Direct Earning Attachment (DEA) Impacts & Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

A Direct Earnings Attachment (DEA) is a way to pay back money you owe directly from your wages. If you’ve noticed ‘DEA’ on your payslip and are worried, you’re in the right place.

Each month, over 170,000 people visit our website seeking advice on money matters. We’re here to guide you through what a DEA means.

In this article, we’ll cover:

- What a DEA is, and why you might have one

- How much money can be taken from your wages

- What to do if you think your DEA payments are wrong

- If a DEA can affect your credit score

- How to deal with a DEA if you’re struggling with debt

We know how troubling it can be when you’re not sure what’s happening with your money. But we’re here to help you make sense of it all. Let’s get started.

What is a direct earnings attachment (DEA)?

A direct earnings attachment (DEA) is a debt recovery method to recover tax credits and benefit overpayments. It means that the benefits overpayment can be taken straight from your wages instead of you paying it back like a normal debt. Anyone overpaid benefits may be subject to a DEA for benefit recovery, meaning they may find the debt comes from their normal payslip.

DEA On Payslip

If you are subject to a direct earnings attachment, your employer will deduct payments from your income. Payslip deductions will continue until all the money is paid back. You will notice these wage deductions on your payslip because “DEA” will be written on the payslip.

What counts as an employee’s earnings for a DEA?

An employee’s earnings that can be deducted to pay back benefits include:

- General Employment

- Bonuses

- Commission

- Sick pay and any compensation

- Overtime

Employers can make a deduction from employee wages for any of the above. But they cannot deduct from:

- Statutory maternity pay

- Statutory redundancy pay

- Statutory adoption pay

- Statutory paternity pay

- Repaid working expenses

If a deduction from any of these is made, the employee should make a complaint or contact the Financial Ombudsman.

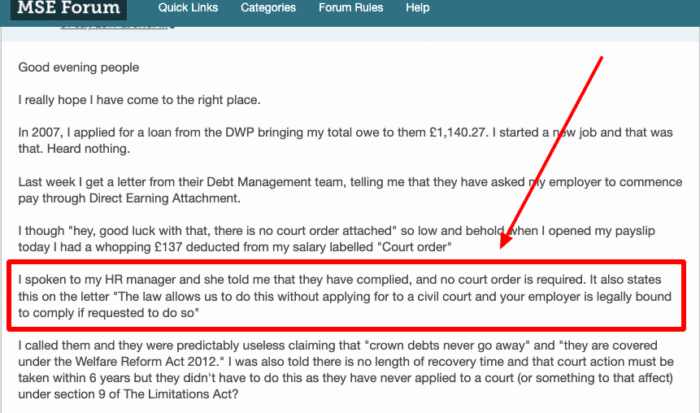

Will I need to attend court?

No, you will not need to attend a court hearing when subject to a DEA. Don’t confuse this with an attachment of earnings order; this type of order does require a court hearing.

An attachment of earnings is used for creditors and private debt collection companies to enforce debt repayment after you are issued with a CCJ. For example, if you have failed to repay payday loans. It’s also not the same as a liability order used by a local authority to recover council tax debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Why have I got a direct earnings attachment?

Direct earnings attachments are only issued when money is owed to the Department for Work and Pensions (DWP) or HMRC. If you have a DEA, you have a debt owed to either of these groups because you have been overpaid tax benefits or a benefit overpayment.

» TAKE ACTION NOW: Fill out the short debt form

How much can be taken if a DEA is applied?

The DWP or HMRC can apply three types of rates to decide how much is deducted from your wage:

- A standard rate amount

- A higher rate amount

- A fixed-rate amount

If the DWP or HMRC apply with the standard rate, you will pay 20% of your salary. But if they apply at a higher rate, you will pay 40% of your net earnings. This percentage applies weekly or monthly however the payroll operates at your place of work.

DEA deductions should not have been collected in April, May or June of 2020 due to the COVID-19 pandemic.

For example, if you are paid £1,500 net per month and pay the standard rate, you will pay an amount of £300 each month until the overpayment is repaid.

They may also apply for a fixed rate which could be more or less than what is deducted using the standard or higher rate. They may choose this option if the debt is smaller or bigger.

You can ask for a lower fixed rate to prevent financial hardship. You may want to contact a charity for support.

The minimum net earnings

DEAs can never leave employees owning more than 40% of their net income. This means at least 60% of your wages are protected earnings.

Your net income is what you earn after deducting taxation, workplace pension contributions and national insurance.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What do I do if the payments are wrong?

If you think your DEA payments are wrong or your employer has made a mistake, you must contact DWP Debt Management or the HMRC tax credits helpline as soon as possible.

The contact information should be on the initial letter you received telling you about your DEA.

This is a shortfall if one or more deductions have been missed or an incorrect amount has been deducted in error.

What happens if you have another arrestment on your earnings?

Direct earnings attachments are a non-priority arrestment, meaning any other earnings order, that order will take priority.

If both can be applied simultaneously and leave you with at least 60% of your net earnings, then you must pay both simultaneously.

Interestingly, student loan debts also take priority over a DEA.

Can I stop a direct earnings attachment?

Yes. The best way to stop a DEA before it begins is to agree to make payments to clear the debt over time. HMRC and the DWP accept debt management plans where you pay a percentage each week or month until the debt is cleared.

The Department of Work and Pensions (DWP) even runs a DWP Debt Management group which is solely responsible for agreeing on a payment plan with people who have been overpaid for housing benefits, tax credits, and more.

Once it has begun, it is unlikely that HMRC or the DWP will entertain a debt management plan because they are already getting the money straight from your employer and any future employers. These types of deductions are convenient for them.

HMRC can also change your PAYE code to recover the overpayments.