Affordable Car Insurance with Points This Year For You

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you trying to save money on your car insurance but have points on your driving licence? This is a common worry. In fact, each month, over 9,300 people come to our website seeking advice on this very topic.

This guide will provide you with all the information you need to navigate this situation. Here’s what you can expect to learn:

- What penalty points are and how they work.

- The impact of penalty points on car insurance costs.

- Whether you need to tell your insurer about your penalty points.

- How you can still get car insurance even with points.

- Tips on how to lower your car insurance costs despite having points.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

I know this can be concerning, but don’t worry. There are ways to find affordable insurance!

Let’s discuss your options.

What are penalty points?

Penalty points are added to your driving licence when you accept guilt for a motoring offence or when you’re convicted of a driving offence.

The number of points you receive will depend on the type of offence and details surrounding the offence.

For example, the number of penalty points you can get for speeding depends on how fast above the speed limit you were travelling and some other factors, such as if you were near a school.

Other reasons why you’d get penalty points are for:

- Traffic violations

- Drink-driving

- Careless driving

- Dangerous driving

Do you have to tell insurance companies about penalty points?

Yes, you must be honest about penalty points and driving convictions received within the last five years.

You have a legal obligation to tell an insurer about endorsements when you renew a policy or take out a new one as per their policy terms.

Failure to disclose the correct information can result in your insurance being invalid and any claims being rejected.

How long do penalty points last?

Penalty points stay on your driving licence for three years.

If you get 12 or more penalty points within a three-year period, you will receive a driving ban for at least six months.

This is called a totting-up ban, but you can be banned in other ways at the discretion of a judge if convicted.

A driving conviction remains on your driving record for longer than the penalty points.

Depending on the seriousness of the conviction, it could remain for four or eleven years.

» TAKE ACTION NOW: Find the best insurance for drivers with points

Can you get insurance with points?

Yes, you can still get insurance when you have penalty points on your driving licence.

I suggest you speak to specialist insurers who may be able to get you a better deal.

You must declare recent offences and penalty points when renewing your insurance or making a new application.

You can even get car insurance after being disqualified.

Some insurance companies need you to declare penalty points during your current insurance period, but this isn’t that common.

Is car insurance more expensive with points?

Your car insurance premium is likely to increase if you have penalty points on your licence when you renew your policy or take out another policy.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Convicted Driver Insurance Reduction

Dealing with higher insurance costs due to points on your licence can be quite frustrating. Fortunately, there are various ways to reduce insurance rates.

These include:

| How to Reduce Insurance Rates | Keep in Mind… |

|---|---|

| Choose Your Car Wisely | Consider age, engine, insurance group & price. The lower the group, the lower the premium. A high-powered & fast car, or cheap car with less value come with a higher risk, which means a higher premium. |

| Ensure Car Safety & Security | Park in a driveway or locked garage. Use safety technology. |

| Add a Named Driver | Adding an experienced driver with a good claims history, such as a parent, can lower your insurance premium by reducing the perceived risk. |

| Drive Fewer Miles | Reduced mileage = Reduced risk. |

| Complete a Rehabilitation Course |

Third-Party Only – the bare minimum; as required by law Comprehensive – provides full coverage and may include personal accident and medical expenses coverage Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles |

| Determine the Cover Level You Need |

Third-Party Only – the bare minimum; as required by law. Comprehensive – provides full coverage and may include personal accident and medical expenses coverage. Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles. |

| Compare Policies and Opt Out of Extras | Get quotes tailored to your specific convictions and needs. Optional extras like excess protection, legal cover, breakdown, windscreen, and gadget cover are nice to have but come with added costs. |

| Increase Your Excess | Raising the amount of excess (upfront payment for any claim; the rest to be paid by the insurer) on your policy can lower your insurance premium. |

Why is car insurance more expensive with points?

Your car insurance premiums increase when you have penalty points because the points signal that you’re guilty of a motoring offence and are, therefore, a higher-risk driver.

The company believes you’re more likely to be involved in an incident or accident and need to make an insurance claim when they do a risk assessment.

The number of points and the nature of the offence will allow the insurance company to assess how much riskier you are to insure.

This can be compared to a loan company assessing your credit score before approving you for a loan and deciding how much interest to charge.

How to reduce car insurance with points?

You could reduce the amount you pay for car insurance in several ways, which I’ve listed here:

- Speak to a specialist insurance broker who could find you a better deal

- Consider driving a car in a lower group which would cost less to insure

- Choose third-party cover, which is typically the cheaper insurance option than comprehensive cover

How much does 3 points put insurance up by?

Several reliable sources suggest there isn’t a huge increase in insurance premiums when you only have three penalty points.

But you should expect to pay between 5% and 10% more than you would otherwise be quoted without points.

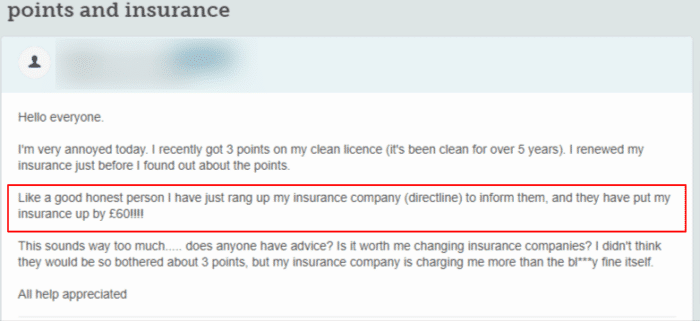

However, there is evidence to indicate that the increase can be more, as this forum user suggests:

Source: Moneysavingexpert

How much does 6 points put insurance up by?

According to data published by Admiral, the average insurance premium increase for someone with six points is 55%. But it could increase up to 86%, depending on the offence.

There is a notable jump in cost when you exceed three points.

Can I get insurance with 9 points?

Yes, you can still find some insurance companies willing to offer you insurance with nine penalty points on your driving licence, but your options will be limited.

You should search for specialist insurers offering high-risk driving insurance or convicted driver insurance.

With nine points on your licence, some insurance companies will quote you 75% or more than if you had no penalty points on your licence.

But don’t give up. There might be ways to get potentially cheaper car insurance with points.

How you could save money on car insurance with points

There are ways you could get cheaper car insurance with penalty points.

I’ve provided some top tips here:

- Search for penalty point driving insurance or comparable terms instead of focusing on the mainstream insurance market

- Get help from a vehicle insurance broker, especially one with a record of helping high-risk drivers get cheap insurance. They might have access to exclusive cheaper deals

- Consider changing your vehicle to one that is usually cheaper to insure

How to get the best deal for you on car insurance renewal

There are things you can do which may reduce the amount you pay for car insurance, and I’ve listed some of them below:

- Don’t auto-renew a policy. Instead, I suggest you compare quotes

- Getting a quote 20 to 26 days ahead of a renewal tends to be cheaper

- Add a driver to the policy to see if it brings down a premium

- Pay your premium annually instead of in instalments

- Increase the excess you pay

- Consider pay-as-you-go insurance

- Look at usage-based policies

What is telematic insurance?

Telematics insurance uses in-car monitoring technology, which adjusts the rates you pay based on your driving habits and the mileage you do.

It’s often referred to as black box car insurance, a popular choice for younger drivers.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How you could save money on your car insurance with points?

There is no single car insurance provider that is the cheapest for everyone with penalty points.

You’ll need to shop around and get the help of an insurance broker to help you find the best policies for you because policy premiums are bound to increase.

Best car insurance for young drivers with points

Likewise, no insurance company is always the cheapest for young drivers with penalty points.

But some insurance companies offer insurance policies to younger drivers with points, so you should be able to find options.

Young drivers should consider an additional driving course to help reduce their insurance, such as courses that help you drive safely on the motorway.

Another option is to look at telematics-based insurance, which could offer a better deal.

Comparison websites

I’ve included links to some top comparison websites in the table below.

| Organisation | Link to website |

| Confused.com | Website link |

| GoCompare.co.uk | Website link |

| Compare the Market | Website link |

| Money Super Market | Website link |

| Money Saving Expert | Website link |

Enrol in driving courses

Consider enrolling in a driving course because car insurance providers favour drivers who have passed an advanced course.

First, check how much a course costs because it may outweigh any savings you make on an insurance premium.