CSA Arrears FAQs – Child Maintenance Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about Child Support Agency (CSA) arrears? You’re in the right place to find answers. Each month, over 170,000 people visit our website for guidance on tough topics like this.

This article we’ll cover:

- Working out child maintenance using a calculator.

- Understanding CSA arrears law.

- Finding out CSA arrears time limit.

- Learning how to appeal the CSA amount for child support.

- Knowing how much can CSA take from your wages for arrears.

We know that dealing with CSA arrears can be a challenge, as many of us have been in similar situations.

Don’t worry! This guide will help you know more about the CSA and how to manage child maintenance issues.

Let’s dive in.

This is a guidance tool only and not an assessment. For accurate child maintenance assessment, contact the Child Maintenance Service. Do not rely solely on this calculator’s results.

Changes made to the UK child support system

Let me give a quick overview of the changes made to the UK child support system.

If you’re a parent, you may have seen a variety of terms used when it comes to paying child maintenance. In the UK, the current system responsible for collecting and distributing funds to dependents is run by the Child Maintenance Group (CMG).

This organisation implements the 1991 Child Support Act, which sees all children get the financial support they need.

Previously, the Child Support Agency (CSA) was responsible for this process.

In 2012, it was replaced by the Child Maintenance Service (CMS). However, people still ask questions about CSA arrears, as payments are still made through this organisation.

Just to summarise – the CSA has been replaced, but payments still go through it as the old organisation.

What is the CSA arrears law?

According to the Child Support Payments Laws UK, both parents of a child are legally accountable for the cost of raising them.

If you’re separate from the other parent, the one who doesn’t have the child on a day-to-day basis is often responsible for making payments.

If you fall into arrears on your CSA payments, you’ll have to find some way of paying it back.

If you don’t pay, the CSA or CMS could take legal action against you. However, it is often possible to arrange a repayment schedule with them.

You have to pay back the arrears within a certain time limit. And you can be asked to pay up to 40% of your income.

However, the exact amount depends on your circumstances, both in life and financially.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do you go about paying back child support arrears?

If you go into arrears with CSA, don’t panic.

Although you may want to rush to pay back the money, it’s best to go through the due process first.

When you have outstanding payments, you’ll first receive a letter from CMS/CSA. Although this may seem unpleasant, they have to work with you to resolve the matter.

The most likely outcome is that you’ll agree to some form of payment plan to repay the money. There are some fairly strict guidelines in place, so they’ll advise you of this in the letter or on the phone.

Do not ignore their contact or assume it will go away. They will continue to pursue you for the arrears.

» TAKE ACTION NOW: Fill out the short debt form

Is there a time limit?

Generally speaking, there is no time limit on when the CMS or CSA can collect your arrears.

Usually, they will try to collect it within two years of you falling behind with your payments. However, this isn’t always possible.

If they are unsuccessful in getting you to repay the money, the CMS or the CSA could take legal action against you. One of the most common child maintenace enforcement measures is deductions from earnings order, which takes money directly from your paycheck.

If you go to court because of CSA arrears, a judge can also give you a liability order or charging order.

The first means that bailiffs can come to your property to recover items to cover your outstanding debt. The latter forces you to sell off your property to pay your child support.

A liability order due to unpaid child support can hurt your credit score since it will be added to your credit file and could remain there for up to six years. This might make it difficult to get approval for a loan or other financial products.

If you receive a liability order, I suggest you pay it as soon as possible to avoid further penalties.

How far back can they claim arrears?

There is currently no time limit for how far back CSA can claim arrears from.

So, even if you’ve not heard about your child support payments for many years, you may still receive a call or letter about it in future.

There have been examples of people in the last couple of years receiving notifications about arrears dating back to the early 90s.

However, there is no way that a liability order can be granted for child maintenance due before 12 July 2000. This makes it harder for them to enforce payment, but not impossible.

Having said that, it is vital to keep up with your child support payments to avoid falling into arrears.

Here are some helpful tips:

- Keep up with your child support payments by setting reminders or standing orders.

- Seek advice from MoneyHelper or other reputable debt charities if you’re falling behind on CSA payments.

- Pay your liability order as soon as possible to avoid escalating the dispute.

How to appeal the amount for child support

You may want to challenge the CSA arrears because you feel the amount is more than you should pay.

You may appeal to The Appeals Service (TAS).

Here’s how to go about the CSA arrears appeal process:

Step 1: Contact the CSA and explain why you need them to review the decision. This is called mandatory reconsideration.

The reasons could be:

- You believe the CSA has used the wrong information for calculating your child’s maintenance.

- Either your or your child’s other parent’s circumstances have changed since the amount was calculated.

- You want further information about the other parent’s income or circumstances taken into account.

Step 2: Once the mandatory consideration is complete, you will receive a Mandatory Reconsideration Notice. If you’re unhappy with the outcome, you can appeal to an independent tribunal (TAS) after one month.

Step 3: Send the completed appeal form with the Mandatory ReconsiAderation Notice directly to TAS. TAS is an independent organisation separate from CMS. They will take another look and make a determination.

The outcome may either increase or reduce the amount of child maintenance arrears you ought to pay.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are CSA arrears written off?

In some rare cases, the CSA will write off arrears, meaning you’ll no longer have to pay what you owe.

However, they will rarely do so, and the final decision rests with the CSA or CMS. Some of the reasons they’ll write off arrears include:

- If the other parent declares to the CSA/CMS, they no longer want the money to be collected.

- If the arrears are specifically from 1993 to 1995 when an interim maintenance agreement was in place.

- If you find out from the CMS or CSA that your arrears are suspended permanently.

- If you die and no money/assets remain for payment to be taken from.

Usually, the CMS/CSA will consider each case individually. They’ll take evidence from both parents and consider the child’s best interest.

Any decisions they make are final and cannot be appealed.

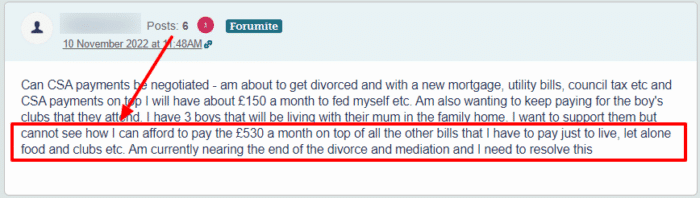

How much can be taken from your wages for arrears?

If you go into arrears with your child support payments, it’s possible that the CSA will take legal action to recover the money.

This can mean that the money is taken directly from your bank or even your paycheck.

The most they can take from your wages is 40% of what you earn each month. They have to leave you with at least 60% and enough to live on.

This is known as wage garnishment for child support. Although the amount does seem high, it can mean you pay off your arrears relatively quickly.

If you’re struggling to live after the money is taken, you can always contact CSA to see if you can arrange a different payment plan or make payment adjustment.

Do not try and get out of paying the money, as it can end up costing you more. The implications of non-payment of CSA arrears could be more serious.

How to dispute arrears?

Like any organisation, the CSA and CMS do get things wrong from time to time.

If you feel that they have wrongly stated you have a case in arrears, you can contact them to discuss the matter.

When dealing with child support arrears disputes, it’s important that you have all of the necessary information at hand.

Make sure to track down any paperwork you have in relation to your case.

This can include things like past letters and bank statements. With this information, you can more effectively dispute your case.

Are CSA arrears written off if self-employed?

In the past, there was a legal loophole that meant it was possible to avoid CSA arrears if you were self-employed.

Because of the way the child support services calculate payments due, it was possible for self-employed non-resident parents to minimise or even cancel their CSA payments.

However, this loophole, along with several others, was closed in recent years. As it stands, if you’re self-employed, you must pay maintenance like any other parent. But the income determination for the self-employed is slightly different. CSA/CMS will work out your income based on average weekly earnings.

They may also use figures from the gross income your business has earned (minus reasonable expenses and VAT) if you recently just started self-employment work.

How to claim CSA arrears?

This depends somewhat on the situation you’re in. For example, if you have a family-based arrangement for your payments, the CMS/CSA can’t help.

In this instance, you’ll have to sort the matter out with the other parent.

If you receive maintenance through Direct Pay, you have a bit more security. They advise that you first try and settle the matter with the other parent.

However, if they’re unwilling to cooperate, you can seek CSA/CMS intervention. They will then contact the other parent and take the necessary steps.

For those who use the CMS/CSA Collect and Pay service, things should happen automatically. If the other parent misses a payment, they will try and recover the money wherever possible.

If the CSA or CMS has made a mistake and you’ve lost out, they may compensate you for this. However, it’s not a legal requirement for them to do so.

Where can you find a child support arrears calculator?

If you receive a notice that you are in arrears with your child support payment, it can be tough to understand what to do.

If the amount on your arrears looks wrong, getting a straight answer isn’t always easy.

However, there are several things you can do to get out of this situation. As well as contacting the CSA directly, you can also try using a CSA arrears calculator.

This tool will help you calculate your CSA arrears accurately so you’re not paying too much. Once you have calculated what you’re supposed to be paying, it can be much easier to resolve the situation.

From experience, he CSA takes into account the following when calculating how much you should pay for child maintenance:

- How much your child’s other parent earns

- How many children they pay child maintenance for

- Whether your child stays overnight with their other parent

- If there are any other children living with your child’s other parent

If the calculator says you should be paying less, you can contact CSA and ask them to review your file.

You can also appeal the amount you’re paying based on the figure the CM Options calculator gives you.