Deed of Trust – Everything That You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you want to know more about a deed of trust, you’ve come to the right place. This document is very important in real estate deals, as it ensures that everything is fair between a person who borrows money and the one who lends it.

Each month, more than 170,000 people visit our website for guidance on similar topics, so you’re not alone in wanting to learn more about this.

In this piece, we’ll cover:

- What a Deed of Trust is and how it works.

- The difference between a deed of trust and a mortgage.

- When and why you might need a deed of trust.

- Things to think about before using a deed of trust.

- How to handle too much debt.

We know that dealing with money can be tough, as some of our team have had to handle big money issues too. We understand how you might feel. Let’s dive in and learn more about deeds of trust.

What is the Deed of Trust?

A deed of trust, also known as the ‘Declaration of Trust,’ is a legal document that secures all the financial positioning between two parties while making a land deal. Usually, the parties involved are referred to as the trustee and beneficiaries of the estate.

The deed trust is drawn up while the realty is being bought. It serves a purpose of making the buyer’s financial and legal stance clear on the property. A property trust deed also plays an important role when selling off the property.

How Does it Work?

The deed of trust can be drawn in two circumstances:

- If you are buying a property jointly with someone (joint property ownership) or;

- If you are financing the property through a third party.

The document provides the legal structure of ownership, mortgage repayments and the responsibilities of the ones involved.

For clarity, joint ownership is divided as follows:

- Joint tenants – You both own the entire property.

- Tenants in common – You each own a share of the property as a percentage.

The deed of trust will always include a trustee, which will work for the interests of the beneficiaries. When the time arises, the trustee has to hand over the property to the beneficiary.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Does the Declaration of Trust Include?

The declaration is flexible in its format. It can include different things which the owners might want to address. However, the usual main points or contents of trust deed are as follows:

- The name of those involved, trustee, trustor, beneficiaries, and at times the advisors

- The land registry

- The deposit, loan amount, and it’s purchase price

- Mortgage payments and their lifespan

- Share of equity in the property.

When to Get a Deed of Trust?

It is better to draw up a deed of trust when you are purchasing a jointly owned property or financing it through someone else. My advice is: make a trust deed as soon as possible.

A bit of sound legal advice might be needed to comprehensively protect your interest, so it would be better to get an advisor.

For example, a solicitor is needed to draw up a trust because the legal wording must be precise.

From experience, creating a deed of trust can cost £1,000 or more, depending upon the extent of the advice required.

But you can offset some of the costs considerably by getting well-prepared before you consult a legal advisor.

» TAKE ACTION NOW: Fill out the short debt form

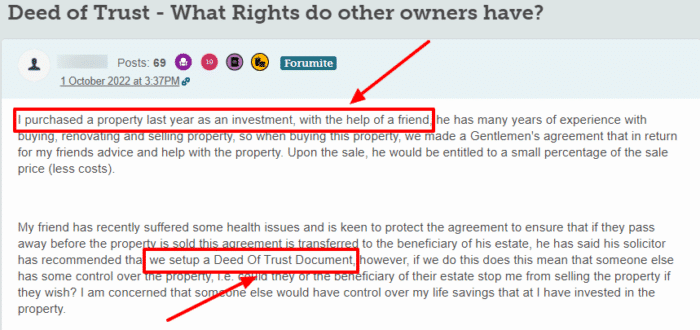

Buying Property with Someone’s Help

If you are financing a property through a loan or with someone’s aid, the deed is drawn up to secure the interests of the lender.

You will have to nominate a trustee (For instance, your family member or friend who will be the guarantee for your loan.)

In case you (trustor) are unable to pay back the loan or are defaulted, the financial obligation will fall upon the trustee. The trustee will be held accountable for the mortgage repayments due to the trust deed.

When the mortgage has been paid off, the deed in the trust is dissolved, and the ownership title is handed over to the actual buyer of the property.

If you set a Deed of Trust Document, the ownership of the property will be transferred to a trustee. However, because a deed of trust is flexible, you can sit down with your Declaration of Trust solicitor to discuss what you want your agreement to cover.

Buying Property as Joint Owners

The contract of trust works as a legal rule and outliner between the joint tenants who have bought property together.

If the co-owners are unable to decide or don’t want to name one of them as the legal owner of the estate (on whom’s name the land registry will be registered), they select a ‘trustee’.

The trustee has to work for the interest of the trustors (the joint possessors) in a transparent manner.

When the property is sold off, this contract works as a crucial document between co-owners of the realty.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Things to Consider Before Using Declaration of Trust

It can be a very good way to protect your interests in the property, but you need to keep in mind some things before signing a trustee deed:

- If you are drawing this contract because of third-person financing, verify that you have a steady income and will be able to pay the mortgage payments timely.

- 2. When in co-ownership, make sure the trustee has no personal interests or hidden agenda. They should be transparent in dealing with the benefit of both owners.

Lastly, keep in mind that a deed of trust can be overturned as long as all parties are in agreement. But you’re free to amend a deed of trust or even waive it completely if all parties agree.