Debt Management Plan Allowable Living Expenses Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you thinking about a Debt Management Plan (DMP)? Wondering how much you’re allowed to spend on basics like food and bills?

You’re in the right place for answers. Each month, over 170,000 people visit this site seeking advice on debt solutions.

This guide will help you understand:

- What you can spend money on during a DMP.

- How to create a budget for your essential living costs.

- Whether you could write off some debt.

- The guidelines set by DMP providers for monthly spending.

- What happens if you spend more than the suggested amount.

You might feel worried about having enough money left after making DMP payments, and may be uncertain about seeking help.

This is quite common. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1 Don’t worry, we’re here to help you figure things out.

Do DMP providers set monthly expenditure guidelines?

Please Note: The above information is provided as a guideline only.

» TAKE ACTION NOW: Fill out the short debt form

What am I Allowed to Spend Money on During a DMP?

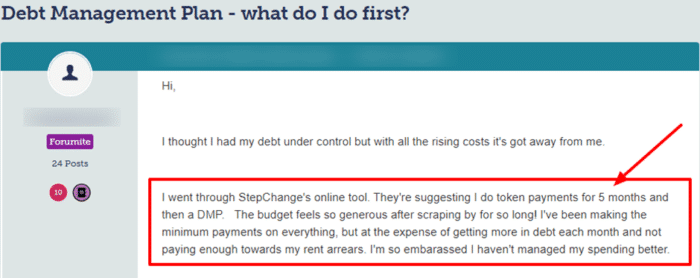

Case study

See this message one concerned person posted on a popular online forum about their situation.

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if I Spend More than the Recommended Amount?

The impact of overspending in a DMP means you’re going to have to justify why you’re living costs are as high as they are.

For example, a child may have special dietary requirements. Or you may have a high electricity bill due to an appliance needed to run your household properly.

Negotiating with creditors in DMP when you overspend is the first step in making sure the agreement doesn’t fail.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Consequences of abandoning a DMP

You must contact your DMP provider and ask to cancel the plan. The provider informs your creditors the agreement has been cancelled.

In short, you would have to deal with your creditors yourself.

DMP cancellation consequences could leave you worse off.

However, before going down this route, you may need to ask yourself the following:

- How do you intend repaying your debts once the DMP is cancelled?

- Will you receive a refund for the fees you paid?

- Will there be a cancellation fee?

- Did the DMP provider mislead you? Therefore, you want to cancel the agreement

Should I review my Debt Management Plan regularly?

There are several advantages to regularly reviewing a DMP. Plus, you can review your plan online.

I’ve listed the benefits of regular DMP reviews here:

- You can review your budget to make sure it’s still feasible

- You get to check the progress of your DMP and how much longer it lasts

I suggest that you review your plan regularly or every 12 months. Sooner if your circumstances change.

Another option is to contact one of the leading UK charities that provide free debt advice. Their help, advice and support could prove invaluable when you need it the most.

I’ve listed some of the free debt advice UK charities here: