personal circumstances

Suppose you experience a change in personal circumstances, such as a change in address or other related situations.

In that case, your insurance provider may cancel the policy when you notify them of the change. Even if you fail to disclose this change, they may find out and cancel the policy as a result.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How does cancelled car insurance affect me?

Cancelled insurance sits on your insurance history for six years in a central database (CUE). This means that insurance companies will be extra careful in providing coverage in future.

Even if your policy was cancelled for non-fraudulent reasons, most insurance providers would presume insuring you will be risky, so they will either refuse or charge a significantly high premium.

» TAKE ACTION NOW: Find the best insurance for drivers with points

Can I drive with cancelled insurance?

If your insurance is cancelled, you should not drive on the road until you have valid insurance.

Driving without valid insurance can lead to a fine and extra points recorded on your driving licence. Depending on the local council laws, you can also face penalties like:

- Suspension of your driver’s licence and/or registration

- Confiscation of your licence plate

- Vehicle impoundment

- Imprisonment

Note that driving with a revoked license is illegal.

Convicted Driver Insurance Reduction

I understand how frustrating it can be to face high insurance costs due to a mistake. That’s why I’ve prepared this table that provides different tips on how to reduce insurance rates.

| How to Reduce Insurance Rates | Keep in Mind… |

|---|---|

| Choose Your Car Wisely | Consider age, engine, insurance group & price. The lower the group, the lower the premium. A high-powered & fast car, or cheap car with less value come with a higher risk, which means a higher premium. |

| Ensure Car Safety & Security | Park in a driveway or locked garage. Use safety technology. |

| Add a Named Driver | Adding an experienced driver with a good claims history, such as a parent, can lower your insurance premium by reducing the perceived risk. |

| Drive Fewer Miles | Reduced mileage = Reduced risk. |

| Complete a Rehabilitation Course |

Third-Party Only – the bare minimum; as required by law Comprehensive – provides full coverage and may include personal accident and medical expenses coverage Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles |

| Determine the Cover Level You Need |

Third-Party Only – the bare minimum; as required by law. Comprehensive – provides full coverage and may include personal accident and medical expenses coverage. Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles. |

| Compare Policies and Opt Out of Extras | Get quotes tailored to your specific convictions and needs. Optional extras like excess protection, legal cover, breakdown, windscreen, and gadget cover are nice to have but come with added costs. |

| Increase Your Excess | Raising the amount of excess (upfront payment for any claim; the rest to be paid by the insurer) on your policy can lower your insurance premium. |

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How to get more affordable car insurance for cancelled policyholders

If you’re a cancelled policyholder, below are tips for getting the most affordable car insurance from companies willing to offer you a second chance.

1. Compare auto insurance quotes.

There are lots of insurers with affordable quotes for cancelled policyholders that you can compare.

A simple online search can show you many of these insurance companies. All you need to do is choose your preferred provider.

2 Ask about discounts

If your preferred insurance option charges an exorbitant amount for high-risk drivers, they may also have discounts for people who meet certain conditions.

For example, many companies give a safe driver discount every month when drivers obey all traffic rules and do not record accidents within a specific period.

3. Consider usage-based insurance

This type of insurance calculates your fee based on your mileage (how many miles you drive) and is usually a more affordable option for cancelled policyholders.

Typically, high-risk drivers drive less due to their records, so using insurance that charges based on your usage will be more affordable than those with a fixed fee.

Getting insurance with penalty points vs convictions or a driving ban

Drivers with penalty points on their licence are often confused with those carrying convictions or driving bans.

If you have penalty points on your licence but haven’t been banned from driving or convicted, it’s easier to get affordable insurance.

From experience, getting car insurance for disqualified drivers requires a more tedious process and often comes at high rates.

Also, how much car insurance costs after a drink-driving ban is significantly higher than when you merely have some penalty points due to breaking basic traffic rules like light/sign violations, road obstruction, etc.