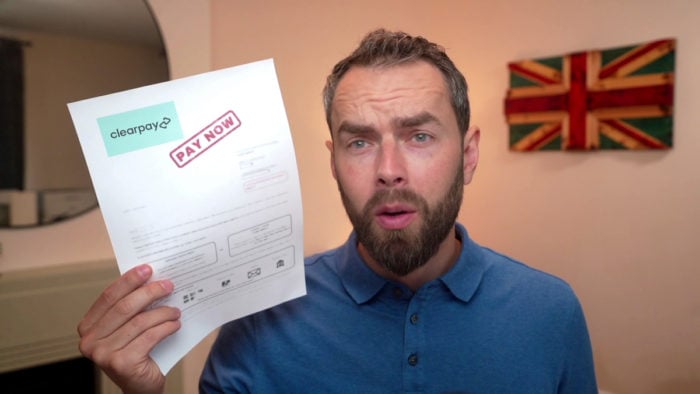

Clearpay Missed Payment – Should you Pay

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a missed Clearpay payment? You’ve come to the right place for help. Each month, over 170,000 people visit our website seeking advice on debt matters.

In this easy-to-read guide, we’ll shed light on:

- What happens when you miss a Clearpay payment

- How Clearpay’s Buy Now Pay Later scheme works

- Ways you might be able to reduce some of your Clearpay debt

- The impact of a missed Clearpay payment on your credit score

- Steps you can take to prevent a Clearpay missed payment

Dealing with missed payments can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry. We understand your concerns and are here to help you find the answers you need.

What Happens When You Miss an Instalment?

According to Clearpay, they are ‘committed’ to ensuring you keep to a prepayment plan. Otherwise, they lose money if they have to chase you for payment or late fees!

Your ability to repay a plan is assessed every time you use Clearpay.

That said, if you miss a payment, they contact you immediately. Also, they will place restrictions on future purchases until you pay.

You have till 11 pm the day after to settle the amount due. If you don’t, Clearpay imposes a late fee of £6. When you don’t pay within seven days, a further £6 late fee is due.

That’s a total of £12 in late fees.

Clearpay caps their late fees. They won’t be more than 25% of the total value of the item purchased through their BNPL scheme.

Clearpay sees this as an ‘incentive’ to make you respect a repayment schedule!

What If It Was Due to Financial Hardship?

Contact their support team immediately if you cannot make a Clearpay instalment on time. This must be before you miss the payment.

Clearpay aims to work with you when this happens as long as you contact their support team.

That said, you can’t make any more purchases using Clearpay. The restriction applies straight away.

Late fees that apply to missed payments are:

· Orders under £24 – a late fee of £6 per order

· Orders of £24 or more – a total late fee capped at 25% of an order or £36, whichever is the lower

You must immediately pay all late fees under the Clearpay terms and conditions.

» TAKE ACTION NOW: Fill out the short debt form

Budget Advice

Dealing with debt and missed payments can be challenging and scary. Some of our team members have been there too.

Don’t worry, there are certain actions that can help you lower your expenses. Here are ten budgeting tips.

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do They Deal With Late Payments?

When you’re late paying Clearpay, they will contact you immediately.

You’re given other ways to make the payment and an option to set up a new repayment plan for any outstanding amounts and late fees.

If you can’t make the payments or pay the late fees, Clearpay could send your details to a debt collection agency. A debt collector will contact you to recover all outstanding amounts due.

Debt collectors, while they have no legal rights to enter your home, can send you all sorts of debt collection communications, including letters, emails and phone, and generally get on your nerves.

They can also take it to court and get court judgments (CCJ) against you.

This is bad news for your credit score and can make getting any credit hard for the next six years, and the impact on your credit score can even stop you from renting a house.

My advice? Keep in contact with Clearpay and try to sort things out before this happens.

Can I Reschedule a Payment?

Yes, providing you reschedule the second or third payment before it is due. You can reschedule the payments using the Clearpay app.

To reschedule a first or last (fourth) payment, you need to speak to Clearpay support.

Contacting the support team will make rescheduling payments less stressful and help you avoid getting into more of a financial mess.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will It Impact My Credit Score?

The research found that two-fifths of people don’t realise a buy now pay later scheme may impact their credit score.

This includes Clearpay when you miss an instalment or fail to pay.

The ‘default’ could stay on your credit report for six years, and future lenders would be aware of it. It will affect your creditworthiness. This includes applying for credit cards, loans or even a mortgage.

Clearpay Contact Details

| Website: | https://www.clearpay.co.uk/en-GB |

| Email: | [email protected] |

| Help Center: | Get in touch |

| Mail: | Clearpay Customer Service, Clearpay Finance Limited, Jactin House, 24 Hood Street, Ancoats, Manchester, M4 6WX |

What You Should Do Before It Happens

My advice? Keep to a plan and make all your Clearpay payments on time.

If you are struggling for cash, get in touch with their support team straight away. Don’t ignore any communication you receive about a missed payment.

The problem won’t go away. In fact, things could get much worse if you do, having a harmful impact on credit score.

You want to avoid Clearpay sending your details to a debt collection agency. You must prevent things from getting critical.

Communication is the key to having a positive outcome for a missed payment. You should pay any outstanding amounts on time when you use a Clearpay buy now pay later option.

There’s lots of help when you struggle with finances and can’t meet commitments. You should contact an independent financial adviser when you find things confusing.

PayPlan, the charity, offers free, impartial financial advice.

This is invaluable for people who struggle with debt and don’t know what to do. It’s an option that could get you back on track with your finances if you are struggling with debt. Stepchange, National Debtline and Citizens Advice are great places for free financial advice.

As you can see, there’s no getting out of paying what you owe. The answer to the question “Should you pay?” Absolutely, or you could ruin your credit history!