If I Declare Bankruptcy: What Happens to my Wife?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debt and thinking about bankruptcy? You’ve come to the right place. Every month, over 170,000 people visit our website seeking advice on sorting out their debts.

In this article, we’ll cover:

- What bankruptcy is

- How bankruptcy works

- The effect of your bankruptcy on your wife

- How bankruptcy might change your shared and sole assets

- Ways to reduce your debt.

It’s common to feel unsure about seeking help when dealing with debt. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

But you’re not alone. We understand your worries and are here to explain bankruptcy in simple terms.

What happens next after bankruptcy?

This is a common question asked by people considering applying to be made bankrupt. And it’s a common question among the partners of debtors considering bankruptcy.

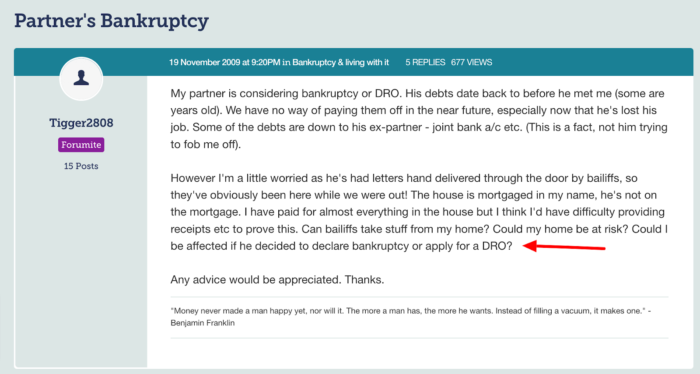

Just like Tigger asked here:

Source: https://forums.moneysavingexpert.com/discussion/2091595/partners-bankruptcy

A bankruptcy will only affect your husband, wife or civil partner if you have joint assets or debts with them.

Your bankruptcy won’t affect assets in your name or their personal debts. But your bankruptcy could affect a property you have an interest in, even if it’s just in your wife’s name.

How does bankruptcy affect joint assets?

If you declare bankruptcy, your wife or husband can be asked to buy your share of the asset for its market value.

This is usually the case for property If this isn’t possible, a court order might be granted to force the sale of the asset.

Your partner will be able to keep half of the sale proceeds from the forced sale of assets.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How will it affect sole assets?

Your assets as the bankrupt person will be subject to bankruptcy proceedings. They’re likely to be sold.

However, any sole assets owned by your wife or husband will be theirs to keep and won’t be forcibly sold.

But there is an important exception to this rule which often affects couples…

A property that is solely in your partner’s name can still be forcibly sold as part of the bankruptcy. This is because you as the bankrupt person are perceived as having a “beneficial interest” in the property, even if your name isn’t on the title of the property.

A beneficial interest could be when you are named on the mortgage and therefore make mortgage payments, or if you have invested in improving the property.

There might be things you can do to prevent the sale in this situation. Speak with Citizens Advice for information.

» TAKE ACTION NOW: Fill out the short debt form

How will it affect joint debts?

If you declare bankruptcy and have joint debts with anyone else, the other person is still responsible for the whole debt.

This is because both individuals on a joint debt take full responsibility for the whole debt, technically known as “joint and several liability”.

For example, you might have taken out a joint loan with your wife in the past. If this loan hasn’t been repaid when you declare bankruptcy, your wife will still be obligated to pay back the whole amount – not just 50% of the loan.

The only exception is if the credit was taken out without your partner’s knowledge. In this case, they could argue that they don’t owe the money.

But on the other hand, you could face more serious consequences if you committed fraud during the credit application to make it a joint debt.

You might benefit from reading the pros and cons of bankruptcy.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Debt support at MoneyNerd

Debt information and support can be found in abundance on the debt info master guide. Check this out now to start your journey free from debt.