Can Creditors Contact You After IVA? Know The Rules

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve been having trouble paying your bills, and are now being harassed by debt collectors, collection agencies, and bailiffs, you may be wondering what you can do to get them off your back – and how you can begin repaying the money that you owe in a manner that is reasonable and within your financial means.

From July to September 2023, the Gazette reported that there was a total of 13,965 Individual Voluntary Arangements.1

An Individual Voluntary Arrangement, often known as an IVA, is one solution that could be considered for this issue. Here, I will go into what an IVA is and explain whether creditors are allowed to contact you once you have an arrangement in place.

What happens once I’ve got an IVA?

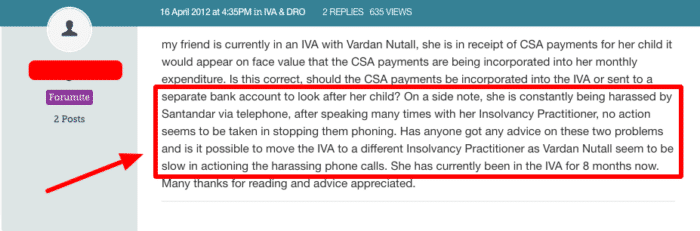

When your individual voluntary arrangement (IVA) has been accepted, an Insolvency Practitioner will be assigned to your case, and they will negotiate with the creditors on your behalf.

This assigned IP will contact your creditors to ask that any further action on debts covered by the arrangement be stopped.

However, it may take a little while for your creditors to update everyone, so if one of your debts is covered by your IVA but you still receive a visit from a bailiff, you can show them your IVA documents to prove that you have made an arrangement to pay your creditors.

What should I do if a creditor contacts me?

Even if the person on the other end of the phone is being impolite to you, you should keep your cool and behave politely.

Keep a log of your talks, noting both the name of the person who called and the name of the creditor who was involved in the matter.

Inform them of the full name, address, and contact information for your Insolvency Practitioner, as well as a reference number if you have one. Explain that you are currently working on putting together a proposal for an IVA and ask them to get in touch with your insolvency practitioner if they have any questions or need any additional information.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Are all my creditors listed in my IVA?

Not all creditors may be listed in your IVA. If they aren’t, it is because either it is a type of debt that can’t be included, or is mortgage or rent arrears.

The following are examples of debts that cannot be settled with an IVA:

- Child support payments

- Magistrates’ court fines

- TV licences

- Student loans

- Social Fund loans

If you are not sure if a creditor is included in your IVA, you need to ask your insolvency practitioner to check for you.

If a creditor is not included, this debt needs to be dealt with separately from your IVA, and they can still contact you and come after you for the debt.

What happens if my circumstances change during an IVA?

If your circumstances change, you must tell your Insolvency Practitioner. If you are having trouble keeping up with your payments, your IP can let you take a payment break, or they might ask your creditors to “vary” the IVA so that you can make smaller payments if you are unable to keep up with them.

Your request for a change to your IVA could result in a fee being imposed by the IP.

Your plan has a chance of falling through if you are unable to make any payments or if your creditors refuse to accept lower payments. If this happens, the IP has the ability to file a petition for your bankruptcy, but there is no guarantee that this will actually take place.

If it is decided that you should not be declared bankrupt by your IP, then your creditors could take legal action against you. To prevent something like this from happening, it is vital to reach a payment arrangement agreement with each of your creditors individually.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if it is a joint debt?

You and another person, like a spouse or partner, could be responsible for some expenses that are referred to as “joint debts.”

Because an IVA can only cover one person at a time, the other individual will continue to be responsible for the entirety of the debt. It is possible that including shared debts in the IVA is not the best course of action.

You and the other person will not be able to take out a joint IVA, but you both might be able to take out individual IVAs that are related to each other. These kinds of IVAs are known as “interlocking” IVAs. Your insolvency practitioner will be able to help and guide you through this process.

If you and the other person share a lot of debt and the other person does not want to enter into an IVA, you might have to select a different course of action.