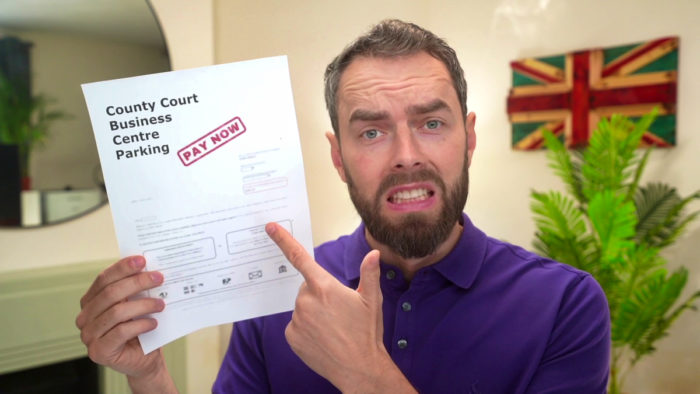

County Court Business Centre Parking Fine? Read This

Have you received a private parking fine from County Court Business Centre (CCBC) and feel unsure about what to do next? You’ve come to the right place. Every month, over 130,000 people visit our website seeking advice on fines and parking tickets as, believe it or not, over 19,000 parking fines are issued each day in the UK.1

This article will guide you on:

- The role of the County Court Business Centre.

- Whether you must pay a CCBC parking fine.

- How to appeal a CCBC parking fine.

- Ways to stop CCBC from calling you.

- What to do if you get a County Court Judgement.

We know how a private parking fine can be concerning. But don’t worry; this guide is full of handy tips and examples to guide you through the process.

Most Ticket Appeals Succeed

In some circumstances, you might have a legitimate reason not to pay your parking fine.

It’s a bit sneaky, but the last time I needed legal advice, I paid £5 for a trial to chat with an online solicitor called JustAnswer.

Not only did I save £50 on solicitor fees, I also won my case and didn’t have to pay my £271 fine.

Chat below to get started with JustAnswer

*According to Martin Lewis, 56% of people who try to appeal their ticket are successful and get the charge overturned, so it’s well worth a try.

The role of the CCBC

The role of the CCBC is to provide various services including:

- Bulk money claims

- Parking ticket disputes

- Deductions from debtor’s earnings by employers

No court hearings are held at the County Court Business Centre. When a hearing is needed, it takes place in a local county court.

In short, if a case goes to court because you’re disputing a parking fine, the hearing is held locally.

I got a letter from them. What should I do?

I was recently featured in The Sun about parking tickets, where I encouraged everyone to check whether the ticket was issued by a member of a trade association. If they aren’t, then they probably can’t get your details from the DVLA to pursue you.

Successful Appeal Case Study

Situation

| Initial Fine | £100 |

| Additional Fees | £171 |

| Total Fine | £271 |

The Appeal Process

Scott used JustAnswer, online legal service to enhance his appeal. The trial of this cost him just £5.

| Total Fine | £271 |

| Cost of legal advice | £5 |

JustAnswer helped Scott craft the best appeal possible and he was able to win his case.

Scott’s fine was cancelled and he only paid £5 for the legal help.

In partnership with Just Answer.

Should I pay?

Should I ignore the letters?

The RAC found that the number of parking tickets being issued is up by nearly 30%! The report also found that misleading and deliberately confusing signage in private car parks is part of the problem.2

» TAKE ACTION NOW: Get legal support from JustAnswer

Case study: What happens when you ignore a fine

I’ve included a message posted online by a motorist who chose not to pay a parking charge notice and ignore all correspondence.

Source: Moneysavingexpert

Can they enter my home for an unpaid ticket?

What grounds could I have to appeal?

You cannot appeal a CCBC fine. However, you can file a written defence.

In short, you can challenge the fine by providing:

- A written defence

- Explanation or mitigating circumstances

However, it might be worth settling a CCJ if one is registered against you. You should pay it within 30 days so it doesn’t adversely affect your credit rating.

The Appeal Process

Typically, appealing a parking ticket has several steps that must be taken to do so successfully. Here’s a quick table explaining what you need to do and when.

| Process: | Steps you should take: |

|---|---|

| When you receive the ticket… | You should gather as much evidence as you can to support your appeal claim and prove that the ticket was unfairly issued. |

| If you were given the ticket in person/attached to your car… | You must make an informal appeal (sent to the local authority/council that issued the PCN) within 14 days. This should be a letter with the evidence proving why the ticket was incorrectly given. |

| If it was posted to you… | You will be given 21 days to submit an informal appeal (from the day you received the letter). Your informal appeal should be a letter with the evidence proving why the ticket was incorrectly given. |

| If the informal appeal is rejected… | You will receive a Notice to Owner and will have 28 days to respond to this with a formal appeal. You can conduct the formal appeal online or via paper form. The Traffic Penalty Tribunal can send you one of these forms. |

| If the formal appeal is rejected… | You will receive a Notice of Rejection. From here, you are free to challenge the council’s verdict at an independent tribunal. |

| If the independent tribunal disagrees with your appeal… | You should pay the ticket within 28 days of the tribunal rejecting your appeal. If you don’t, the fine will be increased by 50%. If you don’t have the money to pay the fine, you should contact Citizens Advice or another debt charity. |

Can I stop them from calling me?

It’s part of the debt collection process to send out letters asking for payment.

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

They won’t stop calling me. What should I do?

Hire a Parking Solicitor for less than a coffee.

If you’re thinking about appealing your parking ticket then getting some professional advice is a good idea.

Getting the support of a Solicitor can make your appeal much more likely to win.

For a £5 trial, Solicitors from JustAnswer can look at your case and help you create an airtight appeal.

Try it below

In partnership with Just Answer.

Glossary of terms

Enforcement agents – bailiffs who are engaged to recover unpaid debts

Charging Order – secures debts with creditors against properties

Attachment of Earnings Order – instructs employers to garner money directly from an employee’s wages to pay back a debt

CCJ – County Court Judgement issued by courts for unpaid debts

FCA – Financial Conduct Authority regulates conduct for financial services firms and financial markets in the UK