Debt Recovery Plus Ltd (DRP) Should You Pay the Parking Ticket?

Are you feeling worried or confused about a letter from Debt Recovery Plus Ltd (DRP)? You’re not alone! We deal with thousands of people who are getting chased by Debt Recovery Plus – they’re one of the biggest debt collectors in the UK.

Don’t worry, though. You’ve come to the right place. In this article, we’ll explain:

- What Debt Recovery Plus Ltd is and what they do.

- How to work out if you really owe the money.

- What a Parking Charge Notice is and how to challenge it.

- If and how DRP can affect your credit score.

- Where you can get free advice if you’re struggling with debt.

If that sounds good, then let’s get started!

Most Ticket Appeals Succeed

In some circumstances, you might have a legitimate reason not to pay your parking fine.

It’s a bit sneaky, but the last time I needed legal advice, I paid £5 for a trial to chat with an online solicitor called JustAnswer.

Not only did I save £50 on solicitor fees, I also won my case and didn’t have to pay my £271 fine.

Chat below to get started with JustAnswer

*According to Martin Lewis, 56% of people who try to appeal their ticket are successful and get the charge overturned, so it’s well worth a try.

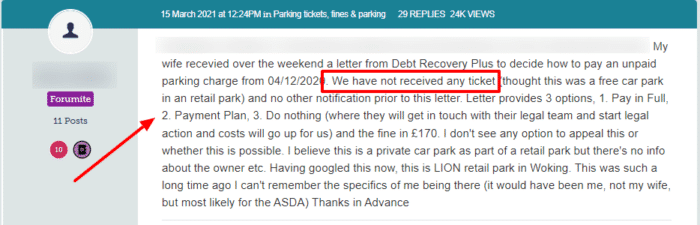

Do You Owe Money for a Parking Charge?

Debt Recovery Plus (DRP) are UK’s leading debt collectors for Parking Charge Notices. They are one of the few debt collection companies that focus entirely on parking charges.

So if you’ve been issued a parking charge notice that you have not addressed yet, chances are the letter you’ve received from DRP is regarding that.

Just like other debt collectors, DRP is employed to recover money that debtors owe to their clients.

Most of DRP’s clients include private establishments whose parking rules are violated such as hospitals, supermarkets, offices, etc.

» TAKE ACTION NOW: Fill out the short debt form

What’s a PCN?

In the UK, a parking charge notice is a fine that is issued to individuals that park their vehicles in a way that is against conventions, laws or road markings. The amount you owe can differ depending on the offence and where it took place.

Some examples of why you might be issued a parking charge notice are:

- Failing to produce a valid ticket

- Keeping your car at a spot for more hours than what was permitted

- Parking your vehicle over yellow lines

- Parking your vehicle in a hatched area

- Parking your vehicle on private property without the owner’s permission

- Parking in a disabled spot without your vehicle displaying a valid Blue Badge

- Parking in a parent and children space without having a child

- Parking in a customer-only area without actually being a customer of the establishment

- Parking across the permitted lines of a spot

Successful Appeal Case Study

Situation

| Initial Fine | £100 |

| Additional Fees | £171 |

| Total Fine | £271 |

The Appeal Process

Scott used JustAnswer, online legal service to enhance his appeal. The trial of this cost him just £5.

| Total Fine | £271 |

| Cost of legal advice | £5 |

JustAnswer helped Scott craft the best appeal possible and he was able to win his case.

Scott’s fine was cancelled and he only paid £5 for the legal help.

In partnership with Just Answer.

How do You Dispute It?

If you feel there’s been a mistake and you don’t owe the parking fine, then you can choose to appeal the notice.

Disputing parking tickets and private parking fines can be complicated, so you need to follow the process set out by the private parking company.

» TAKE ACTION NOW: Fill out the short debt form

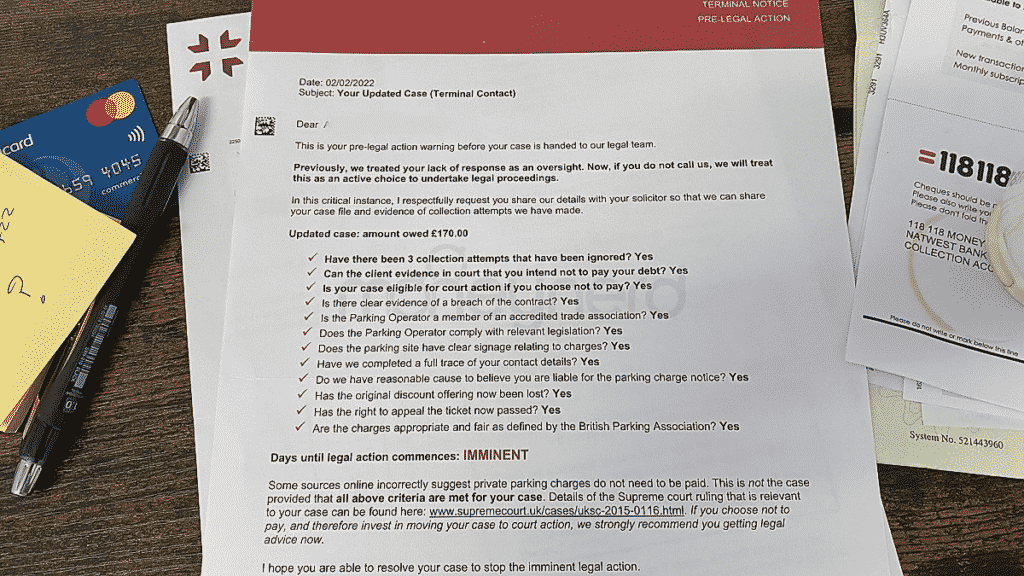

It’s important that you address the notice in some way in order to avoid court action by DRP and that you never ignore the charge.

In fact, we always recommend responding to debt collectors – even just to question the debt’s validity. You have the right to request proof of the debt. They have to prove it, or they can’t charge you.

It’s also key that you know your rights and what the debt collection company is entitled to do. Here are some of the basics:

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Please note that you have limited time to dispute the charge notice.

You should contact the issuer of the notice within 28 days of receiving it. The details of the issuer will be on the notice that you receive.

If your dispute is rejected by the issuer and you reside in England or Wales, then you can appeal your case to Parking on Private Land Appeals (POPLA) or the Independent Appeals Service (IAS).

If this is you, we recommend speaking to a debt charity for some advice. They will be able to walk you through your legal rights in detail and explain what you can do next.

Can They Affect Your Credit?

There could be an impact of non-payment on your credit score. This means that not paying DRP may affect your credit.

Private parking tickets alone will not have an impact on your credit score. But if you don’t pay, you may end up being taken to court.

A County Court Judgement (CCJ) will have a negative impact on your credit score and you will probably find it quite difficult to get credit while it is visible on your credit file.

It’s very important to do your best to avoid getting a bad mark on your credit score and to always manage your debts wisely, as institutions like StepChange found the average unsecured debt amount per client increased by 27% year-on-year to £16,1742.

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

Debt Recovery Plus Ltd Contact Details

| Website: | https://www.debtrecoveryplus.co.uk/ |

| Phone: | 0208 234 6775 |

| Address: | 78 York Street, London, W1H 1DP |