Debt Arrangement and Attachment Scotland Act 2002 Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

The Debt Arrangement and Attachment Scotland Act 2002 is a helpful tool when you’re facing tough times with money. If you feel worried about not being able to pay off debts, you’re not alone. Many people are in the same boat, and this guide is here to help.

Each month, over 170,000 people visit our website for advice on debt solutions. We understand your worries about the impact of debt and unpaid bills. Our team has lots of experience in dealing with these problems.

In this article, we’ll show you:

- How the Debt Arrangement and Attachment Scotland Act 2002 can help you manage your debts.

- What to do when you’re struggling to pay off your debts.

- How to get advice from Citizens Advice Scotland.

- What the Scottish Parliament says about debt.

- If it’s possible to write off some of your debt.

We know how hard it can be to deal with debt, as some of our team members have been in the same situation. We’re here to share our understanding and experience, so you can find the best way out of your debt problems. This guide will give you useful information about the Debt Arrangement and Attachment Scotland Act 2002.

Let’s dive in.

Debt Arrangement & Attachment (Scotland) Act 2002

From 2000 to 2002, there were a series of meetings between representatives from CAS and the Minister for Social Justice, which discussed voluntary debt repayment programmes and the effect that this might have on people.

CAS was then invited to join a Scottish Parliament all-party working group, which was the first group of its kind. It was set up to look at an alternative to poindings (where a debt collector seizes property that makes up the value of the debt they are owed).

This platform later gave birth to the development of the Debt Arrangement and Attachment Scotland Act 2002.

Debt Arrangement Scheme

The main thing that this act produced was the Debt Arrangement Scheme (DAS).

Introduced in 2004, the DAS is a debt management tool that allows people who owe money to debt collectors and other creditors to repay multiple different debts over an extended period of time.

The debt collectors and creditors are also prohibited from using legal force and debt enforcement by this act as well – this means that the debt collection agencies are not permitted to send bailiffs to your home, for instance.

Since the Debt Arrangement and Attachment (Scotland) Act 2002 has been introduced, there have been over 26,000 Debt Arrangement Schemes approved by the Scottish Parliament.

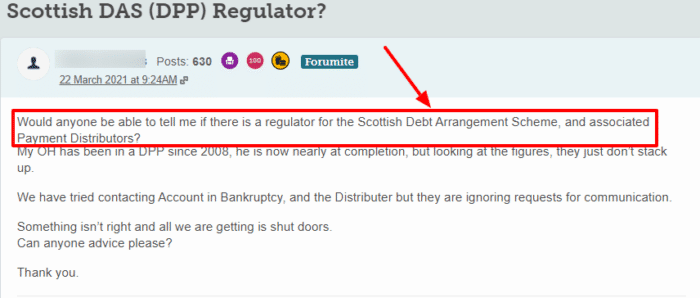

Remember, if you are unhappy with the way in which your debt payment programme has been dealt with, you can complain about your approved money advisor to the DAS Administrator or the company they work for.

Here’s how to go about i:

- Complain about your money advisor to the DAS Administrator

- Complain about the DAS Administrator by following the Accountant in Bankruptcy’s complaints procedure

- Complain to the Scottish Public Services Ombudsman if you’re still unhappy

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Other information included in the Act

The Debt Arrangement Scheme (DAS) is certainly one of the major parts of the Debt Arrangement and Attachment (Scotland) Act 2002. But what about the other parts of the act?

As with any governmental act or legislation, the document itself is extremely dense and rather complex – the Debt Arrangement and Attachment Scotland Act 2002 can be viewed in its entirety in the ‘Legislation’ section of the GOV.UK website.

In short, the Debt Arrangement and Attachment (Scotland) Act 2002 is described as ‘an act of Scottish Parliament to provide a scheme under which individuals may arrange for their debts to be paid under payment programmes…’

» TAKE ACTION NOW: Fill out the short debt form

Debt Arrangement and Attachment (Scotland) Act 2002 – the five parts

The Debt Arrangement and Attachment Scotland Act 2002 is split into five separate parts, each focussing on a different piece of legislation.

Part 1 & 1A – the Debt Arrangement Scheme & interim attachment

This covers the aforementioned arrangement scheme that would permit the debtor to pay off multiple debts simultaneously.

This is with the support of money advisors, and paid in accordance with a Debt Payment Programme (DPP) over a period of time.

Part 2 – Attachment

Part 2 of the Debt Arrangement and Attachment Scotland Act 2002 introduces a new method of enforcement, or diligence, for the attachment of what’s known as ‘moveable’ property.

Moveable property is property that is tangible or corporeal (as they write in the act) – it isn’t fixed like land or buildings, and it can be handled and moved – hence the ‘movability’ clause.

Part 3 – Attachment of articles kept in dwellinghouses: special procedure

Part 3 of the act enforces new legislation, and laws must be followed when property is to be relinquished from a homestead. As the previous part of the Act stipulates, though, it has to be property that can be ‘moved’.

Part 4 – Abolition of poindings and warrant sales

This part of the Debt Arrangement and Attachment Scotland Act 2002 makes provision for the abolition of poindings and warrant sales. It also repeals some of the provisions that are laid out in the Debtors (Scotland) Act 1987.

Part 5 – Miscellaneous and general

The fifth and final part of the Debt Arrangement and Attachment (Scotland) Act 2002 is simply a footnote to the preceding parts of the Act. Namely, it details miscellaneous and general information that relates to the act.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Scottish Parliament

The creation of the Scottish Parliament opened up an opportunity to pursue this campaign once again, however.

The Abolition of Poindings and Warrant Sales Act 2001 was the first piece of legislation to be passed by this new government, which prevented warrant officers from removing people’s furniture to cover the costs of poll and council tax debts.

This opened up a much wider conversation about debt recovery and gave the possibility for something like the Debt Arrangement and Attachment Scotland Act 2002 to be contemplated seriously.

The CAS reported that people were being relentlessly pursued by creditors, some of whom had lent money irresponsibly.

Before the Scottish Parliament, it was extremely difficult to lobby Westminster for change, but with the establishment of the Scottish Parliament, things became a little easier, and voices and concerns were finally heard.

Final thoughts

So that’s your guide to the Debt Arrangement and Attachment Scotland Act 2002. As you can see, the Act is quite an important and fairly ground-breaking piece of legislation to come into play when handling debt in Scotland.

For more information about the Debt Arrangement and Attachment (Scotland) Act 2002, and whether you could benefit from it, be sure to seek advice from Citizens Advice Scotland. Use their Contact page to see where your nearest centre is and give them a visit.

If you need help setting up a Debt Arrangement Scheme, I suggest you contact independent debt charities like StepChange or MoneyHelper for assistance.